IBM 2002 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2002 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management Discussion

50 international business machines corporation and Subsidiary Companies

The company develops software building blocks that may

be used in multiple products to satisfy a wide range of cus-

tomer needs. This has led to efficiencies, cost savings in the

production of code, and improved time to market with new

offerings. The increase in gross profit dollars and gross

profit margin in 2001 versus 2000 was primarily due to

higher Software revenue, lower service costs and purchased

vendor software, partially offset by higher amortization costs

and vendor royalty payments.

looking forward

The company purchased Rational on February 21, 2003 for

approximately $2.1 billion in cash. Rational provides software

tools that allow users to effectively capture and analyze

requirements to create designs for software applications, test

applications, and manage the software development process.

Rational’s software development tools can be used to develop

and upgrade any other company’s software products.

Accordingly, this acquisition is a critical part of IBM’s open

standard strategy. Rational’s revenue for the fiscal year ended

March 31, 2002, was $690 million.

Major IBM customers are embracing the Linux operating

system. Prior to open standard operating systems, a cus-

tomer may have been more likely to purchase middleware

from the software vendor that owns and sells the proprietary

operating system used by that customer. An open standard

operating system gives customers another reason to consider

IBM middleware.

Enterprise Investments/Other

description of business

The Enterprise Investments segment develops and provides

industry-specific information technology solutions supporting

the Hardware, Software and Global Services segments of the

company. Primary product lines include product life cycle

management software and document processing technologies.

Product life cycle management software primarily serves the

industrial sector and helps customers manage the development

and manufacturing of their products. Document processor

products service the financial sector and include products that

enable electronic banking.

historical results

(dollars in millions)

for the year ended december 31: 2002 2001 2000

Enterprise Investments/

Other revenue $«1,064 $«1,153 $«1,404

Enterprise Investments/

Other cost 611 634 747

Gross profit $««««453 $««««519 $««««657

Gross profit margin 42.6% 45.0% 46.8%

Enterprise Investments/Other revenue decreased 7.7 per-

cent (10 percent at constant currency) from 2001, following a

decrease of 17.9 percent (14 percent at constant currency) in

2001 from 2000. The decrease in 2002 revenue was primarily

a result of lower revenue from document processors, partially

offset by increased revenue from product life-cycle manage-

ment software. The company’s strategy has been to shift

development and distribution of certain products to third-

party companies.

The gross profit dollars from Enterprise Investments/

Other declined 12.6 percent in 2002 versus 2001 and

decreased 21.0 percent in 2001 versus 2000. The Enterprise

Investments/Other gross profit margin declined 2.4 points in

2002 following a decrease of 1.8 points in 2001 versus 2000.

The declines in gross profit dollars and margins primarily

relate to software as well as industry dynamics.

looking forward

The key factors that will impact the results of the Enterprise

Investments segment are the economy and corporate IT

spending budgets.

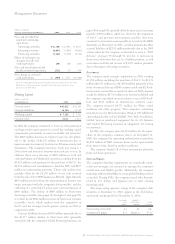

Expense and Other Income

(dollars in millions)

for the year ended december 31: 2002 2001 2000

Selling, general and

administrative $«18,738 $«17,048 $«17,393

Percentage of revenue 23.1% 20.5% 20.4%

Research, development

and engineering 4,750 4,986 5,084

Percentage of revenue 5.9% 6.0% 6.0%

Intellectual property

and custom

development income (1,100) (1,476) (1,664)

Other (income) and expense 227 (353) (990)

Interest expense 145 234 344

Total expense and

other income $«22,760 $«20,439 $«20,167

selling, general and administrative expense

Historical Results

Total Selling, general and administrative (SG&A) expense

increased 9.9 percent (9 percent at constant currency) in

2002 versus 2001, following a decrease of 2.0 percent (flat at

constant currency) in 2001 compared with 2000. The increase

in 2002 was due to actions taken in the second quarter and

fourth quarter of 2002 totaling $1,489 million. See note s,

“2002 Actions,” on pages 90 through 92 for additional details

regarding these actions.