IHOP 2013 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2013 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

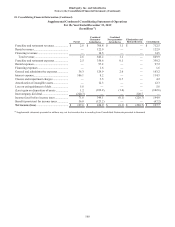

DineEquity, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements (Continued)

Note 15. Income Taxes (Continued)

93

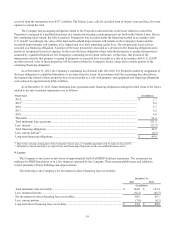

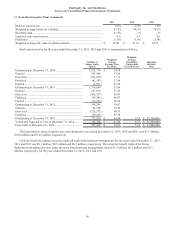

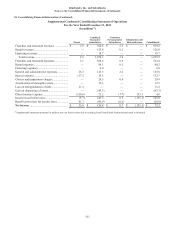

Net deferred tax assets (liabilities) consisted of the following components:

2013 2012

(In millions)

Differences in capitalization and depreciation and amortization of reacquired franchises and

equipment ................................................................................................................................... $ 4.8 $ 4.9

Differences in acquisition financing costs.................................................................................. 1.8 1.8

Employee compensation............................................................................................................. 15.0 15.2

Deferred gain on sale of assets ................................................................................................... 6.3 5.9

Book/tax difference in revenue recognition................................................................................ 29.8 22.2

Other ........................................................................................................................................... 35.0 35.4

Deferred tax assets...................................................................................................................... 92.7 85.4

Valuation allowance.................................................................................................................... (1.1) (4.1)

Total deferred tax assets after valuation allowance.................................................................... 91.6 81.3

Differences between financial and tax accounting in the recognition of franchise and

equipment sales ....................................................................................................................... (51.2)(55.1)

Differences in capitalization and depreciation (1) ................................................................................ (301.1)(310.2)

Differences in acquisition financing costs.................................................................................. (7.1) (7.7)

Book/tax difference in revenue recognition................................................................................ (19.5) (19.5)

Differences between book and tax basis of property and equipment ......................................... (10.1) (9.8)

Other ........................................................................................................................................... (20.3) (19.4)

Deferred tax liabilities ................................................................................................................ (409.3) (421.7)

Net deferred tax liabilities .......................................................................................................... $ (317.7) $ (340.4)

Net deferred tax asset—current .................................................................................................. $ 24.2 $ 22.3

Valuation allowance—current .................................................................................................... (0.3) (0.5)

Net deferred tax asset—current .................................................................................................. 23.9 21.8

Deferred tax liability—non-current ............................................................................................ (340.8) (358.6)

Valuation allowance—non-current............................................................................................. (0.8) (3.6)

Net deferred tax liability—non-current ...................................................................................... (341.6) (362.2)

Net deferred tax liabilities .......................................................................................................... $ (317.7) $ (340.4)

_____________________________________

(1) Primarily related to the Applebee's acquisition.

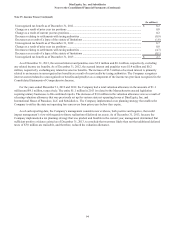

The Company files federal income tax returns and the Company or one of its subsidiaries file income tax returns in various

state and foreign jurisdictions. With few exceptions, the Company is no longer subject to federal, state or non-United States tax

examinations by tax authorities for years before 2008. In the second quarter of 2013, the Internal Revenue Service (“IRS”)

issued a Revenue Agent’s Report (“RAR”) related to its examination of the Company’s U.S federal income tax return for the

tax years 2008 to 2010. The Company disagrees with a portion of the proposed assessments and has contested them through the

IRS administrative appeals procedures. We anticipate the appeals process to continue into 2014. The Company continues to

believe that adequate reserves have been provided relating to all matters contained in the tax periods open to examination.

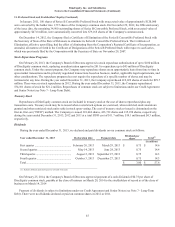

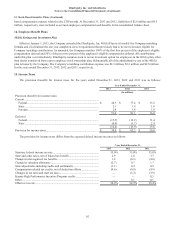

The total gross unrecognized tax benefit as of December 31, 2013 and 2012 was $2.7 million and $6.7 million,

respectively, excluding interest, penalties and related income tax benefits. The decrease of $4.0 million is primarily related to

recent settlements with taxing authorities. The entire $2.7 million will be included in the Company's effective income tax rate if

recognized.

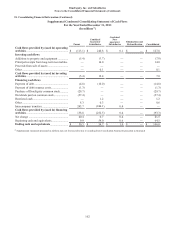

The Company estimates the unrecognized tax benefits may decrease over the upcoming 12 months by an amount up to

$0.2 million related to settlements with taxing authorities and the lapse of the statute of limitations. A reconciliation of the

beginning and ending amount of unrecognized tax benefits is as follows: