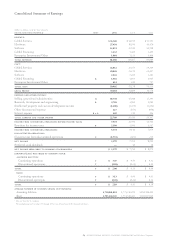

IBM 2002 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2002 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Management Discussion

55international business machines corporation and Subsidiary Companies

Global Financing revenue decreased 10.5 percent (11 per-

cent at constant currency) in the fourth quarter of 2002 to

$829 million. Revenue from the Enterprise Investments/

Other area, which includes industry-specific IT solutions,

increased 1.1 percent (down 6 percent at constant currency)

compared to the fourth quarter of 2001 to $343 million.

The company’s overall gross profit margin was 38.8 per-

cent in the fourth quarter, compared to 40.3 percent in the

2001 fourth quarter, primarily due to lower Global Services

margin as a result of PwCC being at a lower gross profit

margin than the company’s base business. Also, signings in

the company’s ITS Services business came late in the quarter,

which resulted in the company’s utilization rates being

lower. This decline was partially offset by an increase in

Software and Hardware gross profit margins in the fourth

quarter of 2002.

In the fourth quarter, total expense and other income of

$6.5 billion increased 21.4 percent over the year-earlier

period, including charges of $614 million associated with the

acquisition and integration of PwCC and related restructuring

as well as one-time compensation costs, which are partially

offset by a $40 million benefit from net adjustments to

restructuring charges from the second-quarter 2002 actions.

Specifically, SG&A expense increased 16 percent, reflecting

the PwCC charges offset by the benefit from net adjustments

related to second-quarter actions and lower goodwill expense

due to the implementation of new accounting rules. RD&E

expense decreased 2.9 percent in the fourth quarter. Lower IP

and custom development income had a negative impact on

results compared with the year-earlier period, despite two

sizable contracts totaling, in the aggregate, approximately

$170 million in the quarter. Other (income) and expense was

negatively affected by foreign exchange losses as well as lower

gains from certain real estate activities. Overall, IBM continues

to benefit from the company’s continuing e-business trans-

formation and productivity enhancements.

The company’s effective tax rate in the fourth quarter was

29.5 percent compared with 28.6 percent in the fourth quarter

of 2001.

The company spent $74 million on common share repur-

chases in the fourth quarter. The average number of common

shares outstanding assuming dilution was lower by 29.3 mil-

lion shares in fourth quarter of 2002 versus the fourth quarter

of 2001, primarily as a result of the ongoing common share

repurchase program. The average number of shares assuming

dilution was 1,728.7 million in fourth-quarter 2002 versus

1,758.0 million in fourth-quarter 2001.

Discontinued Operations

Revenue from discontinued operations for the fourth quarter

of 2002 was $548 million, a 19.9 percent decrease from the

fourth quarter of 2001. Net loss from discontinued operations

for the fourth quarter of 2002 was $893 million as compared

to a loss of $232 million in 2001. The underlying business

dynamics causing these fourth quarter financial trends are

consistent with those underlying the full-year 2002 and 2001

trends discussed in the Results of Discontinued Operations

section on page 54, including the additional loss of $247 mil-

lion, net of tax, incurred in the fourth quarter on disposal of

the HDD business.

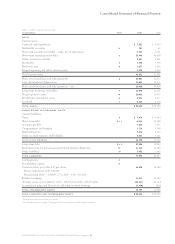

Financial Condition

Dynamics

The assets and debt associated with the company’s Global

Financing business are a significant part of IBM’s financial

condition. Accordingly, although the financial position

amounts appearing below and on pages 56 and 57 are the

company’s consolidated amounts including Global Financing,

to the extent the Global Financing business is a major driver

of the consolidated financial position, reference in the narra-

tive section will be made to a separate Global Financing

section in this Management Discussion on pages 60 through

63. The amounts appearing in the separate Global Financing

section are supplementary data presented to facilitate an

understanding of the company’s Global Financing business.

Overall

During 2002, the company made significant acquisitions as

well as ongoing investments in RD&E and in fixed assets. In

addition, the company fully funded, on an ABO basis, the IBM

Personal Pension Plan (PPP). In spite of this activity, the

company ended the year with $5,975 million in Cash and cash

equivalents and current Marketable securities. In the fourth

quarter, the company took advantage of the low interest rate

environment to execute some term-debt financing that

increased the non-Global Financing debt to $2,189 million at

December 31, 2002. The debt-to-capital ratio of 10.2 percent

is well within the company’s target.

Cash Flow

The company’s cash flow from operating, investing and

financing activities, as reflected in the Consolidated Statement

of Cash Flows on page 69, are summarized in the table on

page 56. These amounts include the cash flows associated

with the company’s Global Financing business, which are pre-

sented on pages 60 through 63.