IBM 2002 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2002 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management Discussion

57international business machines corporation and Subsidiary Companies

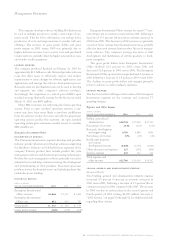

(dollars in millions)

at december 31: 2002 2001

Total company debt $«26,017 $«27,151

Non-global financing debt*$«««2,189 $«««1,606

Non-global financing debt/

capitalization 10.2% 7.5%

*Non-global financing debt is the company’s total external debt less the Global Financing

debt described in the Global Financing balance sheet on page 61.

The company’s non-global financing businesses generate

significant cash from ongoing operations and therefore gen-

erally do not require a significant amount of debt. Cash flows

from operations are these businesses’ primary source of funds

for future investments.

The increase in the non-global financing debt was driven

primarily by the PwCC acquisition.

A review of the company’s debt and equity should also con-

sider other contractual obligations and commitments, which

are disclosed elsewhere in the financial section. These amounts

are summarized in the table below to facilitate a reader’s review.

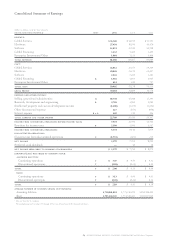

The company’s total consolidated Stockholders’ equity

decreased $666 million to $22,782 million at December 31,

2002, primarily due to a decline in Accumulated gains and

(losses) not affecting retained earnings that resulted from a

$2,765 million charge, net of a tax benefit of $1,574 million,

to establish a minimum pension liability for certain of the

company’s non-U.S. pension plans. See page 95 for further

information about this accounting. The decline was partially

offset by an increase in common stock primarily due to the

common stock issued or to be issued for a portion of the

PwCC acquisition ($284 million), the funding of the

PPP through the issuance of treasury shares ($1,871 million)

and a reduction in the company’s ongoing stock repurchase

activity. See note n, “Stockholders’ Equity Activity,” on

pages 87 and 88.

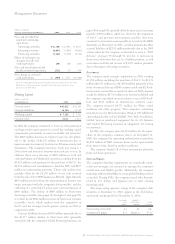

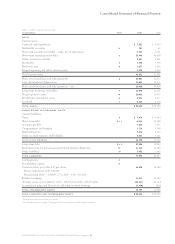

contractual obligations

balance at

payments due in

(dollars in millions) dec. 31, 2002 2003 2004-05 2006-07 after 2007

Long-term debt $«22,723 $«3,949 $«5,283 $«3,551 $«9,940

Lease commitments 6,085 1,370 1,925 1,200 1,590

commitments

balance at

amounts expiring in

(dollars in millions) dec. 31, 2002 2003 2004-05 2006-07 after 2007

Unused lines of credit $÷«3,482 $«3,134 $««««195 $÷÷139 $÷««÷14

Other commitments 288 115 159 14 —

Financial guarantees 126 29 82 1 14

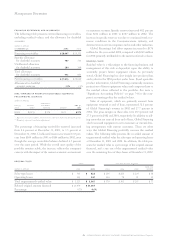

Unused lines of credit represent amounts available to the com-

pany’s distributors to support their working capital needs and

available lines of credit relating to the company’s syndicated

loan activities. Other commitments primarily include the com-

pany’s commitments to provide financing for future purchases

of the company’s products. Financial guarantees represent

guarantees for certain loans and financial commitments the

company had made as of December 31, 2002. See note o,

“Contingencies and Commitments,” on pages 88 and 89.

Liquidity

As discussed on page 50, the company purchased Rational for

approximately $2.1 billion in cash on February 21, 2003. The

company may also decide to make additional contributions to

its pension plans. The decision to fund any of the company’s

plans depends upon economic conditions, employee demo-

graphics, mortality rates and investment performance. The

company estimates that future cash requirements for these

transactions will be funded from cash flow from operations.

See page 83 for a discussion of the company’s lines of credit.

See note y, “Subsequent Events,” on page 104 for information

on the company’s new shelf registration.

Critical Accounting Estimates

The application of GAAP involves the exercise of varying

degrees of judgment. While the resulting accounting estimates

will, by definition, not always precisely equal the related actual

results, seven of these estimates involve more judgment than

others. Two of these estimates are the allowance for uncol-

lectible financing receivables and the fair value of lease residual

values. See page 63 for a discussion of these estimates. The

others are discussed below.

Useful Lives of Technology Group Equipment

The company determines the useful lives and related depre-

ciation charges for plant and equipment in the Technology

Group based on projected product life cycles that could change

significantly due to technical innovations and competitor

actions in response to relatively severe industry cycles. To the

extent actual useful lives are less than previously estimated

lives, the company will increase its depreciation charge or will

write-off or writedown technically obsolete or non-strategic

assets that have been abandoned or sold.