IBM 2002 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2002 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management Discussion

58 international business machines corporation and Subsidiary Companies

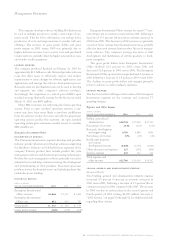

The company estimates useful lives of its Technology

Group equipment by reference to the current and projected

dynamics in the semiconductor industry, product life cycles,

and anticipated competitor actions.

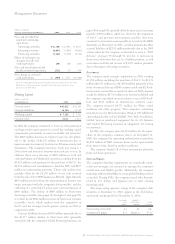

Expected Return on Plan Assets

The expected return on plan assets is used in calculating the

net periodic pension (income)/cost. The differences between

the actual return on plan assets and expected return on plan

assets are recognized in the calculation of net periodic pen-

sion (income)/cost over five years and, over the long term,

typically has not had a material effect on the Consolidated

Financial Statements.

As described on pages 95 and 96, if the fair value of the

pension plan’s assets are below the plan’s ABO, the company

will be required to record a minimum liability. In some situ-

ations, the pension asset must be partially reversed through a

charge to stockholders’ equity. If the ABO in excess of plan

assets is large enough, the company may be required, by law,

to make an additional contribution to the pension plan. While

the amount of funding is not dependent upon the company’s

expected long-term return assumption, the company’s esti-

mated expected return on plan assets is a critical estimate used

by the company. Actual results that differ from the estimates

may result in more or less future company funding into the

pension plans than is planned by management.

Costs to Complete Long-Term Service Contracts

The company enters into numerous long-term service con-

tracts through its SO and BCS businesses. SO contracts range

for periods up to ten years and BCS contracts can be for

several years. During the contractual period, revenue, cost

and profits may be impacted by estimates of the ultimate

profitability of each contract. If at any time, these estimates

indicate the contract will be unprofitable, the entire estimated

loss for the remainder of the contract is recorded immediately.

The company performs ongoing profitability analyses of

its long-term services contracts in order to check whether the

latest estimates require updating. Key factors reviewed by the

company to estimate the future costs to complete each con-

tract are future labor costs and productivity efficiencies.

Net Realizable Value and Customer Demand

The company reviews the net realizable value of and demand

for its inventory on a quarterly basis to ensure recorded

inventory is stated at the lower of cost or net realizable value

and that obsolete inventory is written off. Inventory at higher

risk for writedowns or write-offs are those in the industries

that have lower relative gross margins and that are subject

to a higher likelihood of changes in industry cycles. The

semiconductor and personal computer businesses are two

such industries.

Factors that could impact estimated demand and selling

prices are the timing and success of future technological

innovations and the economy.

Warranty Claims

The company generally offers three-year warranties for its

personal computer products and one-year warranties on most

of its other products. The company estimates the amount and

cost of future warranty claims for its current period sales.

These estimates are used to record accrued warranty cost for

current period product shipments. The company uses histor-

ical warranty claim information as well as recent trends that

might suggest that past cost information may differ from

future claims.

Factors that could impact the estimated claim information

include the success of the company’s productivity and quality

initiatives, as well as parts and labor costs.

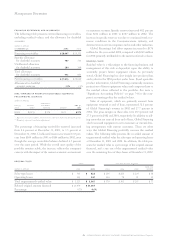

Currency Rate Fluctuations

Changes in the relative values of non-U.S. currencies to the

U.S. dollar affect the company’s results. At December 31,

2002, currency changes resulted in assets and liabilities

denominated in local currencies being translated into more

dollars than at year-end 2001. The currency rate changes

had a favorable effect on revenue growth of approximately

1 percentage point in 2002, and an unfavorable effect on

revenue of approximately 4 percentage points and approxi-

mately 3 percentage points in 2001 and 2000, respectively.

For non-U.S. subsidiaries and branches that operate in

U.S. dollars or whose economic environment is highly infla-

tionary, translation adjustments are reflected in results of

operations, as required by Statement of Financial Accounting

Standards (SFAS) No. 52, “Foreign Currency Translation.”

Generally, the company manages currency risk in these entities

by linking prices and contracts to U.S. dollars and by entering

into foreign currency hedge contracts.

The company uses a variety of financial hedging instru-

ments to limit specific currency risks related to financing

transactions and other foreign currency-based transactions.

Further discussion of currency and hedging appears in note l,

“Derivatives and Hedging Transactions,” on pages 84 to 86.

On January 1, 2001, the company adopted SFAS No. 133,

“Accounting for Derivative Instruments and Hedging

Activities,” as amended by SFAS No. 138, “Accounting for

Certain Derivative Instruments and Certain Hedging

Activities.” See “Standards Implemented,” on pages 75 and 76

for additional information regarding SFAS No. 133.

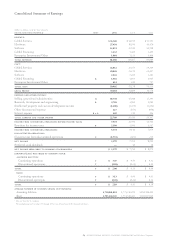

Market Risk

In the normal course of business, the financial position of the

company routinely is subjected to a variety of risks. In addition

to the market risk associated with interest rate and currency

movements on outstanding debt and non-U.S. dollar denom-

inated assets and liabilities, other examples of risk include

collectibility of accounts receivable and recoverability of

residual values on leased assets.