Kraft 2013 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2013 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

37

ratings of our long-term senior unsecured indebtedness. The revolving credit agreement requires us to maintain a

minimum total shareholders’ equity (excluding accumulated other comprehensive income or losses and any income

or losses recognized in connection with “mark-to-market” accounting in respect of pension and other retirement

plans) of at least $2.4 billion. At December 28, 2013, we were compliant. The revolving credit agreement also

contains customary representations, covenants, and events of default. We intend to use the proceeds from this

facility, if any, for general corporate purposes. As of December 28, 2013, no amounts were drawn on this credit

facility.

Long-Term Debt:

On June 4, 2012, we issued $6.0 billion of senior unsecured notes at a weighted average effective rate of 3.938%

and transferred the net proceeds of $5.9 billion to International. We also recorded approximately $260

million of deferred financing costs, including losses on hedging activities in advance of the debt issuance, which will

be recognized in interest expense over the life of the notes. The general terms of the notes are:

• $1 billion of notes due June 4, 2015 at a fixed, annual interest rate of 1.625%, paid semiannually.

• $1 billion of notes due June 5, 2017 at a fixed, annual interest rate of 2.250%, paid semiannually.

• $2 billion of notes due June 6, 2022 at a fixed, annual interest rate of 3.500%, paid semiannually.

• $2 billion of notes due June 4, 2042 at a fixed, annual interest rate of 5.000%, paid semiannually.

On July 18, 2012, International completed a debt exchange in which $3.6 billion of

International debt was exchanged for our debt as part of the Spin-Off capitalization plan. No cash was generated

from the exchange. The general terms of the unsecured notes we received in connection with this exchange are:

• $1,035 million of notes due August 23, 2018 at a fixed, annual interest rate of 6.125%, paid semiannually.

• $900 million of notes due February 10, 2020 at a fixed, annual interest rate of 5.375%, paid semiannually.

• $878 million of notes due January 26, 2039 at a fixed, annual interest rate of 6.875%, paid semiannually.

• $787 million of notes due February 9, 2040 at a fixed, annual interest rate of 6.500%, paid semiannually.

On October 1, 2012, International transferred approximately $400 million of International's

7.550% senior unsecured notes maturing on June 15, 2015 to us in connection with the Spin-Off capitalization plan.

Total Debt:

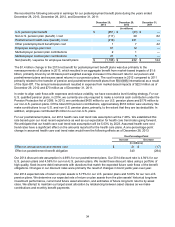

Our total debt was $10.0 billion at December 28, 2013 and December 29, 2012. The weighted average remaining

term of our debt was 13.3 years at December 28, 2013. Our long-term debt contains customary representations,

covenants, and events of default. We were in compliance with all covenants as of December 28, 2013.

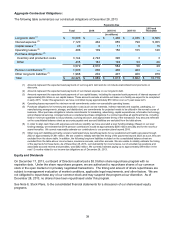

Off-Balance Sheet Arrangements and Aggregate Contractual Obligations

We have no material off-balance sheet arrangements other than the guarantees and contractual obligations that are

discussed below.

As discussed in Note 11, Commitments and Contingencies, to the consolidated financial statements, we have third-

party guarantees primarily covering long-term obligations related to leased properties. The carrying amount of our

third-party guarantees on our consolidated balance sheet was $24 million at December 28, 2013 and $22 million at

December 29, 2012. The maximum potential payment under these guarantees was $53 million at December 28,

2013 and $64 million at December 29, 2012. Substantially all of these guarantees expire at various times through

2027.

In addition, we were contingently liable for guarantees related to our own performance totaling $86 million at

December 28, 2013 and $74 million at December 29, 2012. These include letters of credit related to dairy

commodity purchases and other letters of credit.

Guarantees do not have, and we do not expect them to have, a material effect on our liquidity.