IBM 2002 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2002 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

90 international business machines corporation and Subsidiary Companies

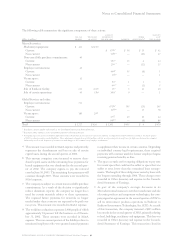

The effect of tax law changes on deferred tax assets and

liabilities did not have a significant effect on the company’s

effective tax rate.

The significant components of activities that gave rise to

deferred tax assets and liabilities that are recorded in the

Consolidated Statement of Financial Position were as follows:

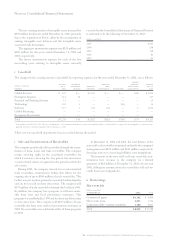

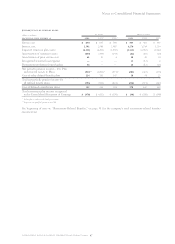

deferred tax assets

(dollars in millions)

at december 31: 2002 2001*

Retirement benefits $«««3,587 $«««2,589

Capitalized research and development 2,251 747

Alternative minimum tax credits 1,316 1,282

Employee benefits 1,049 1,122

Deferred income 895 694

Bad debt, inventory and

warranty reserves 850 863

General business credits 798 700

Infrastructure reduction charges 560 465

Depreciation 441 386

Foreign tax loss carryforwards 304 325

State and local tax loss carryforwards 239 238

Other 2,266 1,781

Gross deferred tax assets 14,556 11,192

Less: Valuation allowance 628 581

Net deferred tax assets $«13,928 $«10,611

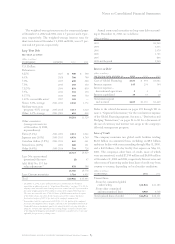

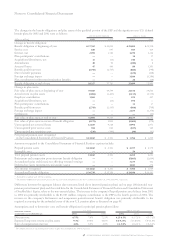

deferred tax liabilities

(dollars in millions)

at december 31: 2002 2001*

Retirement benefits $«««5,904 $«««3,829

Sales-type leases 1,088 1,814

Depreciation 329 425

Other 1,431 1,475

Gross deferred tax liabilities $«««8,752 $«««7,543

*Reclassified to conform with 2002 presentation.

The valuation allowance at December 31, 2002, principally

applies to certain state and local, and foreign tax loss carry-

forwards that, in the opinion of management, are more likely

than not to expire before the company can use them.

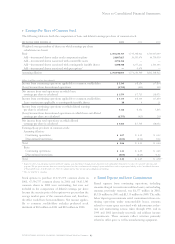

A reconciliation of the company’s continuing operations

effective tax rate to the statutory U.S. federal tax rate is as

follows:

for the year ended december 31: 2002 2001 2000

Statutory rate 35% 35% 35%

Foreign tax differential (7) (6) (6)

State and local 111

Valuation allowance

related items ——(1)

Other —(1) 2

Effective rate 29% 29% 31%

For tax return purposes, the company has available tax

credit carryforwards of approximately $2,234 million, of which

$1,316 million have an indefinite carryforward period and the

remainder begin to expire in 2005. The company also has state

and local, and foreign tax loss carryforwards, the tax effect of

which is $543 million. Most of these carryforwards are avail-

able for five years or have an indefinite carryforward period.

Undistributed earnings of non-U.S. subsidiaries included in

consolidated retained earnings were $16,631 million at

December 31, 2002, and $16,851 million at December 31,

2001. These earnings, which reflect full provision for non-U.S.

income taxes, are indefinitely reinvested in non-U.S. opera-

tions or will be remitted substantially free of additional tax.

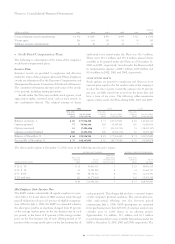

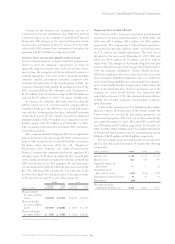

qAdvertising and Promotional Expense

Advertising and promotional expense, which includes

media, agency and promotional expense, was $1,427 mil-

lion, $1,615 million and $1,742 million in 2002, 2001 and

2000, respectively, and is recorded in SG&A expense.

rResearch, Development and Engineering

RD&E expense was $4,750 million in 2002, $4,986 million in

2001 and $5,084 million in 2000.

The company incurred expense of $4,247 million in 2002,

$4,321 million in 2001 and $4,301 million in 2000 for basic

scientific research and the application of scientific advances to

the development of new and improved products and their uses.

Of these amounts, software-related expense was $1,974 mil-

lion, $1,926 million and $1,955 million in 2002, 2001 and

2000, respectively. Included in the expense for 2002 and 2000

were charges for acquired in-process R&D of $4 million and

$9 million, respectively.

Expense for product-related engineering was $503 mil-

lion, $665 million and $783 million in 2002, 2001 and 2000,

respectively.

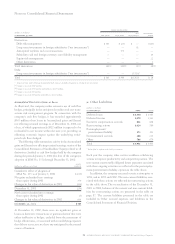

s2002 Actions

Second Quarter Actions

During the second quarter of 2002, the company executed

several actions in its Microelectronics Division. The

Microelectronics Division is within the company’s Technology

Group segment. These actions were the result of the com-

pany’s announced intentions to refocus and direct its

microelectronics business to the high-end foundry, Application

Specific Integrated Circuit and standard products, while

creating a technology services business. A major part of the

actions related to a significant reduction in the company’s

manufacturing capacity for aluminum technology.

In addition, the company rebalanced both its workforce

and its leased space resources primarily in response to the

recent decline in corporate spending on technology services.