IHOP 2013 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2013 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DineEquity, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements (Continued)

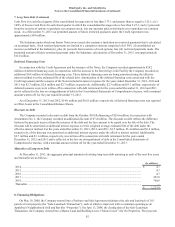

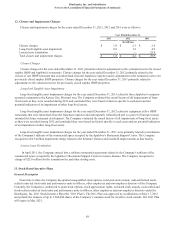

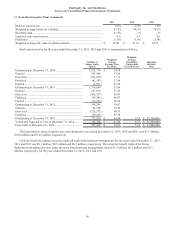

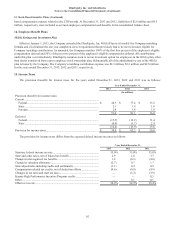

13. Stock-Based Incentive Plans (Continued)

90

2013 2012 2011

Risk free interest rate ...................................................................................... 0.8% 0.9% 1.8%

Weighted average historical volatility............................................................. 83.4% 84.5% 79.1%

Dividend yield................................................................................................. 4.15% —% —%

Expected years until exercise.......................................................................... 4.6 4.7 4.6

Forfeitures ....................................................................................................... 11.0% 11.0% 11.0%

Weighted average fair value of options granted.............................................. $ 36.00 $ 33.53 $ 34.31

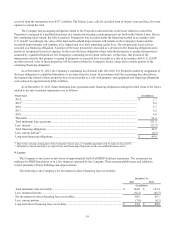

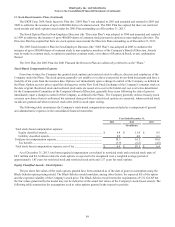

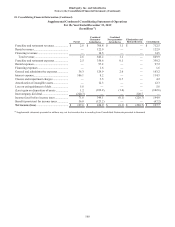

Stock option activity for the years ended December 31, 2013, 2012 and 2011 is summarized as follows:

Number of

Shares Under

Option

Weighted

Average

Exercise Price

Per Share

Weighted

Average

Remaining

Contractual

Term (in Years)

Aggregate

Intrinsic

Val ue

Outstanding at December 31, 2010 ..................................... 1,523,710 $ 24.90

Granted ................................................................................ 233,449 53.04

Exercised ............................................................................. (393,075) 17.11

Forfeited .............................................................................. (42,593) 27.89

Expired ................................................................................ (2,851) 47.08

Outstanding at December 31, 2011 ..................................... 1,318,640 32.06

Granted ................................................................................ 147,674 51.63

Exercised ............................................................................. (455,217) 20.91

Forfeited .............................................................................. (39,381) 46.97

Expired ................................................................................ (13,470) 38.64

Outstanding at December 31, 2012 ..................................... 958,246 39.67

Granted ................................................................................ 81,328 72.28

Exercised ............................................................................. (225,272) 40.31

Forfeited .............................................................................. (39,243) 55.78

Outstanding at December 31, 2013 ..................................... 775,059 $ 42.09 6.28 $ 32,100,000

Vested and Expected to Vest at December 31, 2013............ 758,338 $ 41.64 6.23 $ 31,800,000

Exercisable at December 31, 2013 ...................................... 567,630 $ 35.91 5.55 $ 27,000,000

The total intrinsic value of options exercised during the years ended December 31, 2013, 2012 and 2011 was $7.5 million,

$15.0 million and $14.6 million, respectively.

Cash received from options exercised under all stock-based payment arrangements for the years ended December 31, 2013,

2012 and 2011 was $9.1 million, $9.3 million and $6.7 million, respectively. The actual tax benefit realized for the tax

deduction from option exercises under the stock-based payment arrangements totaled $3.7 million, $6.2 million and $5.8

million, respectively, for the years ended December 31, 2013, 2012 and 2011.