IHOP 2013 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2013 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DineEquity, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements (Continued)

11. Preferred Stock and Stockholders' Equity (Continued)

87

In January 2011, 100 shares of Series B Convertible Preferred Stock with an accreted value of approximately $120,000

were converted by the holder into 1,737 shares of the Company's common stock. On November 29, 2012, the fifth anniversary

of the issue date, the remaining 34,900 outstanding shares of Series B Convertible Preferred Stock, with an accreted value of

approximately $47.0 million, were automatically converted into 679,168 shares of the Company's common stock.

On December 14, 2012, the Company filed a Certificate of Elimination of the Series B Convertible Preferred Stock with

the Secretary of State of the State of Delaware to eliminate its Series B Convertible Preferred Stock. The Certificate of

Elimination, effective upon filing, had the effect of eliminating from the Corporation’s Restated Certificate of Incorporation, as

amended, all matters set forth in the Certificate of Designations of the Series B Preferred Stock with respect to such series,

which was previously filed by the Corporation with the Secretary of State on November 29, 2007.

Stock Repurchase Programs

On February 26, 2013, the Company's Board of Directors approved a stock repurchase authorization of up to $100 million

of DineEquity common stock, replacing an authorization approved in 2011 to repurchase up to $45 million of DineEquity

common stock. Under the current program, the Company may repurchase shares on an opportunistic basis from time to time in

open market transactions and in privately negotiated transactions based on business, market, applicable legal requirements, and

other considerations. The repurchase program does not require the repurchase of a specific number of shares and may be

terminated at any time. During the year ended December 31, 2013, the Company repurchased 412,022 shares of stock for $29.7

million. There were no stock repurchases in 2012. During the year ended December 31, 2011, the Company repurchased

534,101 shares of stock for $21.2 million. Repurchases of common stock are subject to limitations under our Credit Agreement

and Senior Notes (see Note 7 - Long-Term Debt).

Treasury Stock

Repurchases of DineEquity common stock are included in treasury stock at the cost of shares repurchased plus any

transaction costs. Treasury stock may be re-issued when vested stock options are exercised, when restricted stock awards are

granted and when restricted stock units settle in stock upon vesting. The cost of treasury stock re-issued is determined on the

first-in, first-out (“FIFO”) method. The Company re-issued 318,644 shares, 433,732 shares and 135,230 shares, respectively,

during the years ended December 31, 2013, 2012 and 2011 at a total FIFO cost of $11.7 million, $14.1 million and $4.3 million,

respectively.

Dividends

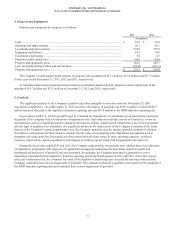

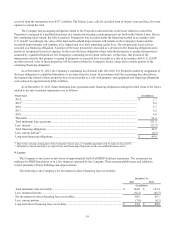

During the year ended December 31, 2013, we declared and paid dividends on our common stock as follows:

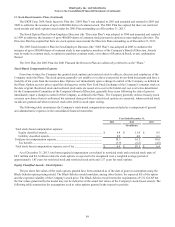

Year ended December 31, 2013 Declaration date Payment date Dividend per

share Total(1)

(In millions)

First quarter ................................................... February 26, 2013 March 29, 2013 $ 0.75 $ 14.6

Second quarter ............................................... May 14, 2013 June 28, 2013 0.75 14.4

Third quarter.................................................. August 2, 2013 September 27, 2013 0.75 14.3

Fourth quarter ................................................ October 3, 2013 December 27, 2013 0.75 14.3

Total............................................................... $ 3.00 $ 57.6

______________________________________________________

(1) Includes dividend equivalents paid on restricted stock units

On February 25, 2014, the Company's Board of Directors approved payment of a cash dividend of $0.75 per share of

DineEquity common stock, payable at the close of business on March 28, 2014 to the stockholders of record as of the close of

business on March 14, 2014

Payment of dividends is subject to limitations under our Credit Agreement and Senior Notes (see Note 7 - Long-Term

Debt). There were no dividends declared or paid on common shares in 2012 or 2011.