IBM 2002 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2002 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

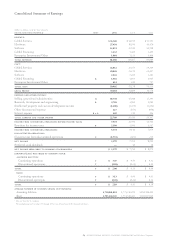

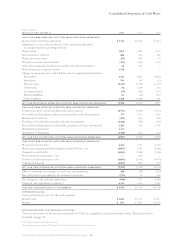

Consolidated Statement of Cash Flows

69

international business machines corporation and Subsidiary Companies

(dollars in millions)

for the year ended december 31: 2002 2001*2000*

cash flow from operating activities from continuing operations:

Income from continuing operations $«5,334 $«8,146 $«7,874

Adjustments to reconcile net income from continuing operations

to cash provided by operating activities:

Depreciation 3,691 3,881 4,224

Amortization of software 688 625 482

Deferred income taxes (67) 664 44

Net gain on assets sales and other (343) (340) (751)

Other than temporary declines in securities and other investments 58 405 —

Noncash portion of special actions 1,350 ——

Change in operating assets and liabilities, net of acquisitions/divestitures:

Receivables 4,125 2,837 (4,692)

Inventories 793 287 (22)

Pension assets (4,227) (1,758) (1,333)

Other assets 70 1,244 673

Accounts payable (55) (918) 2,134

Pension liabilities 83 (69) (237)

Other liabilities 2,288 (1,038) 441

net cash provided by operating activities from continuing operations 13,788 13,966 8,837

cash flow from investing activities from continuing operations:

Payments for plant, rental machines and other property (4,753) (5,400) (5,319)

Proceeds from disposition of plant, rental machines and other property 775 1,149 1,569

Investment in software (597) (655) (565)

Purchases of marketable securities and other investments (1,582) (778) (750)

Proceeds from disposition of marketable securities and other investments 1,185 738 1,393

Divestiture of businesses 1,233 ——

Acquisition of businesses (3,158) (916) (329)

net cash used in investing activities from continuing operations (6,897) (5,862) (4,001)

cash flow from financing activities from continuing operations:

Proceeds from new debt 6,726 4,535 9,604

Short-term (repayments)/borrowings less than 90 days

—

net (4,087) 2,926 (1,400)

Payments to settle debt (5,812) (7,898) (7,561)

Preferred stock transactions

—

net —(254) —

Common stock transactions

—

net (3,087) (3,652) (6,073))

Cash dividends paid (1,005) (966) (929)

net cash used in financing activities from continuing operations (7,265) (5,309) (6,359)

Effect of exchange rate changes on cash and cash equivalents 148 (83) (147)

Net cash (used in)/provided by discontinued operations (722) 55 190

Net change in cash and cash equivalents (948) 2,767 (1,480)

Cash and cash equivalents at January 1 6,330 3,563 5,043

cash and cash equivalents at december 31 $«5,382 $«6,330 $«3,563

supplemental data:

Cash paid during the year for the total company:

Income taxes $«1,841 $«2,279 $«2,697

Interest $««««831 $«1,247 $«1,447

noncash investing and financing activities:

The noncash portion of the purchase price paid for PwCC is a significant noncash investing activity. This transaction is

described on page 78.

*Reclassified to conform with 2002 presentation.

The accompanying notes on pages 70 through 104 are an integral part of the financial statements.