Kraft 2013 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2013 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

53

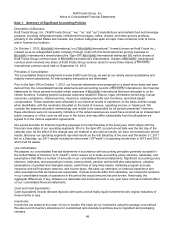

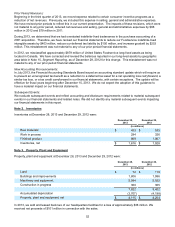

Note 4. Goodwill and Intangible Assets

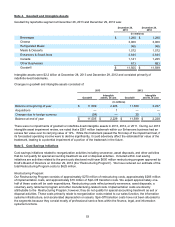

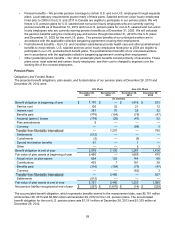

Goodwill by reportable segment at December 28, 2013 and December 29, 2012 was:

December 28,

2013 December 29,

2012

(in millions)

Beverages $ 1,290 $ 1,290

Cheese 3,000 3,000

Refrigerated Meals 985 985

Meals & Desserts 1,572 1,572

Enhancers & Snack Nuts 2,644 2,644

Canada 1,141 1,225

Other Businesses 873 883

Goodwill $ 11,505 $ 11,599

Intangible assets were $2.2 billion at December 28, 2013 and December 29, 2012 and consisted primarily of

indefinite-lived trademarks.

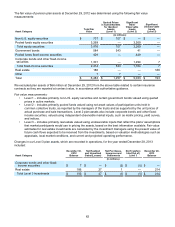

Changes in goodwill and intangible assets consisted of:

2013 2012

Goodwill Intangible

assets, at cost Goodwill Intangible

assets, at cost

(in millions)

Balance at beginning of year $ 11,599 2,228 11,569 2,227

Acquisitions — 1 — —

Changes due to foreign currency (94) — 30 1

Balance at end of year $ 11,505 $ 2,229 $ 11,599 $ 2,228

There were no impairments of goodwill or indefinite-lived intangible assets in 2013, 2012, or 2011. During our 2013

intangible asset impairment review, we noted that a $261 million trademark within our Enhancers business had an

excess fair value over its carrying value of 12%. While this trademark passed the first step of the impairment test, if

its forecasted operating income were to decline significantly, it could adversely affect the estimated fair value of the

trademark, leading to a potential impairment of a portion of the trademark in the future.

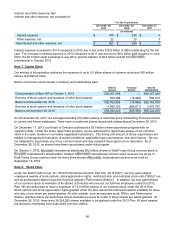

Note 5. Cost Savings Initiatives

Cost savings initiatives related to reorganization activities including severance, asset disposals, and other activities

that do not qualify for special accounting treatment as exit or disposal activities. Included within cost saving

initiatives are activities related to the previously disclosed multi-year $650 million restructuring program approved by

Kraft’s Board of Directors on October 29, 2012 (the “Restructuring Program”). We have reduced our estimate of the

total Restructuring Program costs to $625 million.

Restructuring Program:

Our Restructuring Program consists of approximately $270 million of restructuring costs, approximately $285 million

of implementation costs, and approximately $70 million of Spin-Off transition costs. We expect approximately one-

half of these costs will be cash expenditures. Restructuring costs reflect primarily severance, asset disposals, a

voluntary early retirement program and other manufacturing-related costs. Implementation costs are directly

attributable to the Restructuring Program; however, they do not qualify for special accounting treatment as exit or

disposal activities. These costs primarily relate to reorganization costs related to our sales function, the information

systems infrastructure, and accelerated depreciation on assets. Spin-Off transition costs have not been allocated to

the segments because they consist mostly of professional service fees within the finance, legal, and information

systems functions.