IHOP 2013 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2013 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DineEquity, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements (Continued)

78

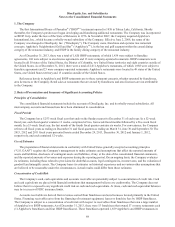

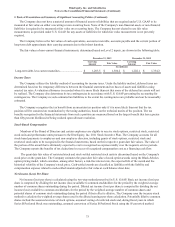

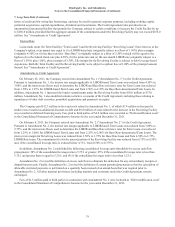

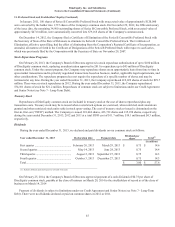

6. Other Intangible Assets

As of December 31, 2013 and 2012, intangible assets were as follows:

Not Subject to Amortization Subject to Amortization

Tradename

Liquor

Licenses Other

Franchising

Rights

Recipes and

Menus Leaseholds Total

(In millions)

Balance, December 31, 2010 ...... $ 652.4 $ 2.6 $ 0.3 $ 169.3 $ 8.9 $ 2.4 $ 835.9

Amortization expense ................. — — — (10.0) (2.3) (0.6) (12.9)

Impairment.................................. ———————

Refranchising.............................. — (1.1) — — 0.3 (0.8)

Other ........................................... — — 0.2 — — 0.2

Balance, December 31, 2011 ...... 652.4 1.5 0.5 159.3 6.6 2.1 822.4

Amortization expense ................. — — — (10.0) (2.3) (0.2) (12.5)

Refranchising.............................. — (1.5) (0.1) (0.3) — (1.9) (3.8)

Other ........................................... — — ————

Balance, December 31, 2012 ...... 652.4 — 0.4 149.0 4.3 — 806.1

Amortization expense ................. — — — (10.0) (2.3) — (12.3)

Other ........................................... — — 0.3———0.3

Balance, December 31, 2013 ...... $ 652.4 $ — $ 0.7 $ 139.0 $ 2.0 $ — $ 794.1

Annual amortization expense for the next five fiscal years is estimated to be approximately $10.4 million per year. The

weighted average life of the intangible assets subject to amortization was 19.0 years at December 31, 2013 and 2012.

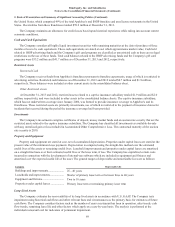

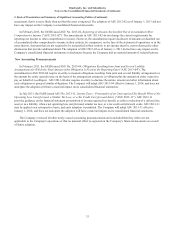

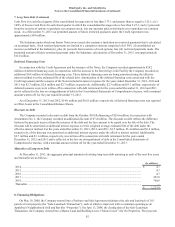

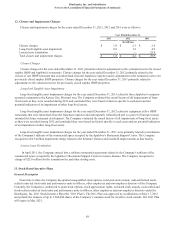

Gross and net carrying amounts of intangible assets subject to amortization at December 31, 2013 and 2012 are as follows:

December 31, 2013 December 31, 2012

Gross

Accumulated

Amortization Net Gross

Accumulated

Amortization Net

(In millions)

Franchising rights........................................ $ 200.0 $ (61.0) $ 139.0 $ 200.0 $ (51.0) $ 149.0

Recipes and menus...................................... 15.7 (13.7) 2.0 15.7 (11.4) 4.3

Leaseholds/other ......................................... 0.3 (0.3) — 0.3 (0.3) —

Total.......................................................... $ 216.0 $ (75.0) $ 141.0 $ 216.0 $ (62.7) $ 153.3

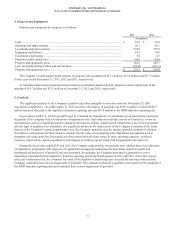

7. Long-Term Debt

Long-term debt consists of the following components:

2013 2012

(In millions)

Senior Secured Credit Facility, due October 2017, at a variable interest rate of 3.75% and

4.25% as of December 31, 2013 and 2012, respectively............................................................ $ 467.2 $ 472.0

Senior Notes due October 2018, at a fixed rate of 9.5% ............................................................ 760.8 760.8

Discount...................................................................................................................................... (19.8)(23.3)

Total debt .................................................................................................................................... 1,208.2 1,209.5

Less: current maturities............................................................................................................... (4.7)(7.4)

Long-term debt ........................................................................................................................... $ 1,203.5 $ 1,202.1

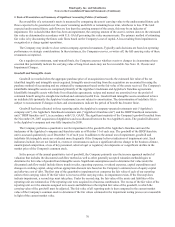

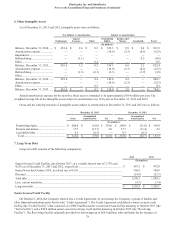

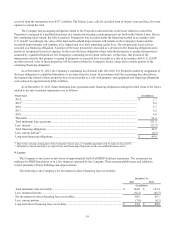

Senior Secured Credit Facility

On October 8, 2010, the Company entered into a Credit Agreement, by and among the Company, a group of lenders and

other financial institutions party thereto (the “Credit Agreement”). The Credit Agreement established a senior secured credit

facility (the “Credit Facility”) that consisted of a $900.0 million senior secured term loan facility maturing in October 2017 (the

“Term Facility”) and a $50.0 million senior secured revolving credit facility maturing in October 2015 (the “Revolving

Facility”). The Revolving Facility originally provided for borrowings up to $50.0 million, with sub-limits for the issuance of