IHOP 2013 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2013 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DineEquity, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements (Continued)

13. Stock-Based Incentive Plans (Continued)

91

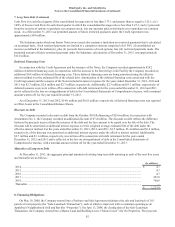

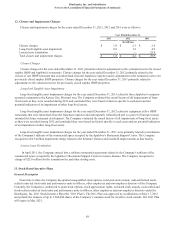

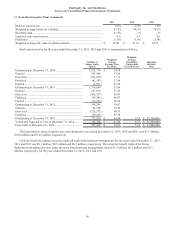

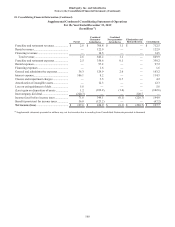

Equity Classified Awards - Restricted Stock and Restricted Stock Units

Activity in equity classified awards of restricted stock and restricted stock units for the years ended December 31, 2013, 2012

and 2011 is as follows:

Shares of

Restricted Stock

Weighted

Average

Grant-Date Per

Share

Fair Value

Restricted

Stock Units

Weighted

Average

Grant-Date

Per Share

Fair Value

Outstanding at December 31, 2010 ..................................... 666,244 $ 28.62 18,000 $ 29.32

Granted ................................................................................ 164,632 53.03 — —

Released............................................................................... (287,735) 37.82 — —

Forfeited .............................................................................. (56,608) 31.56 — —

Outstanding at December 31, 2011 ..................................... 486,533 31.08 18,000 29.32

Granted ................................................................................ 137,852 52.23 19,152 52.23

Released............................................................................... (179,465) 13.83 (3,910) 40.58

Forfeited .............................................................................. (98,357) 44.40 — —

Outstanding at December 31, 2012 ..................................... 346,563 44.74 33,242 41.19

Granted ................................................................................ 97,812 73.11 15,804 72.04

Conversion of cash-settled restricted stock units ................ — — 37,184 72.28

Released............................................................................... (117,075) 30.96 (39,000) 54.66

Forfeited .............................................................................. (61,048) 55.37 — —

Outstanding at December 31, 2013 ..................................... 266,252 $ 58.87 47,230 $ 64.57

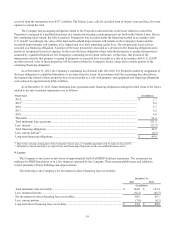

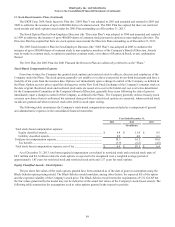

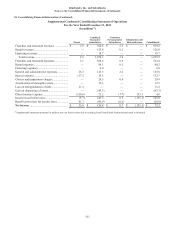

Liability Classified Awards - Restricted Stock Units

The Company previously had issued shares of cash-settled restricted stock units to members of the Board of Directors.

Originally these instruments were expected to be settled in cash and were recorded as liabilities based on the closing price of

the Company’s common stock as of each period end. In February 2013, it was determined that, pursuant to the terms of the

Plan, these restricted stock units would be settled in shares of common stock and all outstanding restricted stock units were

converted to equity classified awards. Activity in liability classified awards of restricted stock units for the years ended

December 31, 2013, 2012 and 2011 is as follows:

Cash-Settled

Restricted Stock

Units

Weighted

Average

Per Share

Fair Value

Outstanding at December 31, 2010...................................................................................... 26,000 $ 64.23

Granted................................................................................................................................. 15,957 64.30

Released ............................................................................................................................... — —

Outstanding at December 31, 2011...................................................................................... 41,957 64.26

Granted................................................................................................................................. — —

Released ............................................................................................................................... (4,773) 49.66

Outstanding at December 31, 2012...................................................................................... 37,184 66.13

Conversion to stock-settled restricted stock units................................................................ (37,184) 72.28

Outstanding at December 31, 2013...................................................................................... —

For the years ended December 31, 2013, 2012 and 2011, $0.3 million, $1.0 million and $0.5 million, respectively, was

included as stock-based compensation expense related to these cash-settled restricted stock units. At December 31, 2012, a

liability of $2.4 million was included as other accrued expenses in the consolidated balance sheet.

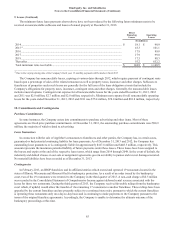

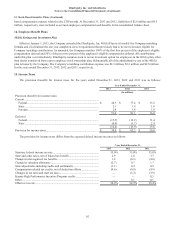

The Company has granted cash long-term incentive awards to certain employees (“LTIP awards”). Annual LTIP awards

vest over a three-year period and are determined using a multiplier from 0% to 200% of the target award based on the total

shareholder return of DineEquity, Inc. common stock compared to the total shareholder returns of a peer group of companies.

Though LTIP awards are only paid in cash, since the multiplier is based on the price of the Company's common stock, the

awards are considered stock-based compensation in accordance with U.S. GAAP and are classified as liabilities. For the years

ended December 31, 2013, 2012 and 2010, $0.6 million, $3.8 million and $0.6 million, respectively, were included in stock-