Kraft 2013 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2013 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.13

chain or distribution network. If we cannot respond to disruptions in our operations, whether by finding alternative

suppliers or replacing capacity at key manufacturing or distribution locations, or are unable to quickly repair damage

to our information, production, or supply systems, we may be late in delivering, or unable to deliver, products to our

customers and may also be unable to track orders, inventory, receivables, and payables. If that occurs, our

customers’ confidence in us and long-term demand for our products could decline. Any of these events could

materially and adversely affect our product sales, financial condition, and operating results.

We may not successfully identify or complete strategic acquisitions, alliances, divestitures or joint

ventures.

From time to time, we may evaluate acquisition candidates, alliances or joint ventures that may strategically fit our

business objectives or we may consider divesting businesses that do not meet our strategic objectives or growth or

profitability targets. These activities may present financial, managerial, and operational risks including, but not

limited to, diversion of management’s attention from existing core businesses, difficulties integrating or separating

personnel and financial and other systems, inability to effectively and immediately implement control environment

processes across a diverse employee population, adverse effects on existing or acquired customer and supplier

business relationships, and potential disputes with buyers, sellers or partners. In addition, to the extent we

undertake acquisitions, alliances or joint ventures or other developments outside our core geography or in new

categories, we may face additional risks related to such developments. For example, risks related to foreign

operations include compliance with U.S. laws affecting operations outside of the United States, such as the Foreign

Corrupt Practices Act, currency rate fluctuations, compliance with foreign regulations and laws, including tax laws,

and exposure to politically and economically volatile developing markets. Any of these factors could materially and

adversely affect our financial condition and operating results.

Volatility of capital markets or macro-economic factors could adversely affect our business.

Changes in financial and capital markets, including market disruptions, limited liquidity, and interest rate volatility,

may increase the cost of financing as well as the risks of refinancing maturing debt. In addition, our borrowing costs

can be affected by short and long-term ratings assigned by rating organizations. A decrease in these ratings could

limit our access to capital markets and increase our borrowing costs, which could materially and adversely affect

our financial condition and operating results.

Adverse changes in the capital markets or interest rates, differences or changes in actuarial assumptions

from actual experience, and legislative or other regulatory actions could substantially increase our

postemployment obligations and materially and adversely affect our profitability and operating results.

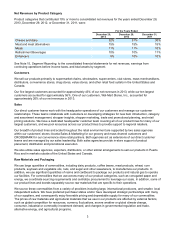

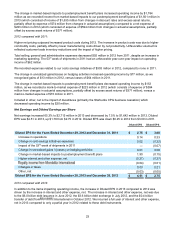

We sponsor a number of benefit plans for employees in the United States and Canada, including defined benefit

pension plans, retiree health and welfare, active health care, severance, and other postemployment benefits. As of

December 28, 2013, the projected benefit obligation of our defined benefit pension plans was $7.2 billion and these

plans had assets of $7.0 billion. The difference between plan obligations and assets, or the funded status of the

plans, significantly affects the net periodic benefit costs of our pension plans and the ongoing funding requirements

of those plans. Among other factors, changes in interest rates, mortality rates, early retirement rates, investment

returns, minimum funding requirements, and the market value of plan assets can affect the level of plan funding,

cause volatility in the net periodic pension cost, and consequently volatility in our reported net income, and increase

our future funding requirements. Legislative and other governmental regulatory actions may also increase funding

requirements for our pension plans’ benefits obligation.

We estimate the 2014 pension contributions will be approximately $200 million. Volatile economic conditions

increase the risk that we will be required to make additional cash contributions to the pension plans and recognize

further increases in our net pension cost. A significant increase in our pension funding requirements could require

us to reduce spending on marketing, retail trade incentives, advertising, and other similar activities or could

negatively affect our ability to invest in our business or pay dividends on our common stock.

Volatility in the market value of all or a portion of the derivatives we use to manage exposures to

fluctuations in commodity prices may cause volatility in our operating results and net earnings.

We use commodity futures and options to partially hedge the price of certain input costs, including dairy products,

coffee beans, meat products, wheat, corn products, soybean oils, sugar, and natural gas. For derivatives not

designated as hedges, changes in the values of these derivatives are currently recorded in earnings, resulting in

volatility in both gross profits and net earnings. We report these gains and losses in cost of sales in our

consolidated statements of earnings to the extent we utilize the underlying input in our manufacturing process. We