IHOP 2013 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2013 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DineEquity, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements (Continued)

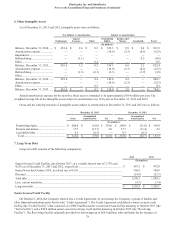

7. Long-Term Debt (Continued)

82

Cash Flow for each fiscal quarter if the consolidated leverage ratio is less than 5.75:1 and greater than or equal to 5.25:1; (iv)

100% of Excess Cash Flow for each fiscal quarter in which the consolidated leverage ratio is less than 5.25:1; and (v) proceeds

from the exercise of options to purchase our common stock, less any amounts paid as dividends or to repurchase our common

stock. As of December 31, 2013 our permitted amount of future restricted payments under the Credit Agreement was

approximately $89 million.

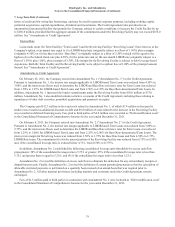

The Indenture under which our Senior Notes were issued also contains a limitation on restricted payments that is calculated

on an annual basis. Such restricted payments are limited to a cumulative amount comprised of (i) 50% of consolidated net

income (as defined in the Indenture), plus (ii) proceeds from exercise of stock options, less (iii) restricted payments made. The

permitted amount of future restricted payments under the Indenture, calculated as of December 31, 2013, was approximately

$112 million.

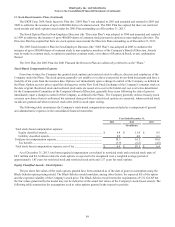

Deferred Financing Costs

In connection with the Credit Agreement and the issuance of the Notes, the Company recorded approximately $28.2

million of deferred financing costs. In connection with the increase to the Revolving Credit Facility the Company recorded an

additional $0.8 million of deferred financing costs. These deferred financing costs are being amortized using the effective

interest method over the estimated life of the related debt. Amortization of the deferred financing costs associated with the

Credit Agreement and the issuance of the Notes included in interest expense for the years ended December 31, 2013, 2012 and

2011 was $2.7 million, $2.6 million and $2.7 million, respectively. Additionally, $2.3 million and $3.1 million, respectively, of

deferred issuance costs were written off in connection with debt retirement for the years ended December 31, 2012 and 2011

and is reflected in the loss on extinguishment of debt in the Consolidated Statements of Comprehensive Income, with a nominal

amount written off for the year ended December 31, 2013.

As of December 31, 2013 and 2012, $14.0 million and $16.8 million, respectively, of deferred financing costs was reported

as Other Assets in the Consolidated Balance Sheets.

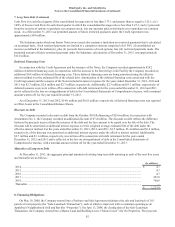

Discount on Debt

The Company recorded a discount on debt from the October 2010 Refinancing of $29.6 million. In connection with

Amendment No. 1, the Company recorded an additional discount of $7.4 million. The discount on debt reflects the difference

between the proceeds received from the issuance of the debt and the face amount to be repaid over the life of the debt. The

discount will be amortized as additional interest expense over the weighted average estimated life of the debt under the

effective interest method. For the years ended December 31, 2013, 2012, and 2011, $3.5 million, $3.4 million and $3.4 million,

respectively, of the discount was amortized as additional interest expense under the effective interest method. Additionally,

$2.7 million and $3.1 million, respectively, was written off in connection with debt retirement for the years ended

December 31, 2012 and 2011 and is reflected in the loss on extinguishment of debt in the Consolidated Statements of

Comprehensive Income, with a nominal amount written off for the year ended December 31, 2013.

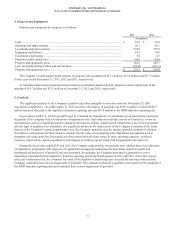

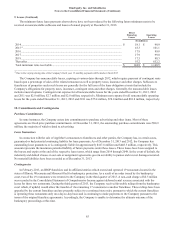

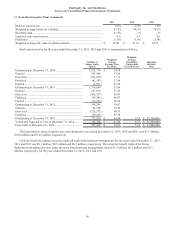

Maturities of Long-term Debt

At December 31, 2013, the aggregate principal amounts of existing long-term debt maturing in each of the next five years

and thereafter are as follows:

(In millions)

2014........................................................................................................................................................................ $ 4.7

2015........................................................................................................................................................................ 4.7

2016........................................................................................................................................................................ 4.7

2017........................................................................................................................................................................ 453.0

2018........................................................................................................................................................................ 760.8

Thereafter ............................................................................................................................................................... —

$ 1,227.9

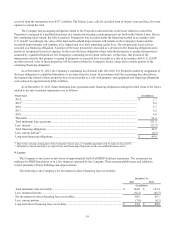

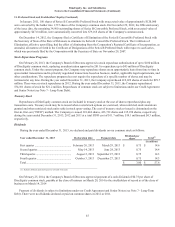

8. Financing Obligations

On May 19, 2008, the Company entered into a Purchase and Sale Agreement relating to the sale and leaseback of 181

parcels of real property (the “Sale-Leaseback Transaction”), each of which is improved with a restaurant operating as an

Applebee's Neighborhood Grill and Bar (the “Properties”). On June 13, 2008, the closing date of the Sale-Leaseback

Transaction, the Company entered into a Master Land and Building Lease (“Master Lease”) for the Properties. The proceeds