IBM 2002 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2002 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Technology Group

The Technology Group, primarily consisting of the

Microelectronics Division, provides leading semiconductor

technology, packaging solutions and engineering technology

services to OEM customers and, although appropriately not

reported as external revenue, to the Systems Group. The

Microelectronics Division develops and manufactures prod-

ucts in three general categories:

Application Specific Integrated Circuits

—

The company man-

ufactures and tests customized semiconductor products for

customers. The customers design these customized product

solutions using IBM’s suite of design tools and portfolio of

intellectual property (IP), resulting in faster speeds to market

for the customers.

Foundry

—

Semiconductor customers provide IBM with

their product designs based upon the customer’s product IP.

Using the customer’s design, IBM provides a full suite of

semiconductor manufacturing and integrated supply chain

services to deliver the product to the customer.

Standard products

—

These are semiconductors that are man-

ufactured and designed primarily based upon IBM’s Power PC

platform. Minor customization is performed for customers.

In addition, Technology Group launched in 2002 its new

Engineering and Technology Services Division that provides

system and component design services, strategic outsourcing

of customers’ design teams, and technology and manufactur-

ing consulting services.

historical results

(dollars in millions)

for the year ended december 31: 2002 2001 2000

Hardware revenue $«27,456 $«30,593 $«34,470

Hardware cost 20,020 21,231 24,207

Gross profit $«««7,436 $«««9,362 $«10,263

Gross profit margin 27.1% 30.6% 29.8%

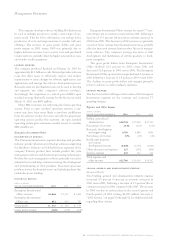

Hardware revenue declined 10.3 percent (11 percent at con-

stant currency) in 2002 versus 2001 and declined 11.2 percent

(8 percent at constant currency) in 2001 compared with 2000.

In 2002, Systems Group revenue declined 8.0 percent

(10 percent at constant currency) to $12,646 million from

2001, following a decrease of 3.2 percent in 2001 versus 2000.

Revenue from the majority of the Systems Group products

was affected by the continuing weak IT spending during

2002. zSeries revenue declined in 2002 following an increase

in 2001. Total deliveries of zSeries computing power increased

approximately 6 percent as measured in MIPS (millions of

instructions per second) versus 2001, while the price per MIP

continued to decline from 2000 through 2002. Revenue from

pSeries UNIX servers decreased in 2002 versus 2001 although

high-end pSeries server revenue increased in 2002 versus

2001. In November 2002 the company announced a new

mid-range p650 server with Power 4 engines, which gener-

ated strong demand. Revenue from pSeries servers declined

due to weak market conditions, although high-end server

revenue increased in 2001 versus 2000. Revenue from iSeries

servers declined in 2002 versus 2001 due to weak volumes

across all product lines. Revenue from iSeries servers also

declined in 2001 versus 2000. These declines in revenue were

partially offset by increased revenue from xSeries servers,

primarily in the high-end servers. The company expects to

have gained market share in xSeries servers in 2002 against

competitors. xSeries revenue declined in 2001 versus 2000,

reflecting the competitive environment in the Intel-based

server market.

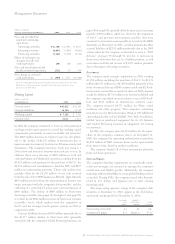

Revenue from storage products decreased in direct access

storage device (DASD) and tape product lines in 2002 versus

2001 as the company experienced weakness in this business

consistent with general industry trends whereby the impact

of price declines exceeded the impact of volume growth as

measured in terabytes. In 2001, revenue increased primarily

as a result of higher revenue from high-end storage products

versus 2000.

Personal Systems Group revenue declined 7.8 percent

(9 percent at constant currency) in 2002 to $11,049 million

from 2001, following a decrease of 20.6 percent in 2001 versus

2000 with personal computers, retail stores solutions and

printer systems all showing declines. The personal computer

revenue decline was primarily driven by the continued

demand weakness and price erosion in the industry.

The Technology Group no longer includes HDDs and

comprises mainly the company’s Microelectronics Division

for all periods presented. Technology Group revenue in 2002

decreased 23.6 percent (23 percent at constant currency) to

$3,935 million when compared with 2001, following a

decrease of 0.7 percent in 2001 versus 2000. The decline in

Technology Group revenue was primarily a result of the

divestiture of multiple, non-core businesses over the past

twelve months, including display and card manufacturing.

These decreases were partially offset by increased revenue

from OEM logic products driven by demand for the com-

pany’s copper products and its growing foundry business.

The decline in 2001 revenue was primarily driven by the

severe slowdown in the semiconductor industry in 2001.

Hardware gross profit dollars decreased 20.6 percent in

2002 from 2001, following an 8.8 percent decrease in 2001

versus 2000. The Hardware gross profit margin decreased

3.5 points in 2002 following an increase of 0.8 points in 2001

versus 2000. The decline in gross profit dollars and gross

profit margin in 2002 was primarily driven by lower volumes

in the company’s microelectronics business and lower gross

profit margins on Systems Group products, primarily pSeries

and storage products, which more than offset the benefits

from hardware manufacturing infrastructure cost reductions.

The decline in gross profit dollars in 2001 was primarily

due to lower volumes in the company’s Technology Group

and pricing pressures in personal computers.

The increase in 2001 gross profit margin was primarily

driven by a shift in the company’s revenue toward servers from

lower gross profit margin products, such as personal computers.

Management Discussion

48 international business machines corporation and Subsidiary Companies