IHOP 2013 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2013 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

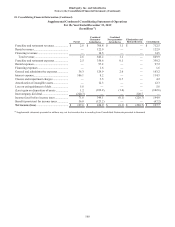

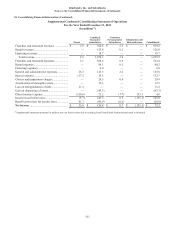

DineEquity, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements (Continued)

Note 15. Income Taxes (Continued)

94

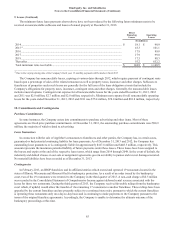

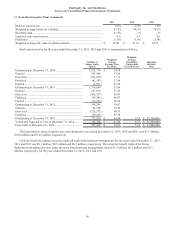

(In millions)

Unrecognized tax benefit as of December 31, 2011............................................................................................... $ 8.2

Change as a result of prior year tax positions ........................................................................................................ 0.8

Change as a result of current year tax positions..................................................................................................... 0.2

Decreases relating to settlements with taxing authorities ...................................................................................... (0.9)

Decreases as a result of a lapse of the statute of limitations .................................................................................. (1.6)

Unrecognized tax benefit as of December 31, 2012 .............................................................................................. 6.7

Change as a result of prior year tax positions ........................................................................................................ 0.8

Decreases relating to settlements with taxing authorities ...................................................................................... (4.7)

Decreases as a result of a lapse of the statute of limitations .................................................................................. (0.1)

Unrecognized tax benefit as of December 31, 2013 .............................................................................................. $ 2.7

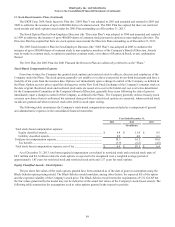

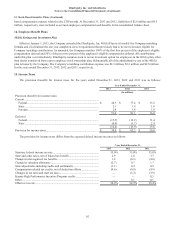

As of December 31, 2013, the accrued interest and penalties were $2.9 million and $0.1 million, respectively, excluding

any related income tax benefits. As of December 31, 2012, the accrued interest and penalties were $1.4 million and $0.2

million, respectively, excluding any related income tax benefits. The increase of $1.5 million of accrued interest is primarily

related to an increase in unrecognized tax benefits as a result of recent audits by taxing authorities. The Company recognizes

interest accrued related to unrecognized tax benefits and penalties as a component of the income tax provision recognized in the

Consolidated Statements of Comprehensive Income.

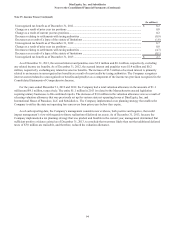

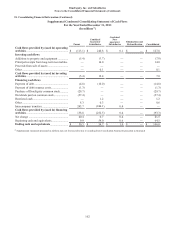

For the years ended December 31, 2013 and 2012, the Company had a total valuation allowance in the amounts of $1.1

million and $4.1 million, respectively. The entire $1.1 million in 2013 is related to the Massachusetts enacted legislation

requiring unitary businesses to file combined reports. The decrease of $3.0 million in the valuation allowance was as a result of

releasing valuation allowance that was previously set up for various state net operating losses at DineEquity, Inc. and

International House of Pancakes, LLC and Subsidiaries. The Company implemented a tax planning strategy that enables the

Company to utilize the state net operating loss carryovers from prior years before they expire.

As of each reporting date, the Company’s management considers new evidence, both positive and negative, that could

impact management’s view with regards to future realization of deferred tax assets. As of December 31, 2013, because the

Company implemented a tax planning strategy that was prudent and feasible in the current year, management determined that

sufficient positive evidence existed as of December 31, 2013, to conclude that was more likely than not that additional deferred

taxes of $3.0 million are realizable, and therefore, reduced the valuation allowance.