Kraft 2013 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2013 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

62

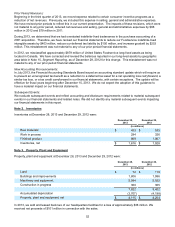

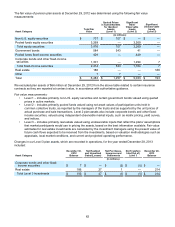

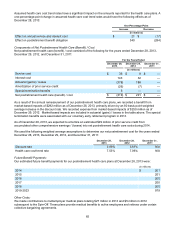

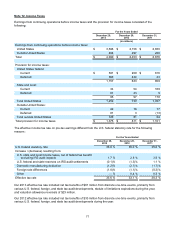

The fair value of pension plan assets at December 29, 2012 was determined using the following fair value

measurements:

Asset Category Total Fair

Value

Quoted Prices

in Active Markets

for Identical

Assets

(Level 1)

Significant

Other

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

(in millions)

Non-U.S. equity securities $ 707 $ 707 $ — $ —

Pooled funds equity securities 3,269 — 3,269 —

Total equity securities 3,976 707 3,269 —

Government bonds 584 543 41 —

Pooled funds fixed-income securities 429 — 429 —

Corporate bonds and other fixed-income

securities 1,301 — 1,294 7

Total fixed-income securities 2,314 543 1,764 7

Real estate 186 — — 186

Other 77 — —

Total $ 6,483 $ 1,257 $ 5,033 $ 193

We excluded plan assets of $66 million at December 29, 2012 from the above table related to certain insurance

contracts as they are reported at contract value, in accordance with authoritative guidance.

Fair value measurements:

• Level 1 – includes primarily non-U.S. equity securities and certain government bonds valued using quoted

prices in active markets.

• Level 2 – includes primarily pooled funds valued using net asset values of participation units held in

common collective trusts, as reported by the managers of the trusts and as supported by the unit prices of

actual purchase and sale transactions. Level 2 plan assets also include corporate bonds and other fixed-

income securities, valued using independent observable market inputs, such as matrix pricing, yield curves,

and indices.

• Level 3 – includes primarily real estate valued using unobservable inputs that reflect the plans’ assumptions

that market participants would use in pricing the assets, based on the best information available. Fair value

estimates for real estate investments are calculated by the investment managers using the present value of

future cash flows expected to be received from the investments, based on valuation methodologies such as

appraisals, local market conditions, and current and projected operating performance.

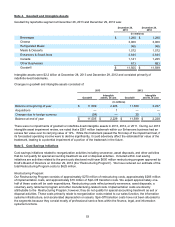

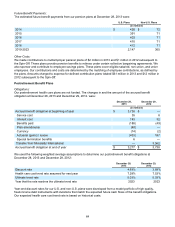

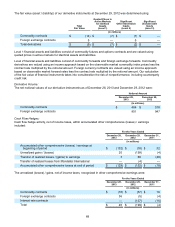

Changes in our Level 3 plan assets, which are recorded in operations, for the year ended December 28, 2013

included:

Asset Category

December 30,

2012

Balance

Net Realized

and Unrealized

Gains/(Losses)

Net Purchases,

Issuances and

Settlements

Net Transfers

Into/(Out of)

Level 3

December 28,

2013

Balance

(in millions)

Corporate bonds and other fixed-

income securities $7$ — $ (2) $ (5) $ —

Real estate 186 27 1 — 214

Total Level 3 investments $ 193 $ 27 $ (1) $ (5) $ 214