IHOP 2013 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2013 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.DineEquity, Inc. and Subsidiaries

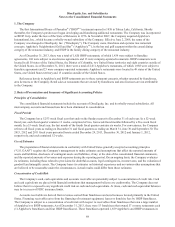

Notes to the Consolidated Financial Statements (Continued)

2. Basis of Presentation and Summary of Significant Accounting Policies (Continued)

75

assessment, that it is more likely than not that the asset is impaired. The adoption of ASU 2012-02 as of January 1, 2013 did not

have any impact on the Company’s consolidated financial statements.

In February 2013, the FASB issued ASU No. 2013-02, Reporting of Amounts Reclassified Out of Accumulated Other

Comprehensive Income (“ASU 2013-02”). The amendments in ASU 2013-02 do not change the current requirements for

reporting net income or other comprehensive income. However, the amendments require disclosure of amounts reclassified out

of accumulated other comprehensive income in their entirety, by component, on the face of the statement of operations or in the

notes thereto. Amounts that are not required to be reclassified in their entirety to net income must be cross-referenced to other

disclosures that provide additional detail. The adoption of ASU 2013-02 as of January 1, 2013 did not have any impact on the

Company's consolidated financial statements or disclosures because the Company had no material amount of reclassifications.

New Accounting Pronouncements

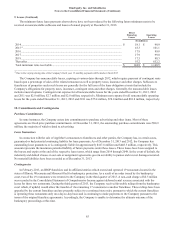

In February 2013, the FASB issued ASU No. 2013-04, Obligations Resulting from Joint and Several Liability

Arrangements for Which the Total Amount of the Obligation Is Fixed at the Reporting Date (“ASU 2013-04”). The

amendments in ASU 2013-04 require an entity to measure obligations resulting from joint and several liability arrangements as

the amount the entity agreed to pay on the basis of the arrangement among its co-obligors plus the amount an entity expects to

pay on behalf of co-obligors. ASU 2013-04 also requires an entity to disclose the nature, amount and other information about

each obligation or group of similar obligations. The Company will adopt ASU 2013-04 effective January 1, 2014, and does not

anticipate the adoption will have a material impact on its consolidated financial statements.

In July 2013, the FASB issued ASU No. 2013-11, Income Taxes - Presentation of an Unrecognized Tax Benefit When a Net

Operating Loss Carryforward, a Similar Tax Loss, or a Tax Credit Carryforward Exists (“ASU 2013-11”). ASU 2013-11

provides guidance on the financial statement presentation of an unrecognized tax benefit, as either a reduction of a deferred tax

asset or as a liability, when a net operating loss carryforward, similar tax loss, or a tax credit carryforward exists. ASU 2013-11

may be applied on a retrospective basis, and early adoption is permitted. The Company will adopt ASU 2013-11 effective

January 1, 2014, and does not anticipate the adoption will have a material impact on its consolidated financial statements.

The Company reviewed all other newly issued accounting pronouncements and concluded that they either are not

applicable to the Company's operations or that no material effect is expected on the Company's financial statements as a result

of future adoption.