IBM 2002 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2002 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management Discussion

60 international business machines corporation and Subsidiary Companies

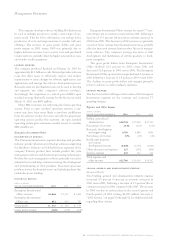

Employees and Related Workforce

percentage changes

2002 2001 2000 2002-01 2001-00

IBM/wholly owned subsidiaries 315,889 319,876 316,303 (1.2) 1.1

Less-than-wholly owned subsidiaries 22,282 25,403 21,886 (12.3) 16.1

Complementary 17,250 21,300 25,500 (19.0) (16.5)

Employees at IBM and its wholly owned subsidiaries in 2002

decreased 3,987 from last year. The decrease was due primarily

to workforce rebalancing initiatives designed to improve

IBM’s competitiveness in the marketplace. The major initia-

tives contributing to this decline include: the divestiture of

the HDD business and 2002 workforce rebalancing and pro-

ductivity actions offset by the acquisition of PwCC.

In less-than-wholly owned subsidiaries, the number of

employees decreased from last year, primarily in China, as a

result of the HDD divestiture.

The company’s complementary workforce is an approxi-

mation of equivalent full-time employees hired under

temporary, part-time and limited-term employment arrange-

ments to meet specific business needs in a flexible and

cost-effective manner.

Global Financing

Description of Business

Global Financing is a business segment within IBM, but is

managed (on an arm’s-length basis) and measured as if it were

a standalone entity. Accordingly, the information presented

in this section is consistent with this separate company view.

The mission of Global Financing is to generate a return

on equity. It also facilitates the acquisition of IBM hardware,

software and services.

Global Financing invests in financing assets, manages the

associated risks, and leverages with debt

,

all with the objective

of generating consistently strong returns on equity. The

focus on IBM product and IBM customers mitigates the risks

normally associated with a financing company. Global

Financing has the benefit of both a deep knowledge of its cus-

tomer base and a clear insight into the products that are being

leased. This pairing allows Global Financing to manage two

of the major risks (credit and residual value) that are normally

associated with financing.

Global Financing comprises three lines of business:

■

Customer financing provides lease and loan financing to end

users and internal customers for terms generally between

two and five years. Internal financing is predominantly in

support of Global Services’ long-term customer service

contracts. Global Financing also factors a selected portion

of the company’s accounts receivable, primarily for cash

management purposes. All of these internal financing

arrangements are at arm’s-length rates and are based upon

market conditions.

■

Commercial financing provides primarily short-term

inventory and accounts receivable financing to dealers and

remarketers of IT products. Global Financing also partici-

pates as a lender in selected syndicated loan facilities

which originated from 1999 through 2001. Syndicated

loans are loans in which Global Financing purchased a

fixed percentage of a loan facility from a bank or other

lending institution. Global Financing no longer partici-

pates in new syndicated loan programs. There are,

however, remaining amounts committed and outstanding.

Outstandings represent less than 2 percent of total Global

Financing assets at December 31, 2002, as compared to 4

percent at December 31, 2001.

■

Remarketing includes the sale and lease of used equipment

to new or existing customers. This equipment is primarily

sourced from the conclusion of lease transactions.

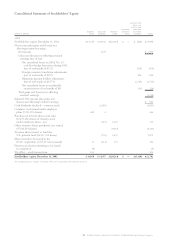

Results of Operations

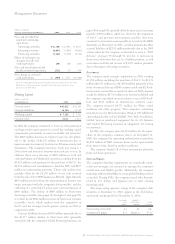

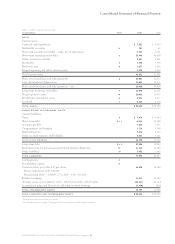

(dollars in millions)

for the year ended december 31: 2002 2001 2000

Global Financing

external revenue $«3,203 $«3,407 $«3,500

Global Financing

internal revenue «939 836 «944

Total Global

Financing revenue 4,142 4,243 4,444

Global Financing cost 1,803 «2,016 «2,390

Gross profit $«2,339 $«2,227 $«2,054

Gross profit margin 56.5% 52.5% 46.2%

Pre-tax income $««««955 $«1,143 $«1,176

After-tax income $««««627 $««««727 $««««763

Return on equity*«17.2% 18.4% 16.5%

*Return on equity is calculated using a five-point average of equity and an estimated

tax rate principally based on Global Financing’s geographic mix of earnings as IBM’s

provision for income taxes is determined on a consolidated basis. See page 89 for the

IBM consolidated tax rate.

Global Financing total revenue declined 2.4 percent in 2002

from 2001, following a decline of 4.5 percent in 2001 versus

2000. The decline in 2002 was driven by a lower asset base,

primarily due to decreases in demand for IT equipment

caused by the current economic environment. The decline in

2001 was also driven by a lower asset base and a decline in

used equipment sales.

Global Financing gross profit dollars increased 5.0 percent

in 2002 versus 2001, following an increase of 8.4 percent in 2001

versus 2000. Global Financing gross profit margin improved 4.0

points in 2002 following an increase of 6.3 points in 2001 as