IHOP 2013 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2013 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.51

(c) the one-month LIBOR rate (which was subject to a floor of 1.50%) plus 1.00%, plus a margin of 3.50%. The margin for the

Revolving Facility was subject to debt leverage-based step-downs. There was a commitment fee for the unused portion of the

Revolving Facility of 0.75%. LIBOR rates did not exceed the interest rate floor under the Credit Agreement; accordingly, the

interest rate on our LIBOR-based Term Loan borrowings under the Credit Agreement was 6.00% until February 2011.

Credit Agreement Amendments

In February 2011, we entered into Amendment No. 1 (“Amendment No. 1”) to the Credit Agreement. Pursuant to

Amendment No. 1, the interest rate margin applicable to LIBOR-based Term Loans was reduced from 4.50% to 3.00%, and the

interest rate floors used to determine the LIBOR and Base Rate reference rates for Term Loans were reduced from 1.50% to

1.25% for LIBOR-based loans and from 2.50% to 2.25% for Base Rate-denominated loans. Amendment No. 1 did not change

the interest rates on Revolving Loans, but it did increase the available lender commitments under the Revolving Facility from

$50 million to $75 million. Amendment No. 1 also modified certain restrictive covenants of the Credit Agreement, including

those relating to repurchases of other debt securities, permitted acquisitions and payments on equity. LIBOR rates did not

exceed the revised interest rate floor under Amendment No. 1; accordingly, the interest rate on our LIBOR-based Term Loan

borrowings under Amendment No. 1 was 4.25% until February 2013.

In February, 2013, we entered into Amendment No. 2 (“Amendment No. 2”) to the Credit Agreement. Pursuant to

Amendment No. 2, the interest rate margin for Term Loans was reduced from 2.00% to 1.75% for Base Rate-denominated

loans and from 3.00% to 2.75% for LIBOR-based loans. The interest rate margin for loans under the Revolving Facility

(“Revolving Loans”) was reduced from 3.50% to 1.75% for Base Rate-denominated loans and from 4.50% to 2.75% for

LIBOR-based loans. The interest rate floors used to determine the Base Rate and LIBOR reference rates for Term Loans were

reduced from 2.25% to 2.00% for Base Rate-denominated Term Loans and from 1.25% to 1.00% for LIBOR-based Term

Loans. The interest rate floors for Revolving Loans were eliminated. The commitment fee for the unused portion of the

Revolving Facility was reduced from 0.75% to 0.50% and, if our consolidated leverage ratio is lower than 4.75:1, from 0.50%

to 0.375%. Through December 31, 2013, LIBOR rates have not exceeded the interest rate floor set by Amendment No. 2;

accordingly, the interest rate on our LIBOR-based Term Loans borrowings under Amendment No. 2 was 3.75%.

Taking into account fees and expenses associated with the Credit Agreement and subsequent amendments thereto that are

amortized as additional non-cash interest expense over the seven-year life of the Credit Agreement, the weighted average

effective interest rate for the Credit Facility as of December 31, 2013 was 5.0%.

In addition, Amendment No. 2 established the following consolidated leverage ratio thresholds for excess cash flow (as

defined in the Credit Agreement) (“Excess Cash Flow”) prepayments: 50% if the consolidated leverage ratio is 5.75:1 or

greater; 25% if the consolidated leverage ratio is less than 5.75:1 and greater than or equal to 5.25:1; and 0% if the consolidated

leverage ratio is less than 5.25:1. Amendment No. 2 also revised the definition of “Permitted Amount” so that it is now

measured on a quarterly basis for purposes of computing the permitted amount of restricted payments, which includes payment

of dividends on and repurchases of our common stock. Finally, Amendment No.2 revised the definition of Excess Cash Flow to

eliminate the deduction for any extraordinary receipts or disposition proceeds. All of these provisions were retroactively

applied to the calculation of Excess Cash Flow for fiscal 2012. All other material provisions, including maturity and covenants

under the Credit Agreement, remain unchanged.

Concurrent with Amendment No. 2, in February 2013, we borrowed $472.0 million under the Term Facility, retiring the

same amount of then-outstanding borrowings under Amendment No. 1.

Mandatory Repayments

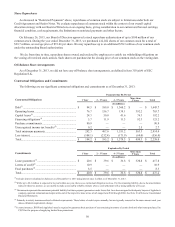

Term Loans under Amendment No. 2 are subject to the following prepayment requirements:

• Mandatory prepayments equal to 0.25% of the aggregate principal amount of the Term Loan borrowing ($472.0 million

borrowed concurrent with Amendment No. 2) must be made on a quarterly basis (1.0% for a fiscal year); and

• 50% of Excess Cash Flow if the consolidated leverage ratio is 5.75:1 or greater; 25% if the consolidated leverage ratio is

less than 5.75:1 and greater than or equal to 5.25:1; and 0% if the consolidated leverage ratio is less than 5.25:1. There were

no mandatory repayments of Term Loans from Excess Cash Flow required in 2013.

We may voluntarily prepay loans under both the Term Facility and the Revolving Facility without premium or penalty.

Revolving Loans

During the year ended December 31, 2013, we did not borrow from our Revolving Facility. The Revolving Facility is

utilized, among other purposes, to collateralize certain letters of credit we are required to maintain. Such collateralization does

not constitute a draw-down under the Revolving Facility but does reduce the amount that can be borrowed under the Revolving