IBM 2002 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2002 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management Discussion

46 international business machines corporation and Subsidiary Companies

The following table presents each segment’s revenue as a

percentage of the company’s total:

for the year ended december 31: 2002 2001 2000

Global Services 44.8% 42.1% 39.0%

Hardware 33.8 36.8 40.5

Software 16.1 15.6 14.8

Global Financing 4.0 4.1 4.1

Enterprise Investments/Other 1.3 1.4 1.6

Total 100.0% 100.0% 100.0%

In the Americas, full-year 2002 revenue was $36,423 million,

down 2.7 percent (1 percent at constant currency) from the

2001 period. Revenue from Europe/Middle East/Africa was

$24,260 million, an increase of 1.1 percent (down 4 percent

at constant currency). Asia Pacific revenue declined 0.5 per-

cent (flat at constant currency) to $17,153 million. Original

equipment manufacturer (OEM) revenue decreased 24.1 per-

cent (24 percent at constant currency) to $3,350 million.

The reference to constant currency is made so that a seg-

ment can be viewed without the impacts of changing foreign

currency exchange rates and therefore facilitates a comparative

view of business growth. The U.S. dollar generally weakened

against other currencies during 2002, so growth at constant

currency exchange rates was lower than growth at actual

currency exchange rates.

The overall gross profit margin of 37.3 percent decreased

1.1 points from 2001, following a 1.3 point increase in 2001

versus 2000. The decrease in 2002 gross profit margin was

primarily driven by lower gross profit in Global Services and

Hardware, partially offset by improved gross profit margins

in Software and Global Financing. The increase in 2001

gross profit margin was primarily driven by improvement in

Global Services, Hardware, Software and Global Financing

gross profit margins.

Total expense and other income increased primarily

due to the company’s special actions associated with its

Microelectronics Division, productivity initiatives, and the

PwCC acquisition. The provision for bad debts also increased

in 2002. These increases were offset by lower advertising

expense, the elimination of goodwill amortization and con-

tinued ongoing business transformation and efficiency

initiatives as described on pages 50 and 51.

Looking Forward

The outlook for 2003 is dependent upon the following key

factors, among others:

■

The market for IT products and services and the company’s

ability to gain market share

■

The acceptance of open standards such as Linux

■

The ability to continue converting the company’s tech-

nology leadership into product and services leadership

■

The transformation of IBM’s business into an on demand

business and the streamlining and cost reduction initiatives

associated with the company’s Integrated Supply Chain

The following discussion is based on the Consolidated

Financial Statements on pages 64 through 69, which reflect,

in all material respects, the company’s segment results on an

external basis. Additional financial information about each

segment including the results of certain intercompany trans-

actions is included in note x, “Segment Information,” on

pages 100 to 104. The Global Financing results of operations

are included in the new Global Financing section on pages 60

through 63.

Global Services

description of business

Global Services is an important part of the company’s strat-

egy of providing insight and solutions to customers. The

application of technology is becoming increasingly critical to

customers’ advantage in the marketplace. As a result, the

value that customers place on IBM’s business insight and solu-

tions is increasing. As the company continues to evolve, the

expectation is that Global Services will play a larger role

interfacing with IBM’s customers. Global Services comprises

three main lines of business:

■

Strategic Outsourcing Services (SO) provides customers

with competitive cost advantages by outsourcing customers’

processes and operations.

■

Business Consulting Services (BCS), formerly Business

Innovation Services, delivers value to customers through

business process innovation, application enablement and

integration services. The acquisition of PwCC greatly

enhances IBM’s capabilities in these areas.

■

Integrated Technology Services (ITS) designs, implements,

and maintains customers’ technology infrastructures.

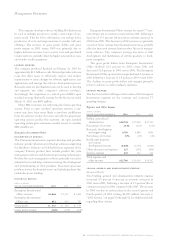

historical results

(dollars in millions)

for the year ended december 31: 2002 2001 2000

Global Services revenue $«36,360 $«34,956 $«33,152

Global Services cost 26,812 25,355 24,309

Gross profit $«««9,548 $«««9,601 $«««8,843

Gross profit margin 26.3% 27.5% 26.7%

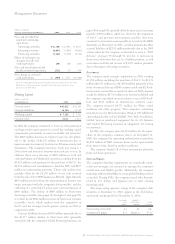

Global Services revenue increased 4.0 percent (3 percent at

constant currency) in 2002 over 2001 and 5.4 percent (10 per-

cent at constant currency) in 2001 over 2000. The increase in

2002 resulted from the acquisition of PwCC on October 1,

2002 and growth in the SO business. Global Services revenue,

excluding maintenance, increased 4.5 percent (4 percent at

constant currency) in 2002 versus 2001 and 6.8 percent (11 per-

cent at constant currency) in 2001 versus 2000. Maintenance

revenue improved 1.3 percent to $5,070 million (1 percent at con-

stant currency) in 2002 versus 2001 and declined 2.2 percent (up

2 percent at constant currency) in 2001 when compared to 2000.

SO revenue increased 2.4 percent to $14,995 million (2 per-

cent at constant currency) in 2002 versus 2001. SO remains

attractive to customers in both strong and weak economies.