IHOP 2013 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2013 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

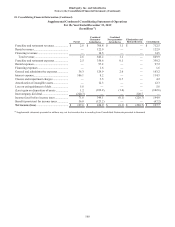

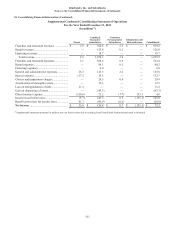

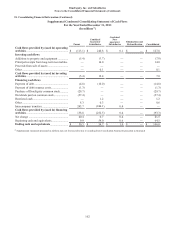

DineEquity, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements (Continued)

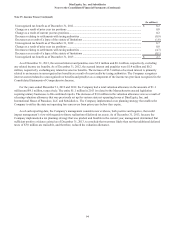

18. Consolidating Financial Information (Continued)

98

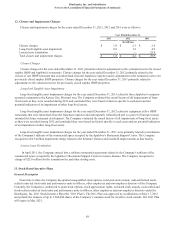

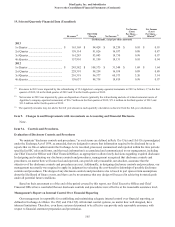

Supplemental Condensed Consolidating Balance Sheet

December 31, 2012

(In millions(1))

Parent

Combined

Guarantor

Subsidiaries

Combined

Non-guarantor

Subsidiaries

Eliminations

and

Reclassification Consolidated

Assets

Current Assets

Cash and cash equivalents ............................... $ 9.9 $ 54.0 $ 0.6 $ — $ 64.5

Receivables, net ............................................... 2.8 133.7 0.1 (8.0) 128.6

Prepaid expenses and other current assets ....... 151.3 64.6 — (136.3) 79.5

Deferred income taxes ..................................... (3.2) 24.1 0.8 — 21.8

Intercompany ................................................... (394.9) 389.0 6.0 — —

Total current assets........................................... (234.1) 665.4 7.5 (144.3) 294.5

Long-term receivables ..................................... — 212.3 — — 212.3

Property and equipment, net ............................ 23.2 270.2 0.9 — 294.4

Goodwill .......................................................... — 697.5 — — 697.5

Other intangible assets, net .............................. — 806.1 — — 806.1

Other assets, net ............................................... 18.4 92.3 — — 110.7

Investment in subsidiaries................................ 1,697.6 — — (1,697.6)—

Total assets....................................................... $ 1,505.1 $ 2,743.8 $ 8.5 $ (1,841.9) $ 2,415.4

Liabilities and Stockholders' Equity

Current Liabilities

Current maturities of long-term debt ............... $ 15.4 $ — $ — $ (8.0) $ 7.4

Accounts payable............................................. 1.4 29.3 0.1 — 30.8

Accrued employee compensation and benefits 9.4 13.0 — — 22.4

Gift card liability.............................................. — 161.7 — — 161.7

Other accrued expenses.................................... (42.5) 223.8 0.5 (136.3) 45.5

Total current liabilities..................................... (16.3) 427.8 0.6 (144.3) 267.8

Long-term debt................................................. 1,202.1 — — 1,202.1

Financing obligations....................................... — 52.0 — 52.0

Capital lease obligations .................................. — 124.4 — — 124.4

Deferred income taxes ..................................... 4.7 357.6 (0.2) 362.2

Other liabilities................................................. 5.6 91.9 0.7 98.2

Total liabilities ................................................. 1,196.1 1,053.8 1.1 (144.3) 2,106.6

Total stockholders' equity ................................ 309.0 1,690.0 7.4 (1,697.6) 308.8

Total liabilities and stockholders' equity.......... $ 1,505.1 $ 2,743.8 $ 8.5 $ (1,841.9) $ 2,415.4

(1) Supplemental statements presented in millions may not foot/crossfoot due to rounding from Consolidated Statements presented in thousands