IBM 2002 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2002 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

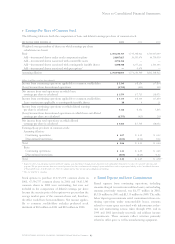

Notes to Consolidated Financial Statements

83international business machines corporation and Subsidiary Companies

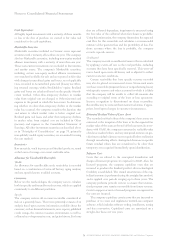

The weighted-average interest rates for commercial paper

at December 31, 2002 and 2001, were 1.7 percent and 1.9 per-

cent, respectively. The weighted-average interest rates for

short-term loans at December 31, 2002 and 2001, were 2.5 per-

cent and 4.0 percent, respectively.

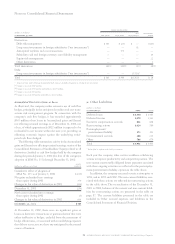

Long-Term Debt

pre-swap activity

(dollars in millions)

at december 31: maturities 2002 2001

U.S. Dollars:

Debentures:

6.22% 2027 $««««««500 $««««««500

6.5% 2028 700 700

7.0% 2025 600 600

7.0% 2045 150 150

7.125% 2096 850 850

7.5% 2013 550 550

8.375% 2019 750 750

3.43% convertible notes*2007 328 —

Notes: 6.0% average 2003-2032 2,130 2,772

Medium-term note

program: 4.0% average 2003-2018 7,113 3,620

Other: 4.9% average 2003-2009 610 828

14,281 11,320

Other currencies

(average interest rate

at December 31, 2002,

in parentheses):

Euros (5.4%) 2003-2009 2,111 3,042

Japanese yen (1.0%) 2003-2015 4,976 4,749

Canadian dollars (5.8%) 2003-2011 445 441

Swiss francs (4.0%) 2003 180 151

Other (6.6%) 2003-2014 730 726

22,723 20,429

Less: Net unamortized

(premium)/discount (1) 47

Add: SFAS No. 133 fair

value adjustment** 978 396

23,702 20,778

Less: Current maturities 3,716 4,815

Total $«19,986 $«15,963

*On October 1, 2002, as part of the purchase price consideration for the PwCC

acquisition, as addressed in note C, “Acquisitions/Divestitures,” on pages 78 to 80, the

company issued convertible notes bearing interest at a stated rate of 3.4 percent with a

face value of approximately $328 million to certain of the acquired PwCC partners.

The notes are convertible into 4,764,543 shares of IBM common stock at the option

of the holders at any time after the first anniversary of their issuance based on a

fixed conversion price of $68.81 per share of the company’s common stock.

** In accordance with the requirements of SFAS No. 133, the portion of the company’s

fixed rate debt obligations that is hedged is reflected in the Consolidated Statement of

Financial Position as an amount equal to the sum of the debt’s carrying value plus a

SFAS No. 133 fair value adjustment representing changes recorded in the fair value

of the hedged debt obligations attributable to movements in market interest rates and

applicable foreign currency exchange rates.

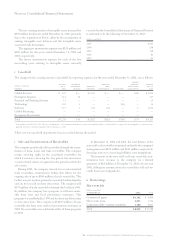

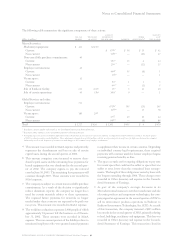

Annual contractual maturities on long-term debt outstand-

ing at December 31, 2002, are as follows:

(dollars in millions)

2003««« $«3,949

2004 3,613

2005 1,670

2006 2,705

2007 846

2008 and beyond ««««9,940

Interest on Debt

(dollars in millions)

for the year ended december 31: 2002 2001 2000

Cost of Global Financing $«633 $««««964 $«1,082

Interest expense 145 234 344

Interest expense

—

discontinued operations 243

Interest capitalized 35 33 20

Total interest paid

and accrued $«815 $«1,235 $«1,449

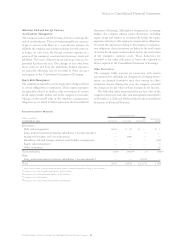

Refer to the related discussion on pages 101 through 103 in

note x, “Segment Information,” for the total interest expense

of the Global Financing segment. See note l, “Derivatives and

Hedging Transactions,” on pages 84 to 86 for a discussion of

the use of currency and interest rate swaps in the company’s

debt risk management program.

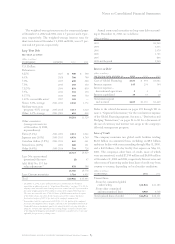

Lines of Credit

The company maintains two global credit facilities totaling

$12.0 billion in committed lines, including an $8.0 billion

multiyear facility with a term extending through May 31, 2006,

and a $4.0 billion, 364-day facility that expires on May 30,

2003. The company’s other lines of credit, most of which

were uncommitted, totaled $7,190 million and $6,860 million

at December 31, 2002 and 2001, respectively. Interest rates and

other terms of borrowing under these lines of credit vary from

country to country, depending on local market conditions.

(dollars in millions)

at december 31: 2002 2001

Unused lines:

From the committed global

credit facility $«11,945 $«11,383

From other committed

and uncommitted lines 4,989 4,738

Total unused lines of credit $«16,934 $«16,121