Kraft 2013 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2013 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

38

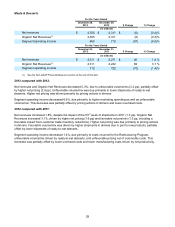

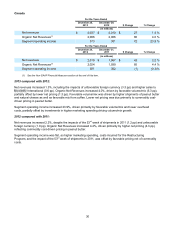

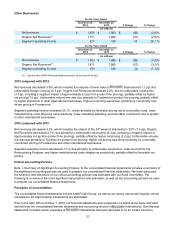

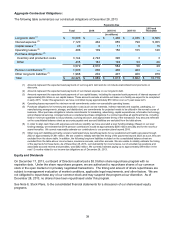

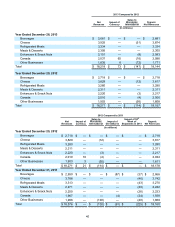

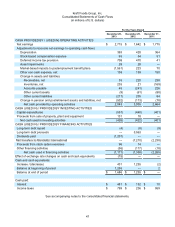

Aggregate Contractual Obligations:

The following table summarizes our contractual obligations at December 28, 2013.

Payments Due

Total 2014 2015-16 2017-18 2019 and

Thereafter

(in millions)

Long-term debt (1) $ 10,000 $ — $ 1,400 $ 2,035 $ 6,565

Interest expense (2) 7,120 462 855 798 5,005

Capital leases (3) 40 6 11 8 15

Operating leases (4) 496 109 156 105 126

Purchase obligations: (5)

Inventory and production costs 3,144 2,748 390 3 3

Other 435 162 194 53 26

3,579 2,910 584 56 29

Pension contributions (6) 1,000 200 400 400 —

Other long-term liabilities (7) 1,988 202 407 400 979

Total $ 24,223 $ 3,889 $ 3,813 $ 3,802 $ 12,719

(1) Amounts represent the expected cash payments of our long-term debt and do not include unamortized bond premiums or

discounts.

(2) Amounts represent the expected cash payments of our interest expense on our long-term debt.

(3) Amounts represent the expected cash payments of our capital leases, including the expected cash payments of interest expense of

approximately $9 million on our capital leases. These amounts exclude a build-to-suit lease on a facility we expect to be completed

in early 2015. Under this agreement, we have committed to pay approximately $70 million over a 21-year lease term.

(4) Operating leases represent the minimum rental commitments under non-cancelable operating leases.

(5) Purchase obligations for inventory and production costs (such as raw materials, indirect materials and supplies, packaging, co-

manufacturing arrangements, storage, and distribution) are commitments for projected needs to be utilized in the normal course of

business. Other purchase obligations include commitments for marketing, advertising, capital expenditures, information technology,

and professional services. Arrangements are considered purchase obligations if a contract specifies all significant terms, including

fixed or minimum quantities to be purchased, a pricing structure, and approximate timing of the transaction. Any amounts reflected

on the consolidated balance sheet as accounts payable and accrued liabilities are excluded from the table above.

(6) In order to align cash flows with expenses and reduce volatility, we have executed a level funding strategy. Based on our level

funding strategy, we estimate that 2014 pension contributions would be approximately $200 million annually and for the next four

years thereafter. We cannot reasonably estimate our contributions to our pension plans beyond 2018.

(7) Other long-term liabilities primarily consist of estimated future benefit payments for our postretirement health care plans through

2023 of approximately $1,981 million. We are unable to reliably estimate the timing of the payments beyond 2023; as such, they are

excluded from the above table. In addition, the following long-term liabilities included on the consolidated balance sheet are

excluded from the table above: income taxes, insurance accruals, and other accruals. We are unable to reliably estimate the timing

of the payments for these items. As of December 28, 2013, our total liability for income taxes, net of uncertain tax positions and

associated accrued interest and penalties, was $282 million. We currently estimate paying up to approximately $98 million in the

next 12 months related to our income tax obligations as of December 28, 2013.

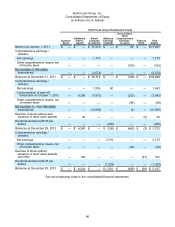

Equity and Dividends

On December 17, 2013, our Board of Directors authorized a $3.0 billion share repurchase program with no

expiration date. Under the share repurchase program, we are authorized to repurchase shares of our common

stock in the open market or in privately negotiated transactions. The timing and amount of share repurchases are

subject to management evaluation of market conditions, applicable legal requirements, and other factors. We are

not obligated to repurchase any of our common stock and may suspend the program at our discretion. As of

December 28, 2013, no shares have been repurchased under this program.

See Note 8, Stock Plans, to the consolidated financial statements for a discussion of our share-based equity

programs.