IHOP 2013 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2013 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

25

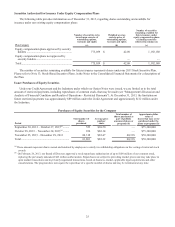

Securities Authorized for Issuance Under Equity Compensation Plans

The following table provides information as of December 31, 2013, regarding shares outstanding and available for

issuance under our existing equity compensation plans:

Plan Category

Number of securities to be

issued upon exercise of

outstanding options,

warrants and rights

Weighted average

exercise price of

outstanding options,

warrants and rights

Number of securities

remaining available for

future issuance under

equity compensation plans

(excluding securities

reflected in column (a))

(a) (b) (c)

Equity compensation plans approved by security

holders ............................................................... 775,059 $ 42.09 1,192,180

Equity compensation plans not approved by

security holders.................................................. ———

Total....................................................................... 775,059 $ 42.09 1,192,180

The number of securities remaining available for future issuance represents shares under our 2011 Stock Incentive Plan.

Please refer to Note 13, Stock-Based Incentive Plans, in the Notes to the Consolidated Financial Statements for a description of

the Plan.

Issuer Purchases of Equity Securities

Under our Credit Agreement and the Indenture under which our Senior Notes were issued, we are limited as to the total

amount of restricted payments, including repurchases of common stock, that may be made (see “Management's Discussion and

Analysis of Financial Condition and Results of Operations - Restricted Payments”). At December 31, 2013, the limitation on

future restricted payments was approximately $89 million under the Credit Agreement and approximately $112 million under

the Indenture.

Purchases of Equity Securities by the Company

Period

Total number of

shares

purchased

Average price

paid per

share

Total number of

shares purchased as

part of publicly

announced plans or

programs (b)

Approximate dollar

value of

shares that may yet be

purchased under the

plans or programs (b)

September 30, 2013 – October 27, 2013(a)......... 553 $69.50 — $75,300,000

October 28, 2013 – November 24, 2013(a) ......... 930 $82.14 — $75,300,000

November 25, 2013 – December 29, 2013 60,318 $83.47 60,318 $70,300,000

Total ................................................................... 61,801 $83.32 60,318 $70,300,000

(a) These amounts represent shares owned and tendered by employees to satisfy tax withholding obligations on the vesting of restricted stock

awards.

(b) On February 26, 2013, our Board of Directors approved a stock repurchase authorization of up to $100 million of our common stock,

replacing the previously announced $45 million authorization. Repurchases are subject to prevailing market prices and may take place in

open market transactions and in privately negotiated transactions, based on business, market, applicable legal requirements and other

considerations. The program does not require the repurchase of a specific number of shares and may be terminated at any time.