IHOP 2013 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2013 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50

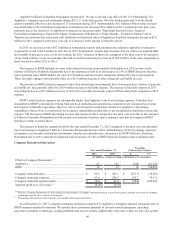

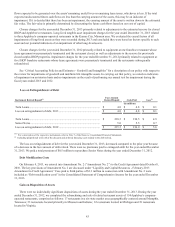

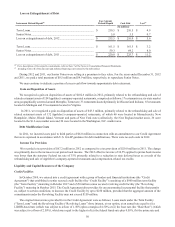

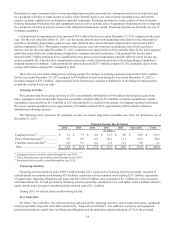

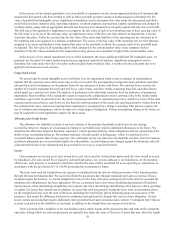

Loss on Extinguishment of Debt

Instrument Retired/Repaid(1) Face Amount

Retired/Repaid Cash Paid

Loss(2)

(In millions)

Term Loans ........................................................................................ $ 210.5 $ 210.5 $ 4.9

Senior Notes....................................................................................... 5.0 5.5 0.7

Loss on extinguishment of debt, 2012 ............................................... $ 215.5 $ 216.0 $ 5.6

Term Loans ........................................................................................ $ 161.5 $ 161.5 $ 3.2

Senior Notes....................................................................................... 59.3 64.2 8.0

Loss on extinguishment of debt, 2011 ............................................... $ 220.8 $ 225.7 $ 11.2

_____________________________________________________

(1) For a description of the respective instruments, refer to Note 7 of the Notes to Consolidated Financial Statements.

(2) Including write-off of the discount and deferred financing costs related to the debt retired.

During 2012 and 2011, our Senior Notes were selling at a premium to face value. For the years ended December 31, 2012

and 2011, we paid a total premium of $0.5 million and $4.9 million, respectively, to repurchase Senior Notes.

We may continue to dedicate a portion of excess cash flow towards opportunistic debt retirement.

Gain on Disposition of Assets

We recognized a gain on disposition of assets of $102.6 million in 2012, primarily related to the refranchising and sale of

related restaurant assets of 154 Applebee's company-operated restaurants, comprised as follows: 17 restaurants in a six-state market

area geographically centered around Memphis, Tennessee; 33 restaurants located primarily in Missouri and Indiana; 65 restaurants

located in Michigan and 39 restaurants located in Virginia.

In 2011, we recognized a gain on disposition of assets of $43.3 million, primarily related to the refranchising and sale of

related restaurant assets of 132 Applebee's company-operated restaurants, of which 66 were located in Massachusetts, New

Hampshire, Maine, Rhode Island, Vermont and parts of New York state (collectively, the New England market area), 36 were

located in the St. Louis market area and 30 were located in the Washington, D.C. market area.

Debt Modification Costs

In 2011, we incurred costs paid to third parties of $4.0 million in connection with an amendment to our Credit Agreement

that were expensed in accordance with U.S. GAAP guidance for debt modifications. There were no such costs in 2012.

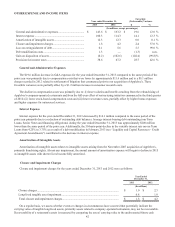

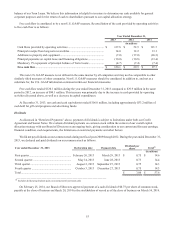

Income Tax Provision

We recorded a tax provision of $67.2 million in 2012 as compared to a tax provision of $29.8 million in 2011. The change

was primarily due to the increase in our pretax book income. The 2012 effective tax rate of 34.5% applied to pretax book income

was lower than the statutory Federal tax rate of 35% primarily related to a reduction in state deferred taxes as a result of the

refranchising and sale of Applebee's company-operated restaurants and compensation-related tax credits.

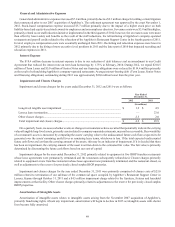

Liquidity and Capital Resources of the Company

Credit Facilities

In October 2010, we entered into a credit agreement with a group of lenders and financial institutions (the "Credit

Agreement") that established a senior secured credit facility (the “Credit Facility”) consisting of a $900 million term facility

(the “Term Facility”) maturing in October 2017 and a $50 million senior secured revolving credit facility (the “Revolving

Facility”) maturing in October 2015. The Credit Agreement also provides for an uncommitted incremental facility that permits

us, subject to certain conditions, to increase the Credit Facility by up to $250 million, provided that the aggregate amount of the

commitments under the Revolving Facility may not exceed $150 million.

The original interest rates provided for in the Credit Agreement were as follows: Loans made under the Term Facility

(“Term Loans”) and the Revolving Facility (“Revolving Loans”) bore interest, at our option, at an annual rate equal to (i) a

LIBOR-based rate (which was subject to a floor of 1.50%) plus a margin of 4.50% or (ii) the base rate (the “Base Rate”) (which

was subject to a floor of 2.50%), which was equal to the highest of (a) the federal funds rate plus 0.50%, (b) the prime rate and