IBM 2002 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2002 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

intellectual property and custom development income

Description

As discussed above, the company’s world-class R&D function

results in superior products for the company’s customers, and

also results in IP income. Some of the technological break-

throughs that IBM achieves are used exclusively in IBM

products while other breakthroughs are used by others when

the new technology is not strategic to IBM’s business goals. A

third group is both used internally and licensed externally.

IP and custom development income comprises the three

categories in the table below. Sales and other transfers of IP

are typically transaction-based lump sums and are relatively

less predictable in amount and timing than licensing/royalty-

based fees. Licensing/royalty-based fees involve ongoing cash

inflow and income streams. The key factors impacting the

amount of income earned in these two categories are the

timing and availability of the company’s licensable IP. IBM

also earns income from performing custom development for

specific customers.

In addition to the IP income sources in the table below,

the company also generates value from its patent portfolio

through cross-licensing arrangements and IP licensed in

divestiture transactions. Cross-licensing arrangements involve

licensing of the company’s IP to a third party in exchange for

the third party’s IP. The company does not record income on

these transactions except to the extent that cash is received.

The value received by IBM for IP transferred in divestiture

transactions is included in the overall gain or loss from the

divestiture and is therefore excluded from the table below.

Historical Results

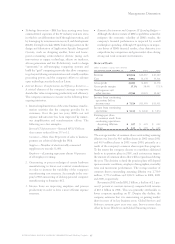

(dollars in millions)

for the year ended december 31: 2002 2001 2000

Sales and other transfers of

intellectual property $«÷«511 $««««727 $««««913

Licensing/royalty-based fees 351 465 528

Custom development income 238 284 223

Total $«1,100 $«1,476 $«1,664

The decreases in sales and other transfers of IP in 2002 versus

2001 and 2001 versus 2000 were primarily due to a greater

number of larger dollar sales and other transfers during the

prior years. The amount of income from licensing/royalty-

based fee transactions has been declining due to economic

conditions and fewer licensing opportunities resulting from

industry consolidation.

Looking Forward

The timing and amount of sales and other transfers of IP may

vary significantly from year to year depending upon the

timing of new patents and know-how development, economic

conditions, and the extent of further industry consolidation,

if any.

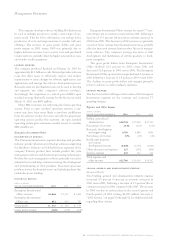

other (income)and expense

The primary reason for the reduction in Other (income) and

expense in 2002 was the actions taken by the company in the

second and fourth quarters of 2002 amounting to $513 mil-

lion. See note s, “2002 Actions,” on pages 90 through 92 for

further information. The remaining items of Other (income)

and expense largely offset. These offsetting items include the

lower writedowns of certain equity investments for other

than temporary market declines of $58 million in 2002 as

compared to $405 million in 2001. There were no such write-

downs in 2000. Net realized gains on sales of securities and

other investments were $(63) million in 2002, $(236) million

in 2001 and $(265) million in 2000. These writedowns and

sales activity are related to the dynamics in the equity markets

over the past few years. Additionally, net realized gains from

certain real estate activities were $(66) million in 2002, $(133)

million in 2001 and $(222) million in 2000. The company

recorded interest income (from securities and other invest-

ments excluding the Global Financing business transactions)

of $(127) million in 2002, $(175) million in 2001 and $(308)

million in 2000. Foreign currency transaction gains were

$(39) million, $(190) million and $(128) million in 2002, 2001

and 2000, respectively. The reduction of Other (income) and

expense from 2000 to 2001 was primarily attributable to the

2001 writedown of certain equity investments for other than

temporary market declines.

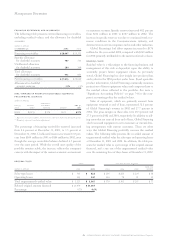

interest expense

Interest expense is presented in Cost of Global Financing in

the Consolidated Statement of Earnings only if the related

external borrowings are to support the Global Financing

external business. See page 63 for additional information

regarding Global Financing debt and interest expense.

Interest expense, excluding amounts recorded in Cost of

Global Financing, declined 37.9 percent in 2002 from 2001

and 31.4 percent in 2001 versus 2000. The declines were pri-

marily due to lower average interest rates and a decline in

average debt outstanding in the periods.

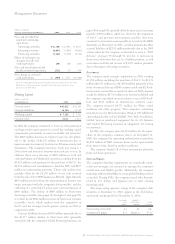

Retirement-Related Benefits

description

The company provides a number of retirement-related ben-

efits to its employees including defined benefit pension plans

and defined contribution pension plans. The company also

provides nonpension postretirement plans comprising retiree

medical and life insurance plans.

historical results

The following table provides the total pre-tax (income)/cost

for all retirement-related plans. (Income)/cost amounts are

included as a reduction of/addition to, respectively, the

company’s cost and expense amounts in the Consolidated

Statement of Earnings within the caption (e.g., Cost, SG&A,

RD&E) relating to the job function of the individuals partici-

pating in the plans.

Management Discussion

52 international business machines corporation and Subsidiary Companies