IHOP 2013 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2013 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.DineEquity, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements (Continued)

2. Basis of Presentation and Summary of Significant Accounting Policies (Continued)

71

In the process of the Company's annual impairment review of the tradename, the most significant indefinite life intangible

asset, the Company primarily uses the relief of royalty method under income approach method of valuation. Significant

assumptions used to determine fair value under the relief of royalty method include future trends in sales, a royalty rate and a

discount rate to be applied to the forecast revenue stream.

There were no impairments of goodwill or intangible assets recorded in 2013, 2012 or 2011.

Revenue Recognition

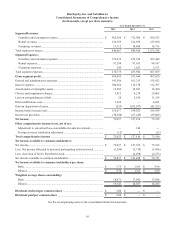

The Company's revenues are recorded in four categories: franchise operations, company restaurant operations, rental

operations and financing operations.

Franchise operations revenue consists primarily of royalty revenues, sales of proprietary IHOP products, IHOP advertising

fees and the portion of the franchise fees allocated to the Company's intellectual property. Company restaurant sales are retail

sales at company-operated restaurants. Rental operations revenue includes revenue from operating leases and interest income

from direct financing leases. Financing operations revenue consists primarily of interest income from the financing of franchise

fees and equipment leases, as well as sales of equipment associated with refranchised IHOP restaurants.

Revenues from franchised and area licensed restaurants include royalties, continuing rent and service fees and initial

franchise fees. Royalties are recognized in the period in which the sales are reported to have been earned, which occurs at the

franchisees' point of sale. Continuing rent and fees are recognized in the period earned. Initial franchise fees are recognized

upon the opening of a restaurant, which is when the Company has performed substantially all initial services required by the

franchise agreement. Fees from development agreements are deferred and recorded into income as restaurants under the

development agreement are opened.

Sales by company-operated restaurants are recognized when food and beverage items are sold. Company restaurant sales

are reported net of sales taxes collected from guests that are remitted to the appropriate taxing authorities.

The Company records a liability in the period in which a gift card is sold. As gift cards are redeemed, this liability is

reduced, with revenue recognized only on redemptions at company-operated restaurants. The Company recognizes gift card

breakage income on gift cards issued when the assessment of the likelihood of redemption of the gift card becomes remote.

This assessment is based upon Applebee's and IHOP's historical experience with gift card redemptions for their respective gift

card program. The Company recorded gift card breakage revenue of $0.2 million, $1.3 million and $2.1 million for the years

ended December 31, 2013, 2012 and 2011, respectively. The progressive decline is due to the decrease in the number of

Applebee's company-operated restaurants.

Allowance for Credit Losses

The allowance for doubtful accounts is the Company's best estimate of the amount of probable credit losses in existing

receivables; however, changes in circumstances relating to receivables may result in additional allowances in the future. The

Company determines the allowance based on historical experience, current payment patterns, future obligations and the

Company's assessment of the franchisee's or area licensee's ability to pay outstanding balances. The primary indicator of credit

quality is delinquency, which is considered to be a receivable balance greater than 90 days past due. The Company continually

reviews the allowance for doubtful accounts. Past due balances and future obligations are reviewed individually for

collectability. Account balances are charged against the allowance after all collection efforts have been exhausted and the

potential for recovery is considered remote.

Leases

The Company is the lessor or sub-lessor of the properties on which 723 IHOP restaurants and one Applebee's restaurant

are located. The restaurants are subleased to franchisees or, in a few instances, are operated by the Company. The Company's

IHOP leases generally provide for an initial term of 15 to 25 years, with most having one or more five-year renewal options at

the Company's option. In addition, the Company leases a majority of its Applebee's company-operated restaurants. The

Applebee's company-operated leases generally have an initial term of 10 to 20 years, with renewal terms of five to 20 years,

and provide for a fixed rental plus, in certain instances, percentage rentals based on gross sales. The rental payments or receipts

on leases that meet the operating lease criteria are recorded as rental expense or rental income, respectively. Rental expense and

rental income for these operating leases are recognized on the straight-line basis over the original terms of the leases. Any

difference between straight-line rent expense or income and actual amounts paid or received represents deferred rent and is

included in the consolidated balance sheets as other assets or other liabilities, as appropriate. There was $91.4 million and $89.7