IHOP 2013 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2013 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DineEquity, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements (Continued)

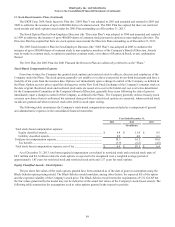

13. Stock-Based Incentive Plans (Continued)

89

The IHOP Corp. 2001 Stock Incentive Plan (the “2001 Plan”) was adopted in 2001 and amended and restated in 2005 and

2008 to authorize the issuance of up to 4,200,000 shares of common stock. The 2001 Plan has expired but there are restricted

stock awards and stock options issued under the 2001 Plan outstanding as of December 31, 2013.

The Stock Option Plan for Non-Employee Directors (the “Directors Plan”) was adopted in 1994 and amended and restated

in 1999 to authorize the issuance of up to 400,000 shares of common stock pursuant to options to non-employee directors. The

Directors Plan has expired but there are stock options issued under the Directors Plan outstanding as of December 31, 2013.

The 2005 Stock Incentive Plan for Non-Employee Directors (the “2005 Plan”) was adopted in 2005 to authorize the

issuance of up to 200,000 shares of common stock to non-employee members of the Company's Board of Directors. Awards

may be made in common stock, in options to purchase common stock, or in shares of Restricted Stock, or any combination

thereof.

The 2011 Plan, the 2005 Plan, the 2001 Plan and the Directors Plan are collectively referred to as the “Plans.”

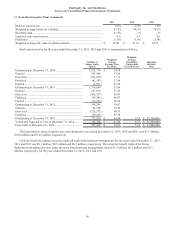

Stock-Based Compensation Expense

From time to time, the Company has granted stock options and restricted stock to officers, directors and employees of the

Company under the Plans. The stock options generally vest ratably over a three-year period in one-third increments and have a

maturity of ten years from the issuance date. Options vest immediately upon a change in control of the Company, as defined in

the Plans. Option exercise prices equal the closing price on the New York Stock Exchange of the Company's common stock on

the date of grant. Restricted stock and restricted stock units are issued at no cost to the holder and vest over terms determined

by the Compensation Committee of the Company's Board of Directors, generally three years following the date of grant or

immediately upon a change in control of the Company, as defined in the Plans. The Company generally utilizes treasury stock

or issues new shares from its authorized but unissued share pool when vested stock options are exercised, when restricted stock

awards are granted and when restricted stock units settle in stock upon vesting.

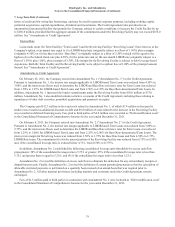

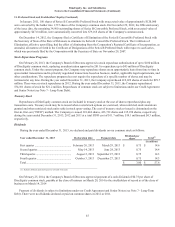

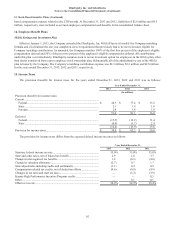

The following table summarizes the Company's stock-based compensation expense included as a component of general

and administrative expenses in the consolidated financial statements:

Year Ended December 31,

2013 2012 2011

(In millions)

Total stock-based compensation expense:

Equity classified awards............................................................................. $ 9.4 $ 11.4 $ 9.5

Liability classified awards.......................................................................... 0.9 4.8 1.1

Total pre-tax compensation expense................................................................ 10.3 16.3 10.6

Tax benefit.................................................................................................. (3.9) (6.2) (4.2)

Total stock-based compensation expense, net of tax ...................................... $ 6.4 $ 10.1 $ 6.4

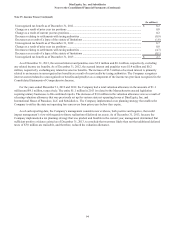

As of December 31, 2013, total unrecognized compensation cost related to restricted stock and restricted stock units of

$8.2 million and $4.1 million related to stock options is expected to be recognized over a weighted average period of

approximately 1.83 years for restricted stock and restricted stock units and 1.57 years for stock options.

Equity Classified Awards - Stock Options

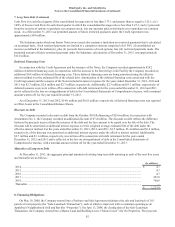

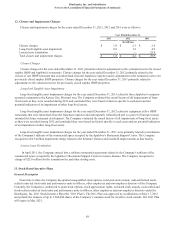

The per share fair values of the stock options granted have been estimated as of the date of grant or assumption using the

Black-Scholes option pricing model. The Black-Scholes model considers, among other factors, the expected life of the option

and the expected volatility of the Company's stock price. The Black-Scholes model meets the requirements of U.S. GAAP but

the fair values generated by the model may not be indicative of the actual fair values of the Company's stock-based awards. The

following table summarizes the assumptions used to value options granted in the respective periods: