IHOP 2013 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2013 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DineEquity, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements (Continued)

96

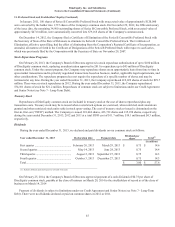

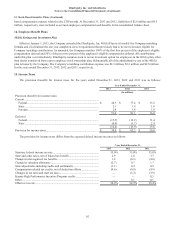

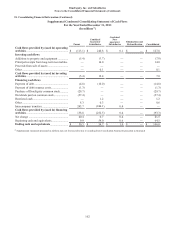

17. Segment Reporting

Information on segments and a reconciliation to income (loss) before income taxes are as follows:

Year Ended December 31,

2013 2012 2011

Revenues (In millions)

Franchise operations ....................................................................................... $ 439.2 $ 421.4 $ 398.5

Company restaurants....................................................................................... 63.4 291.1 531.0

Rental operations............................................................................................. 124.8 122.9 126.0

Financing operations ....................................................................................... 13.1 14.5 19.7

Total............................................................................................................ $ 640.5 $ 849.9 $ 1,075.2

Income (loss) before income taxes

Franchise operations ....................................................................................... $ 329.5 $ 311.5 $ 293.5

Company restaurants....................................................................................... (0.2) 41.8 72.6

Rental operations............................................................................................. 27.5 25.7 27.8

Financing operations ....................................................................................... 12.9 12.9 13.7

Corporate......................................................................................................... (259.1) (197.0) (302.6)

Income (loss) before income taxes ............................................................ $ 110.6 $ 194.9 $ 105.0

Interest expense

Company restaurants....................................................................................... $ 0.4 $ 0.4 $ 0.5

Rental operations............................................................................................. 15.7 17.0 18.0

Corporate......................................................................................................... 100.3 114.3 132.7

Total............................................................................................................ $ 116.4 $ 131.7 $ 151.2

Depreciation and amortization

Franchise operations ....................................................................................... $ 10.8 $ 9.8 $ 9.9

Company restaurants....................................................................................... 2.2 6.9 16.6

Rental operations............................................................................................. 13.4 13.6 14.0

Corporate......................................................................................................... 9.0 9.2 9.7

Total............................................................................................................ $ 35.4 $ 39.5 $ 50.2

Closure and impairment charges

Company restaurants....................................................................................... $ 1.8 $ 4.2 $ 2.4

Corporate......................................................................................................... — — 27.5

Total............................................................................................................ $ 1.8 $ 4.2 $ 29.9

Capital expenditures

Company restaurants....................................................................................... $ 1.3 $ 9.5 $ 15.5

Corporate......................................................................................................... 5.7 7.5 10.8

Total $ 7.0 $ 17.0 $ 26.3

Goodwill (all franchise segment) ................................................................... $ 697.5 $ 697.5 $ 697.5

Total assets

Franchise operations ....................................................................................... $ 1,606.4 $ 1,523.0 $ 1,472.3

Company restaurants....................................................................................... 191.6 186.2 423.1

Rental operations............................................................................................. 364.0 397.3 407.9

Financing operations ....................................................................................... 117.1 125.4 136.4

Corporate......................................................................................................... 125.5 183.5 174.6

Total............................................................................................................ $ 2,404.6 $ 2,415.4 $ 2,614.3

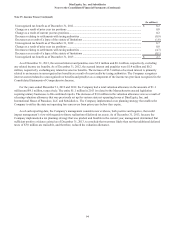

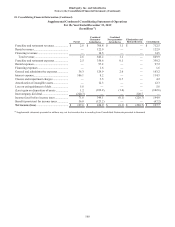

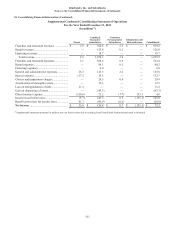

18. Consolidating Financial Information

Certain of our subsidiaries have guaranteed our obligations under the Credit Facility. The following presents the

condensed consolidating financial information separately for: (i) the Parent Company, the issuer of the guaranteed obligations;

(ii) the Guarantor subsidiaries, on a combined basis, as specified in the Credit Agreement; (iii) the Non-guarantor subsidiaries,

on a combined basis; (iv) Consolidating eliminations and reclassification; and (v) DineEquity, Inc. and Subsidiaries on a

consolidated basis. Each guarantor subsidiary is 100% owned by the Parent Company at the date of each balance sheet

presented. The Term Loans under the Credit Facility are fully and unconditionally guaranteed on a joint and several basis by

each guarantor subsidiary. Each entity in the consolidating financial information follows the same accounting policies as

described in the consolidated financial statements.