Kraft 2013 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2013 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

72

Our 2011 effective tax rate included net tax costs of $52 million, primarily due to various U.S. federal and state tax

audit developments during the year as well as the revaluation of state deferred tax assets and liabilities resulting

from state tax legislation enacted in 2011.

Our unrecognized tax benefits of $259 million at December 28, 2013 are included in other current liabilities and

other liabilities. If we had recognized all of these benefits, the net impact on our income tax provision would have

been $168 million. The amount of net unrecognized tax benefits could decrease by approximately $50 million to $75

million during the next 12 months. We include accrued interest and penalties related to uncertain tax positions in

our tax provision. We have accrued interest and penalties of $74 million as of December 28, 2013 and $67 million

as of December 29, 2012. Our provision for income taxes included $13 million in 2013 and $18 million in 2012 for

interest and penalties and we paid interest and penalties of $2 million during 2013 and $4 million during 2012.

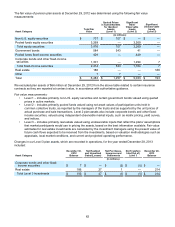

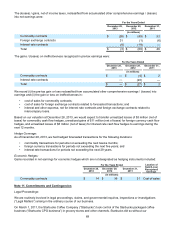

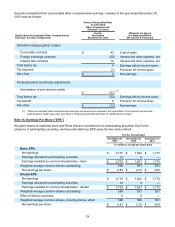

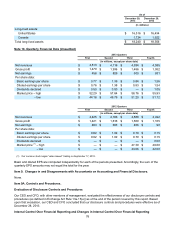

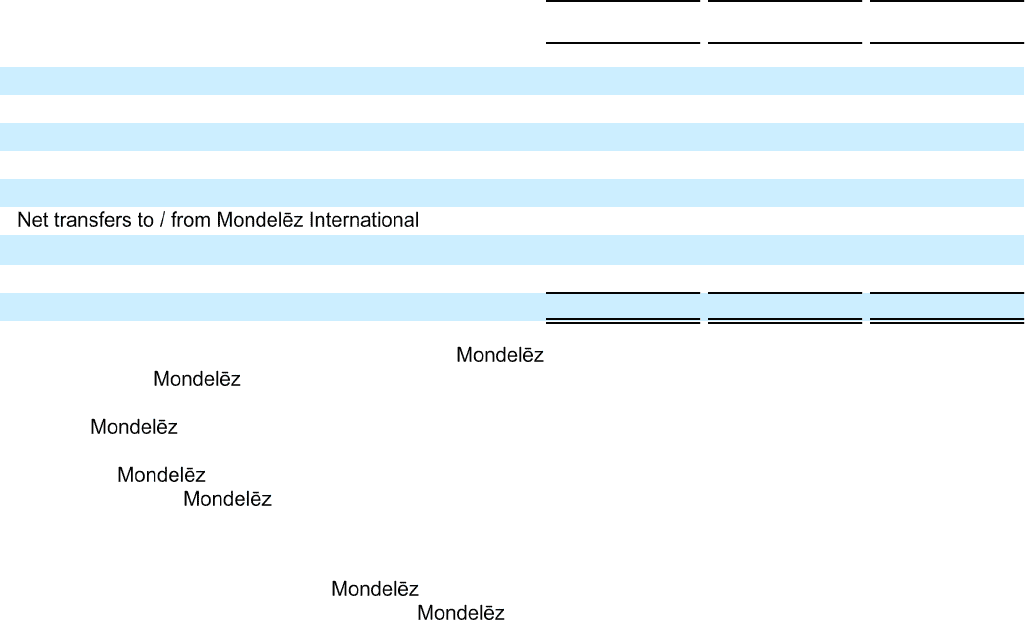

The changes in our unrecognized tax benefits were:

For the Years Ended

December 28,

2013 December 29,

2012 December 31,

2011

(in millions)

Beginning of year $ 258 $ 371 $ 329

Increases from positions taken during prior periods 2 11 34

Decreases from positions taken during prior periods (5) (90) (18)

Decreases from statute of limitations expirations (28) — (1)

Increases from positions taken during the current period 39 16 33

— (9) —

Decreases relating to settlements with taxing authorities (3) (33) (13)

Currency / other (4) (8) 7

End of year $ 259 $ 258 $ 371

We have entered into a tax sharing agreement with International, which provides that for periods prior to

October 1, 2012, International is liable for and will indemnify us against all U.S. federal income taxes and

substantially all foreign income taxes, excluding Canadian income taxes; and that we are liable for and will

indemnify International against U.S. state income taxes and Canadian federal and provincial income

taxes. However, if we breach certain covenants or other obligations or are involved in certain change-in-control

transactions, International may not be required to indemnify us for income taxes arising pursuant to the

Spin-Off. Similarly, if International breaches certain covenants or other obligations or are involved in other

change-in-control transactions, we may not be required to indemnify them for income taxes arising pursuant to the

Spin-Off.

Our U.S. operations were included in International’s U.S. federal consolidated income tax returns for tax

periods through October 1, 2012. In July 2012, International reached a final resolution on a U.S. federal

income tax audit of the 2004-2006 tax years and on a Canadian income tax audit of certain matters related to the

2003-2006 tax years. The U.S. federal statute of limitations remains open for tax year 2007 and forward, and

federal income tax returns for 2007-2009 are currently under examination. As noted above Kraft is indemnified for

federal taxes U.S. state and local and foreign jurisdictions have statutes of limitations generally ranging from three

to five years unless we agree to an extension. In Canada, our only significant foreign jurisdiction, the earliest open

tax year is 2006.

At December 28, 2013, Kraft had outside tax basis in excess of book basis in certain foreign subsidiaries in which

earnings are indefinitely reinvested. As of that date, applicable U.S. federal income taxes and foreign withholding

taxes had not been provided on approximately $375 million of unremitted earnings of such foreign subsidiaries. If

such earnings were to be remitted, our incremental tax cost would be approximately $15 million.