Kraft 2013 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2013 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

56

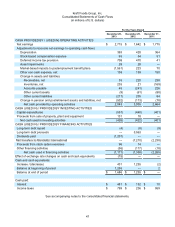

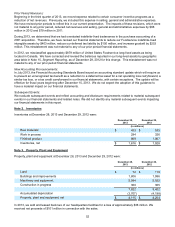

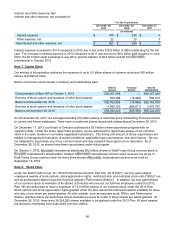

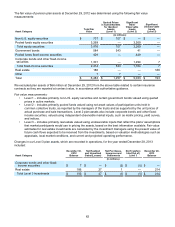

Interest and Other Expense, Net:

Interest and other expense, net consisted of:

For the Years Ended

December 28,

2013 December 29,

2012 December 31,

2011

(in millions)

Interest expense $ 479 $ 238 $ 4

Other expense, net 22 20 3

Total interest and other expense, net $ 501 $ 258 $ 7

Interest expense increased in 2013 compared to 2012 due to the entire $10.0 billion of debt outstanding for the full

year. The increase in interest expense in 2012 compared to 2011 was due to the $6.0 billion debt issuance in June

2012, the $3.6 billion debt exchange in July 2012, and the transfer of $0.4 billion of debt from

International in October 2012.

Note 7. Capital Stock

Our articles of incorporation authorize the issuance of up to 5.0 billion shares of common stock and 500 million

shares of preferred stock.

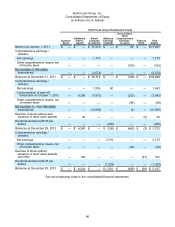

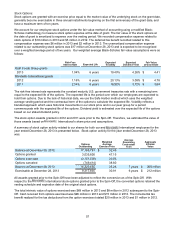

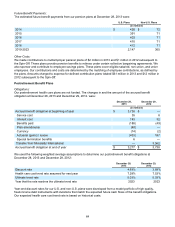

Shares of common stock issued, in treasury and outstanding were:

Shares

Issued Treasury

Shares Shares

Outstanding

Consummation of Spin-Off on October 1, 2012 592,257,298 — 592,257,298

Exercise of stock options and issuance of other stock awards 526,398 (19,988) 506,410

Balance at December 29, 2012 592,783,696 (19,988) 592,763,708

Exercise of stock options and issuance of other stock awards 4,059,753 (589,011) 3,470,742

Balance at December 28, 2013 596,843,449 (608,999) 596,234,450

As of December 28, 2013, we had approximately 0.8 million shares of restricted stock outstanding that were issued

to current and former employees. There were no preferred shares issued and outstanding at December 28, 2013.

On December 17, 2013, our Board of Directors authorized a $3.0 billion share repurchase program with no

expiration date. Under the share repurchase program, we are authorized to repurchase shares of our common

stock in the open market or in privately negotiated transactions. The timing and amount of share repurchases are

subject to management evaluation of market conditions, applicable legal requirements, and other factors. We are

not obligated to repurchase any of our common stock and may suspend the program at our discretion. As of

December 28, 2013, no shares have been repurchased under this program.

On October 1, 2012, International distributed 592 million shares of Kraft Foods Group common stock to

International’s shareholders. Holders of International common stock received one share of

Kraft Foods Group common stock for every three shares of International common stock held on

September 19, 2012.

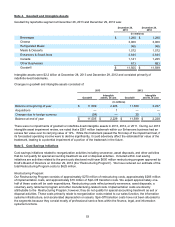

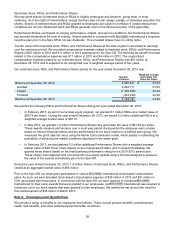

Note 8. Stock Plans

Under the Kraft Foods Group, Inc. 2012 Performance Incentive Plan (the "2012 Plan"), we may grant eligible

employees awards of stock options, stock appreciation rights, restricted stock and restricted stock units (“RSUs”) as

well as performance based long-term incentive awards (“Performance Shares”). In addition, we may grant shares

of our common stock to members of the Board of Directors who are not our full-time employees under the 2012

Plan. We are authorized to issue a maximum of 72.0 million shares of our common stock under the 2012 Plan.

Stock options and stock appreciation rights granted under the plan reduce the authorized shares available for issue

at a ratio of one share per award granted. All other awards, such as restricted stock, RSUs, and Performance

Shares, granted reduce the authorized shares available for issue at a ratio of three shares per award granted. At

December 28, 2013, there were 38,339,262 shares available to be granted under the 2012 Plan. All stock awards

are issued to employees from authorized common shares.