Kraft 2013 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2013 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

71

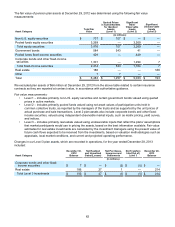

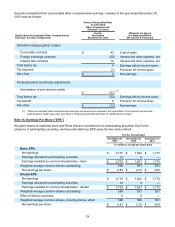

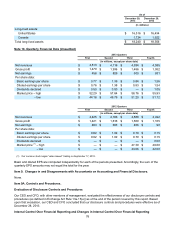

Note 12. Income Taxes

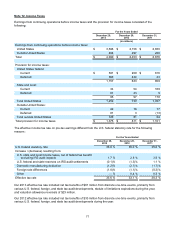

Earnings from continuing operations before income taxes and the provision for income taxes consisted of the

following:

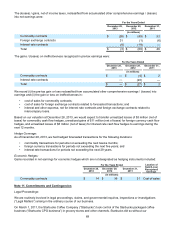

For the Years Ended

December 28,

2013 December 29,

2012 December 31,

2011

(in millions)

Earnings from continuing operations before income taxes:

United States $ 3,596 $ 2,156 $ 2,650

Outside United States 494 297 226

Total $ 4,090 $ 2,453 $ 2,876

Provision for income taxes:

United States federal:

Current $ 591 $ 209 $ 816

Deferred 566 424 43

1,157 633 859

State and local:

Current 34 54 169

Deferred 61 43 9

95 97 178

Total United States 1,252 730 1,037

Outside United States:

Current 42 78 77

Deferred 81 3 (13)

Total outside United States 123 81 64

Total provision for income taxes $ 1,375 $ 811 $ 1,101

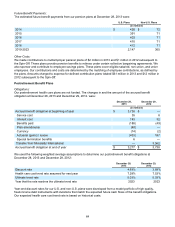

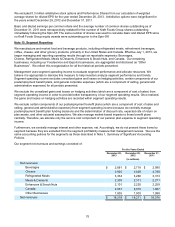

The effective income tax rate on pre-tax earnings differed from the U.S. federal statutory rate for the following

reasons :

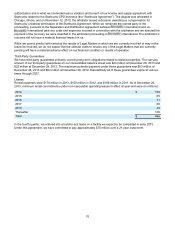

For the Years Ended

December 28,

2013 December 29,

2012 December 31,

2011

U.S. federal statutory rate 35.0 % 35.0 % 35.0 %

Increase / (decrease) resulting from:

U.S. state and local income taxes, net of federal tax benefit

excluding IRS audit impacts 1.7 % 2.8 % 3.9 %

U.S. federal and state reserves on IRS audit settlements (0.1)% (1.3)% 1.1 %

Domestic manufacturing deduction (1.2)% (2.7)% (1.7)%

Foreign rate differences (1.8)% (1.1)% (0.3)%

Other — % 0.4 % 0.3 %

Effective tax rate 33.6 % 33.1 % 38.3 %

Our 2013 effective tax rate included net tax benefits of $61 million from discrete one-time events, primarily from

various U.S. federal, foreign, and state tax audit developments, statute of limitations expirations during the year,

and valuation allowance reversals of $23 million.

Our 2012 effective tax rate included net tax benefits of $33 million from discrete one-time events, primarily from

various U.S. federal, foreign, and state tax audit developments during the year.