Kraft 2013 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2013 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

59

• Pension benefits – We provide pension coverage to certain U.S. and non-U.S. employees through separate

plans. Local statutory requirements govern many of these plans. Salaried and non-union hourly employees

hired prior to 2009 in the U.S. and 2011 in Canada are eligible to participate in our pension plans. We will

freeze U.S. pension plans for U.S. salaried and non-union hourly employees who are currently earning

pension benefits as of December 31, 2019 and non-U.S. pension plans for non-U.S. salaried and non-union

hourly employees who are currently earning pension benefits as of December 31, 2023. We will calculate

the pension benefits using the continuing pay and service through December 31, 2019 for the U.S. plans

and December 31, 2023 for the non-U.S. plans. The pension benefits of our unionized workers are in

accordance with the applicable collective bargaining agreement covering their employment.

• Postretirement benefits – Our U.S. and Canadian subsidiaries provide health care and other postretirement

benefits to most retirees. U.S. salaried and non-union hourly employees hired prior to 2004 are eligible to

participate in our U.S. postretirement benefit plans. The postretirement benefits of our unionized workers

are in accordance with the applicable collective bargaining agreement covering their employment.

• Other postemployment benefits – Our other postemployment benefits consist primarily of severance. These

plans cover most salaried and certain hourly employees, and their cost is charged to expense over the

working life of the covered employees.

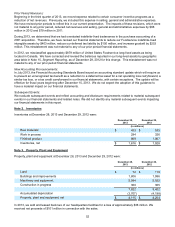

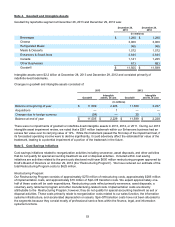

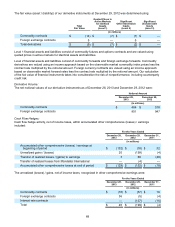

Pension Plans

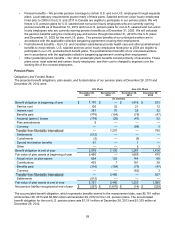

Obligations and Funded Status:

The projected benefit obligations, plan assets, and funded status of our pension plans at December 28, 2013 and

December 29, 2012 were:

U.S. Plans Non-U.S. Plans

December 28,

2013 December 29,

2012 December 28,

2013 December 29,

2012

(in millions)

Benefit obligation at beginning of year $ 7,130 $ — $ 1,418 $ 573

Service cost 100 32 21 12

Interest cost 287 70 55 32

Benefits paid (316) (154) (79) (47)

Actuarial (gains) / losses (778) (25) (47) 52

Plan amendments 9— — —

Currency — — (98) 3

— 7,207 — 790

Settlements (512) — — —

Curtailments (3) — (9) —

Special termination benefits 61 — 1 —

Other — — 5 3

Benefit obligation at end of year 5,978 7,130 1,267 1,418

Fair value of plan assets at beginning of year 5,460 — 1,089 470

Actual return on plan assets 654 122 144 68

Contributions 435 7 181 38

Benefits paid (316) (154) (79) (47)

Currency — — (82) 3

— 5,485 — 557

Settlements (512) — — —

Fair value of plan assets at end of year 5,721 5,460 1,253 1,089

Net pension liability recognized at end of year $ (257) $ (1,670) $ (14) $ (329)

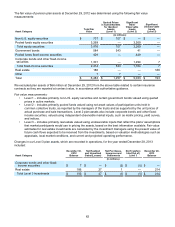

The accumulated benefit obligation, which represents benefits earned to the measurement date, was $5,781 million

at December 28, 2013 and $6,802 million at December 29, 2012 for the U.S. pension plans. The accumulated

benefit obligation for the non-U.S. pension plans was $1,191 million at December 28, 2013 and $1,303 million at

December 29, 2012.