IBM 2002 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2002 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

84 international business machines corporation and Subsidiary Companies

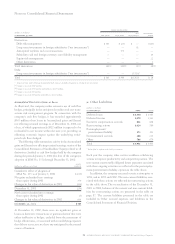

lDerivatives and Hedging Transactions

The company operates in approximately 35 functional cur-

renciesand is a significant lender and borrower in the global

markets. In the normal course of business, the company is

exposed to the impact of interest rate changes and foreign cur-

rency fluctuations, and to a lesser extent equity price changes.

The company limits these risks by following established risk

management policies and procedures including the use of

derivatives and, where cost-effective, financing with debt in

the currencies in which assets are denominated. For interest

rate exposures, derivatives are used to align rate movements

between the interest rates associated with the company’s lease

and other financial assets and the interest rates associated with

its financing debt. Derivatives are also used to manage the

related cost of debt. For foreign currency exposures, deriva-

tives are used to limit the effects of foreign exchange rate

fluctuations on financial results.

The company does not use derivatives for trading or spec-

ulative purposes, nor is it a party to leveraged derivatives.

Further, the company has a policy of only entering into con-

tracts with carefully selected major financial institutions

based upon their credit ratings and other factors, and maintains

strict dollar and term limits that correspond to the institu-

tion’s credit rating. When viewed in conjunction with the

underlying and offsetting exposure that the derivatives are

designed to hedge, the company has not sustained a material

loss from these instruments.

In its hedging programs, the company employs the use of

forward contracts, futures contracts, interest rate and currency

swaps, options, caps, floors or a combination thereof depending

upon the underlying exposure.

A brief description of the major hedging programs follows.

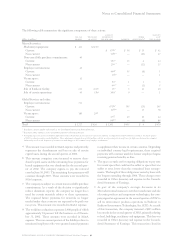

Debt Risk Management

The company issues debt on the global capital markets, princi-

pally to fund its financing lease and loan portfolio. Access to

cost-effective financing can result in interest rate and/or cur-

rency mismatches with the underlying assets. To manage these

mismatches and to reduce overall interest cost, the company

primarily uses interest-rate and currency instruments, prin-

cipally swaps, to convert specific fixed-rate debt issuances

into variable-rate debt (i.e., fair value hedges) and to convert

specific variable-rate debt and anticipated commercial paper

issuances to fixed rate (i.e., cash flow hedges). The resulting

cost of funds is lower than that which would have been avail-

able if debt with matching characteristics was issued directly.

The weighted-average remaining maturity of all swaps in the

debt risk management program is approximately four years.

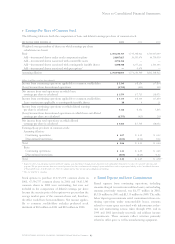

Long-Term Investments in Foreign Subsidiaries

(Net Investment)

A significant portion of the company’s foreign currency

denominated debt portfolio is designated as a hedge of net

investment to reduce the volatility in stockholders’ equity

caused by changes in foreign currency exchange rates in the

functional currency of major foreign subsidiaries with respect

to the U.S. dollar. The company also uses currency swaps and

foreign exchange forward contracts for this risk management

purpose. The currency effects of these hedges (approximately

$317 million for the current period, net of tax) are reflected

as a loss in the Accumulated gains and (losses) not affecting

retained earnings section of the Consolidated Statement of

Stockholders’ Equity, thereby offsetting a portion of the

translation of the applicable foreign subsidiaries’ net assets.

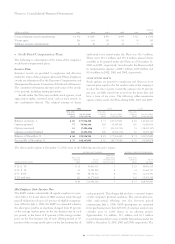

Anticipated Royalties and Cost Transactions

The company’s operations generate significant non-functional

currency, third party vendor payments and intercompany

payments for royalties, and goods and services among the

company’s non-U.S. subsidiaries and with the parent company.

In anticipation of these foreign currency cash flows and in

view of the volatility of the currency markets, the company

selectively employs foreign exchange forward and option

contracts to manage its currency risk. At December 31, 2002,

the maximum remaining maturity of these derivative instru-

ments was less than 18 months, commensurate with the

underlying hedged anticipated cash flows.