IHOP 2013 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2013 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.52

Facility. Our available borrowing capacity under the Revolving Facility is reduced by outstanding letters of credit, which

totaled $10.9 million at December 31, 2013.

9.5% Senior Notes due 2018

In October 2010, we issued $825.0 million aggregate principal amount of 9.5% Senior Notes due October 30, 2018 (the

“Senior Notes”) pursuant to an Indenture (the “Indenture”) by and among the Company, the Guarantors party thereto and Wells

Fargo Bank, National Association, as trustee. The Senior Notes are unsecured senior obligations of the Company and are jointly

and severally guaranteed on a senior unsecured basis by the Guarantors under the Credit Agreement. There are no mandatory

repayments of the Senior Notes, although under certain conditions we may be required to repurchase Senior Notes with excess

proceeds of assets sales or upon a change of control, as described in the Indenture under which the Senior Notes were issued.

There were no such required repurchases during 2013.

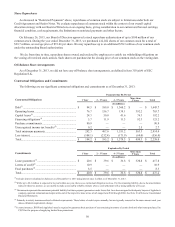

Restricted Payments

The Credit Agreement contains covenants considered customary for similar types of facilities that limit certain permitted

restricted payments, including those related to dividends on and repurchases of our common stock. The limitation on restricted

payments under the Credit Agreement is recalculated quarterly. Such restricted payments are limited to a cumulative amount

comprised of (i) a general restricted payments allowance of $35.0 million, plus (ii) 50% of Excess Cash Flow for each fiscal

quarter in which the consolidated leverage ratio is greater than 5.75:1; (iii) 75% of Excess Cash Flow for each fiscal quarter if

the consolidated leverage ratio is less than 5.75:1 and greater than or equal to 5.25:1; (iv) 100% of Excess Cash Flow for each

fiscal quarter in which the consolidated leverage ratio is less than 5.25:1; and (v) proceeds from the exercise of options to

purchase our common stock, less any amounts paid as dividends or to repurchase our common stock. As of December 31,

2013, the permitted amount of future restricted payments under the Credit Agreement was approximately $89 million.

The Indenture under which our Senior Notes were issued also contains a limitation on restricted payments that is

recalculated on an annual basis. Such restricted payments are limited to a cumulative amount comprised of (i) 50% of

consolidated net income (as defined in the Indenture), plus (ii) proceeds from exercise of stock options, less (iii) restricted

payments made. The permitted amount of future restricted payments under the Indenture, calculated as of December 31, 2013,

was approximately $112 million.

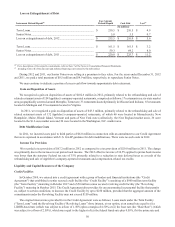

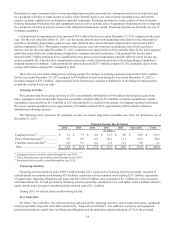

We made restricted payments of $87.1 million during the year ended December 31, 2013, comprised of cash dividends on

our common stock of $57.4 million and repurchases of common stock of $29.7 million.

Debt Covenants

Pursuant to our Credit Agreement, we are required to comply with a maximum consolidated leverage ratio and a minimum

consolidated cash interest coverage ratio. Our current maximum consolidated leverage ratio of total debt (net of unrestricted

cash not to exceed $75 million) to adjusted EBITDA is 7.0:1. Our current minimum ratio of adjusted EBITDA to consolidated

cash interest is 1.75:1. Compliance with each of these ratios is required quarterly, calculated on a trailing four-quarter basis.

The ratio thresholds become more rigorous over time. The maximum consolidated leverage ratio, which began at 7.5:1,

declines in annual 25-basis-point decrements beginning with the first quarter of 2012 to 6.5:1 by the first quarter of 2015, then

to 6.0:1 for the first quarter of 2016 until the Credit Agreement expires in October 2017. The minimum consolidated cash

interest coverage ratio began at 1.5:1, increased to 1.75:1 beginning with the first quarter of 2013 and will increase to 2.0:1

beginning with the first quarter of 2016 and will remain at that level until the Credit Agreement expires in October 2017. There

are no financial maintenance covenants associated with our Senior Notes.

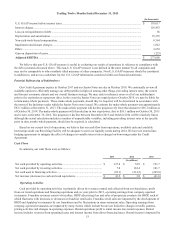

For the trailing twelve months ended December 31, 2013, our consolidated leverage ratio was 4.8:1 and our consolidated

cash interest coverage ratio was 2.5:1. Our adjusted EBITDA for the twelve months ended December 31, 2013 exceeded the

amount necessary to remain in compliance with these ratios by 45% and 43%, respectively.

Our Senior Notes, Term Loans and Revolving Loans are also subject to affirmative and negative covenants considered

customary for similar types of facilities, including, but not limited to, covenants with respect to incremental indebtedness, liens,

investments, affiliate transactions, and capital expenditures. These covenants are subject to a number of important limitations,

qualifications and exceptions. Certain of these covenants will not be applicable to the Senior Notes during any time that the

Senior Notes maintain investment grade ratings.

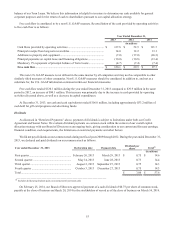

The adjusted EBITDA used in calculating the covenant ratios is considered to be a non-U.S. GAAP measure. The

reconciliation between our income before income taxes, as determined in accordance with U.S. GAAP, and adjusted EBITDA

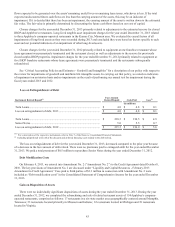

used for covenant compliance purposes is as follows: