IBM 2002 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2002 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

82 international business machines corporation and Subsidiary Companies

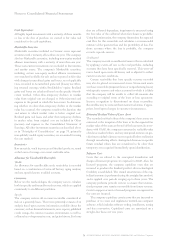

The net carrying amount of intangible assets increased by

$259 million for the year ended December 31, 2002, primarily

due to the acquisition of PwCC, offset by the amortization of

existing intangible asset balances and the intangible assets

associated with divestitures.

The aggregate amortization expense was $181 million and

$100 million for the years ended December 31, 2002 and

2001, respectively.

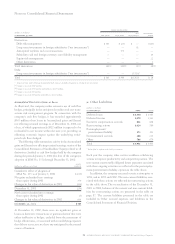

The future amortization expense for each of the five

succeeding years relating to intangible assets currently

recorded in the Consolidated Statement of Financial Position

is estimated to be the following at December 31, 2002:

(dollars in millions)

2003 $«245

2004 208

2005 138

2006 82

2007 ««««42

iGoodwill

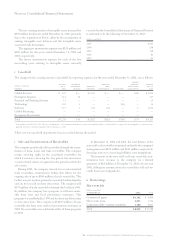

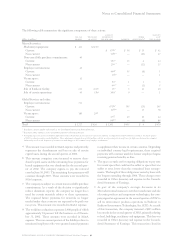

The changes in the carrying amount of goodwill, by reporting segment, for the year ended December 31, 2002, are as follows:

foreign

balance assembled purchase currency balance

(dollars in millions) jan. 1, workforce goodwill price translation dec. 31,

segment 2002 reclass*additions adjustments divestitures adjustments 2002

Global Services $««««325 $«— $«2,532 $««— $««— $«69 $«2,926

Enterprise Systems 111 ««««««26 ————137

Personal and Printing Systems 13 —————13

Technology 102 5 — — (83) — 24

Software 727 2 293 (12) — 5 1,015

Global Financing ———————

Enterprise Investments ———————

Total $«1,278 $«33 $«2,825 $«(12) $«(83) $«74 $«4,115

*In accordance with SFAS No. 141, “Business Combinations,” the unamortized balance for acquired assembled workforce, which had been recognized as an intangible asset separate from

goodwill, has been reclassified to goodwill effective January 1, 2002.

There were no goodwill impairment losses recorded during the period.

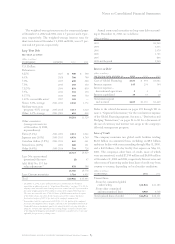

jSale and Securitization of Receivables

The company periodically sells receivables through the securi-

tization of loans, leases and trade receivables. The company

retains servicing rights in the securitized receivables for

which it receives a servicing fee. Any gain or loss incurred as

a result of such sales is recognized in the period in which the

sale occurs.

During 2001, the company entered into an uncommitted

trade receivables securitization facility that allows for the

ongoing sale of up to $500 million of trade receivables. This

facility was put in place primarily to provide backup liquidity

and can be accessed on three days notice. The company sold

$179 million of trade receivables through this facility in 2001.

In addition, the company has a program to sell loans receiv-

able from state and local government customers. This

program was established in 1990 and has been used from time

to time since then. The company sold $278 million of loans

receivable due from state and local government customers in

2001. No receivables were sold under either of these programs

in 2002.

At December 31, 2002 and 2001, the total balance of the

state and local receivables securitized and under the company’s

management was $101 million and $213 million, respectively.

Servicing assets net of servicing liabilities were insignificant.

The investors in the state and local loans receivable secu-

ritizations have recourse to the company via a limited

guarantee of $69 million at December 31, 2002. At year-end

2002, delinquent amounts from the receivables sold and net

credit losses were insignificant.

kBorrowings

Short-term debt

(dollars in millions)

at december 31: 2002 2001

Commercial paper $«1,302 $«««4,809

Short-term loans 1,013 1,564

Long-term debt

—

current maturities 3,716 4,815

Total $«6,031 $«11,188