IBM 2002 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2002 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management Discussion

45international business machines corporation and Subsidiary Companies

■

Technology Innovations

—

IBM has been moving away from

commoditized segments of the IT industry and into areas

in which it can differentiate itself through innovation, and

by leveraging its investments in research and development

(R&D). Examples include IBM’s leadership position in the

design and fabrication of Application Specific Integrated

Circuits; work on designing smaller, faster and lower-

power-consuming semiconductor devices (using such

innovations as copper technology, silicon on insulator,

silicon germanium and low-K dielectric); work to design

“autonomic” or self-managing computing systems and

build the “grid” computing networks that allow computers

to go beyond sharing communications and actually combine

processing power; and the company’s efforts to advance

open technology standards such as Linux.

■

Internal Business Transformation and Efficiency Initiatives

—

A critical element of the company’s strategy to improve

shareholder value is improving productivity and efficiency.

The company continues to execute on the following three

ongoing initiatives.

1. Internal implementation of the same business transfor-

mation activities that the company provides for its

customers. Over the past ten years, IBM’s cost and

expense infrastructure has been improved by numer-

ous simplification and transformation efforts. The

following are a few examples:

Internal IT Infrastructure

—

Internal MVS/VM host

data centers reduced from 155 to 11.

Customers

—

More than 80 percent of sales to business

partners are achieved through the Web.

Suppliers

—

Number of electronically connected

suppliers now exceeds 31,000.

Employees

—

eLearning represents almost 50 percent

of all employee training.

2. Outsourcing or process redesign of certain hardware

manufacturing to lower-cost contract manufacturers

in order to increase the variability of the company’s

manufacturing cost structure. An example is the com-

pany’s 2002 outsourcing of desktop personal computer

manufacturing to Sanmina

–

SCI.

3. Intense focus on improving employee and process

productivity in order to drive a more efficient expense

structure.

■

Economic Environment and Corporate IT Spending Budgets

—

Although the diverse nature of IBM’s capabilities somewhat

mitigates the economic volatility of IBM’s results, the

company’s financial performance is impacted by overall

marketplace spending. Although IT spending is an impor-

tant driver of IBM’s financial results, a key objective is to

outperform key competitors and gain market share during

strong and weak economic environments.

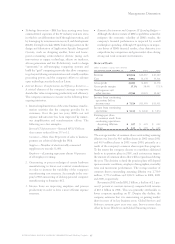

Historical Results

(dollars in millions except per share amounts)

for the year ended december 31: 2002 2001 2000

Revenue $«81,186 $«83,067 $«85,089

Cost 50,902 51,178 53,511

Gross profit «30,284 «31,889 «31,578

Gross profit margin 37.3% 38.4% 37.1%

Total expense and

other income 22,760 20,439 20,167

Income from continuing

operations before

income taxes $«««7,524 $«11,450 $«11,411

Income from continuing

operations $«««5,334 $«÷8,146 $«««7,874

Earnings per share

of common stock from

continuing operations:

Assuming dilution $«««««3.07 $÷÷«4.59 $«««««4.32

Basic $«««««3.13 $÷÷«4.69 $÷÷«4.45

The average number of common shares outstanding assuming

dilution was lower by 40.3 million shares in 2002 versus 2001

and 40.9 million shares in 2001 versus 2000, primarily as a

result of the company’s common share repurchase program.

To the extent the company chooses to contribute additional

funds to its pension plans in 2003, such actions may impact

the amount of common shares that will be repurchased during

the year. The decision to fund the pension plans will depend

upon economic conditions, employee demographics, mortality

rates and investment performance. The average number of

common shares outstanding assuming dilution was 1,730.9

million, 1,771.2 million and 1,812.1 million in 2002, 2001

and 2000, respectively.

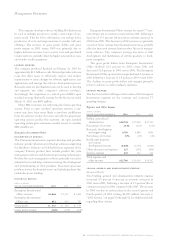

Revenue in 2002 totaled $81.2 billion, a decline of 2.3 per-

cent (3 percent at constant currency) compared with revenue

of $83.1 billion in 2001. This was primarily attributable to

lower corporate spending on IT. Despite this decline, the

company estimates that it is maintaining or gaining market

share in most of its key business areas. Global Services and

Software revenue grew year over year, but was more than

offset by lower Hardware and Global Financing revenue.