IBM 2002 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2002 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

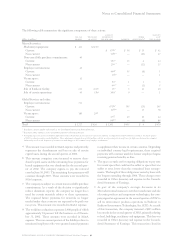

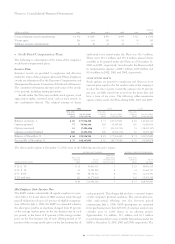

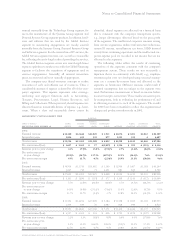

2002 2001 2000

wtd. avg. wtd. avg. wtd. avg.

exercise no. of shares exercise no. of shares exercise no. of shares

price under option price under option price under option

Balance at January 1 $««85 177,956,490 $««73 160,557,003 $««60 146,136,523

Options granted 77 59,966,106 110 43,410,364 102 42,601,014

Options exercised 33 (7,490,424)) 37 (20,354,701) 35 (18,243,347)

Options canceled/expired 103 (7,495,472) 100 (5,656,176) 87 (9,937,187)

Balance at December 31 $««84 222,936,700 $««85 177,956,490 $««73 160,557,003

Exercisable at December 31 $««75 108,347,895 $««62 80,773,980 $««45 66,599,878

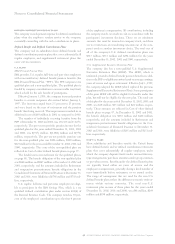

The shares under option at December 31, 2002, were in the following exercise price ranges:

options outstanding options currently exercisable

wtd. avg.

wtd. avg. remaining wtd. avg.

exercise no. of contractual exercise no. of

exercise price range price options life (in years) price options

$12

–

$50 $««29 30,094,313 3 $««29 30,094,313

$51

–

$90 65 74,701,940 8 61 32,466,761

$91

–

$110 103 68,564,527 8 105 22,223,431

$111 and over 122 49,575,920 8 126 23,563,390

$««84 222,936,700 7 $««75 108,347,895

Notes to Consolidated Financial Statements

94 international business machines corporation and Subsidiary Companies

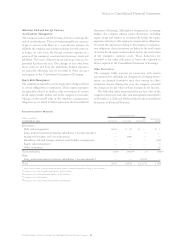

authorized to be issued under the Plans was 411.3 million.

There were 183.3 million and 193.4 million unused shares

available to be granted under the Plans as of December 31,

2002 and 2001, respectively. Awards under the Plans resulted

in compensation expense of $183 million, $170 million and

$134 million in 2002, 2001 and 2000, respectively.

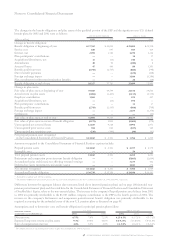

stock option grants

Stock options are granted to employees and directors at an

exercise price equal to the fair market value of the company’s

stock at the date of grant. Generally, options vest 25 percent

per year, are fully vested four years from the grant date and

have a term of ten years. The following tables summarize

option activity under the Plans during 2002, 2001 and 2000:

vStock-Based Compensation Plans

The following is a description of the terms of the company’s

stock-based compensation plans:

Incentive Plans

Incentive awards are provided to employees and directors

under the terms of the company’s plans (the Plans). Employee

awards are administered by the Executive Compensation and

Management Resources Committee of the Board of Directors.

The committee determines the type and terms of the awards

to be granted, including vesting provisions.

Awards under the Plans may include stock options, stock

appreciation rights, restricted stock, cash or stock awards, or

any combination thereof. The original amount of shares

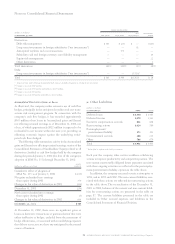

IBM Employees Stock Purchase Plan

The ESPP enables substantially all regular employees to pur-

chase full or fractional shares of IBM common stock through

payroll deductions of up to 10 percent of eligible compensa-

tion. Effective July 1, 2000, the ESPP was amended whereby

the share price paid by an employee changed from 85 percent

of the average market price on the last business day of each

pay period, to the lesser of 85 percent of the average market

price on the first business day of each offering period or 85

percent of the average market price on the last business day of

each pay period. This change did not have a material impact

on the company’s financial condition. The current plan pro-

vides semi-annual offerings over the five-year period

commencing July 1, 2000. ESPP participants are restricted

from purchasing more than $25,000 of common stock in one

calendar year or 1,000 shares in an offering period.

Approximately 4.6 million, 16.5 million and 26.3 million

reserved unissued shares were available for purchase under the

ESPP at December 31, 2002, 2001 and 2000, respectively. The

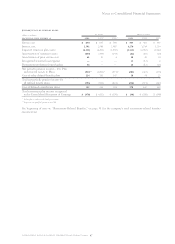

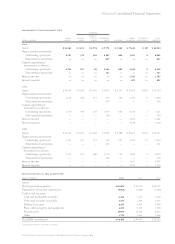

beyond

(dollars in millions) 2003 2004 2005 2006 2007 2007

Gross minimum rental commitments $«1,370 $«1,066 $«859 $«689 $«511 $«1,590

Vacant space ««««206 «««««161 «««131 «««92 «««54 ««««««185

Sublease income commitments ««««««46 ««««««38 «««31 «««20 «««5 ««««««41