IBM 2002 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2002 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

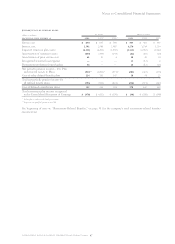

Notes to Consolidated Financial Statements

87international business machines corporation and Subsidiary Companies

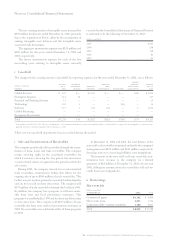

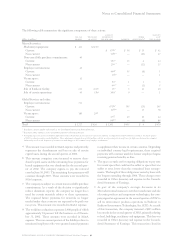

balance at other balance at

dec. 31, adjust- dec. 31,

(dollars in millions) 2001 additions payments ments*2002

Current:

Workforce $«««87 $«1,225 $«670 $««««5 $««««647

Space 65 146 97 67 181

Other —178 90 27 115

Total $«152 $«1,549 $«857 $««99 $««««943

Non-current:

Workforce $«385 $««««109 $«««— $««80 $««««574

Space 204 281 — (66) 419

Other —58—(27) 31

Total $«589 $««««448 $«««— $«(13) $«1,024

*The Other adjustments column in the table above includes the reclassification of

non-current to current and foreign currency translation adjustments. In addition,

net adjustments of $30 million were made in the fourth quarter of 2002 to reduce

the liabilities previously recorded in the second quarter of 2002.

The workforce accruals primarily relate to the company’s

Global Services business. The non-current portion of the

liability relates to terminated employees who are no longer

working for the company, but who were granted annual pay-

ments to supplement their incomes in certain countries.

Depending on the individual country’s legal requirements,

these required payments will continue until the former

employee begins receiving pension benefits or dies.

The space accruals are for ongoing obligations to pay rent

for vacant space that could not be sublet or space that was

sublet at rates lower than the committed lease arrangement.

The length of these obligations varies by lease with the

longest extending through 2019.

Other accruals are primarily the remaining liabilities associ-

ated with the 2002 second quarter actions described in note s,

“2002 Actions,” on pages 90 through 92. In addition, there

are $39 million of remaining liabilities associated with the

HDD-related restructuring discussed in note c, “Acquisitions/

Divestitures” on pages 78 to 80.

The Additions column in the table above includes accru-

als for workforce, space and other reductions relating to

actions taken in the second and fourth quarters of 2002.

Please see note s, “2002 Actions” on pages 90 through 92 for

a detailed discussion of second and fourth quarters 2002

actions. Also included in the Additions column are the actions

associated with the HDD business for reductions in work-

force, manufacturing capacity and space, totaling $295 million

that were recorded in the (Loss)/income from discontinued

operations in the Consolidated Statement of Earnings.

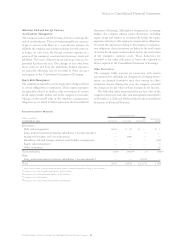

The company employs extensive internal environmental

protection programs that primarily are preventive in nature.

The company also participates in environmental assessments

and cleanups at a number of locations, including operating

facilities, previously owned facilities and Superfund sites.

The total amounts accrued for environmental liabilities,

including amounts classified as current in the Consolidated

Statement of Financial Position, that do not reflect actual or

anticipated insurance recoveries, were $247 million and

$238 million at December 31, 2002 and 2001, respectively.

Estimated environmental costs are not expected to mate-

rially affect the financial position or results of the company’s

operations in future periods. However, estimates of future

costs are subject to change due to protracted cleanup periods

and changing environmental remediation regulations.

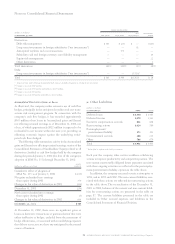

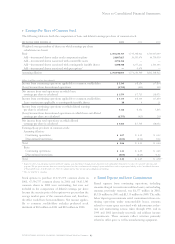

nStockholders’ Equity Activity

In the fourth quarter of 2002, in connection with the PwCC

acquisition, IBM issued 3,677,213 shares of restricted stock

valued at approximately $254 million and recorded an addi-

tional $30 million for stock to be issued in future periods as

part of the purchase price consideration paid to the PwCC

partners. See note c, “Acquisitions/Divestitures,” on pages 78

to 80, for further information regarding this acquisition and

related payments made by the company. Additionally, in the

fourth quarter of 2002, in conjunction with the funding of the

company’s U.S. pension plan, the company issued an addi-

tional 24,037,354 shares of common stock from treasury

shares valued at $1,871 million.

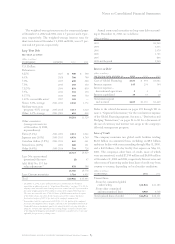

Stock Repurchases

From time to time, the Board of Directors authorizes the

company to repurchase IBM common stock. The company

repurchased 48,481,100 common shares at a cost of $4,212 mil-

lion and 50,764,698 common shares at a cost of $5,293 million

in 2002 and 2001, respectively. In 2002 and 2001, the company

issued 979,246 and 1,923,502 treasury shares, respectively, as

a result of exercises of stock options by employees of certain

recently acquired businesses and by non-U.S. employees.

At December 31, 2002, $3,864 million of Board-authorized

repurchases remained. The company plans to purchase shares

on the open market from time to time, depending on market

conditions. The company also repurchased 189,797 common

shares at a cost of $18 million and 314,433 common shares at

a cost of $31 million in 2002 and 2001, respectively, as part of

other stock compensation plans.

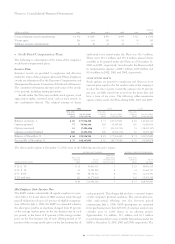

In 1995, the Board of Directors authorized the company

to repurchase all of its outstanding Series A 7-1⁄2 percent

callable preferred stock. On May 18, 2001, the company

announced it would redeem all outstanding shares of its

Series A 7-1/2 percent callable preferred stock, represented

by the outstanding depositary shares (10,184,043 shares).

The depositary shares represent ownership of one-fourth of a

share of preferred stock. Depositary shares were redeemed as

of July 3, 2001, the redemption date, for cash at a redemption

price of $25 plus accrued and unpaid dividends to the

redemption date for each depositary share. Accordingly, these

shares are no longer outstanding. Dividends on preferred

stock, represented by the depositary shares, ceased to accrue

on the redemption date. The company did not repurchase

any shares in 2000.