IBM 2002 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2002 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

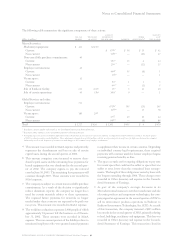

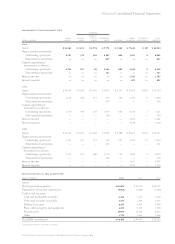

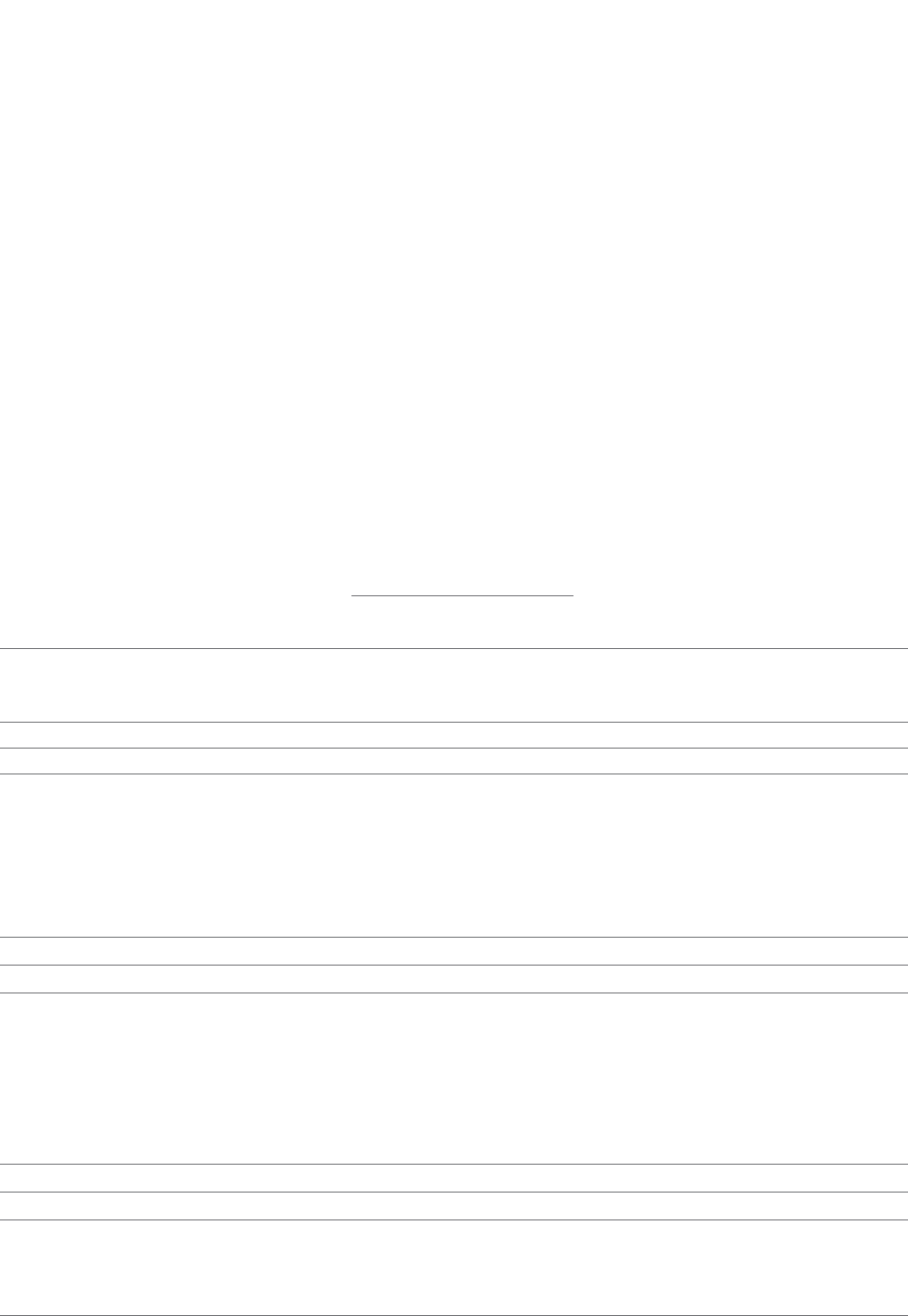

management system segment view

hardware

personal

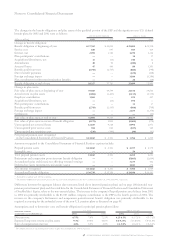

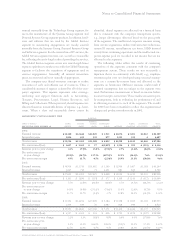

(dollars in millions) global systems systems technology global enterprise total

for the year ended december 31: services group group group software financing investments segments

2002:

External revenue $«36,360 $«12,646 $«11,049 $««3,935 $«13,074 $«3,203 $«1,022 $«81,289

Internal revenue 2,854 659 139 877 1,225 939 4 6,697

Total revenue $«39,214 $«13,305 $«11,188 $««4,812 $«14,299 $«4,142 $«1,026 $«87,986

Pre-tax income/(loss) $«««3,657 $÷«1,561 $««««««««57 $«(1,057) $«««3,556 $««««955 $«««(293) $«««8,436

Revenue year-to-year change 4.3% (7.9) % (7.2) % (27.1) % 2.7% (2.4) % (8.6) % (2.2) %

Pre-tax income year-

to-year change (29.1) % (14.7) % 137.3% (697.2) % 12.2% (16.4) % 7.6% (23.4) %

Pre-tax income margin 9.3% 11.7% 0.5% (22.0) % 24.9% 23.1% (28.6) % 9.6%

2001:

External revenue $«34,956 $«13,743 $«11,982 $««5,149 $«12,939 $«3,407 $«1,118 $«83,294

Internal revenue 2,647 710 73 1,451 981 836 4 6,702

Total revenue $«37,603 $«14,453 $«12,055 $««6,600 $«13,920 $«4,243 $«1,122 $«89,996

Pre-tax income/(loss) $«««5,161 $÷«1,830 $«««««(153) $«««««177 $«««3,168 $«1,143 $«««(317) $«11,009

Revenue year-to-year change 5.7% (2.6) % (20.5) % (8.0) % 3.7% (4.5) % (18.2) % (2.2) %

Pre-tax income year-

to-year change 14.3% (4.8) % (251.5) % (74.6) % 13.4% (2.8) % (6.7) % 0.9%

Pre-tax income margin 13.7% 12.7% (1.3) % 2.7% 22.8% 26.9% (28.3) % 12.2%

2000:

External revenue $«33,152 $«14,194 $«15,098 $««5,184 $«12,598 $«3,500 $«1,369 $«85,095

Internal revenue 2,439 649 70 1,987 828 944 3 6,920

Total revenue $«35,591 $«14,843 $«15,168 $««7,171 $«13,426 $«4,444 $«1,372 $«92,015

Pre-tax income/(loss) $«««4,517 $÷«1,922 $««««««101 $«««««696 $«««2,793 $«1,176 $«««(297) $«10,908

Revenue year-to-year change 2.2% 3.1% (3.0) % 8.9% 0.0% 9.6% (17.8) % 1.6%

Pre-tax income year-

to-year change 1.2% 21.3% 304.0% 205.3% (9.9) % 12.3% 57.4% 11.9%

Pre-tax income margin 12.7% 12.9% 0.7% 9.7% 20.8% 26.5% (21.6) % 11.9%

Notes to Consolidated Financial Statements

101international business machines corporation and Subsidiary Companies

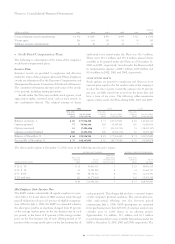

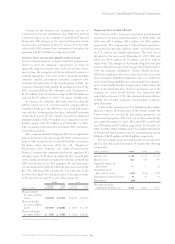

sourced internally from the Technology Group segment for

use in the manufacture of the Systems Group segment and

Personal Systems Group segment products. In addition, hard-

ware and software that are used by the Global Services

segment in outsourcing engagements are mostly sourced

internally from the Systems Group, Personal Systems Group

and Software segments. For the internal use of IT services, the

Global Services segment recovers cost, as well as a reasonable

fee, reflecting the arm’s-length value of providing the services.

The Global Services segment enters into arm’s-length leases

at prices equivalent to market rates with the Global Financing

segment to facilitate the acquisition of equipment used in

services engagements. Generally, all internal transaction

prices are reviewed and reset annually if appropriate.

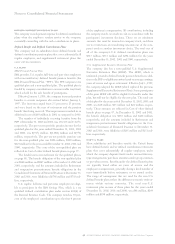

The company uses shared-resources concepts to realize

economies of scale and efficient use of resources. Thus, a

considerable amount of expense is shared by all of the com-

pany’s segments. This expense represents sales coverage,

marketing and support functions such as Accounting,

Tr easury, Procurement, Legal, Human Resources, and

Billing and Collections. Where practical, shared expenses are

allocated based on measurable drivers of expense, e.g., head-

count. When a clear and measurable driver cannot be

identified, shared expenses are allocated on a financial basis

that is consistent with the company’s management system;

e.g., image advertising is allocated based on the gross profit

of the segments. The unallocated corporate amounts arising

from certain acquisitions, indirect infrastructure reductions,

certain IP income, miscellaneous tax items, HDD internal

activity from continuing operations and the unallocated cor-

porate expense pool are recorded in net income but are not

allocated to the segments.

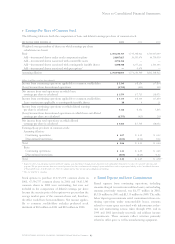

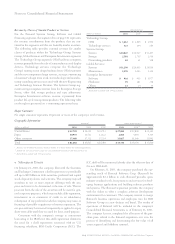

The following tables reflect the results of continuing

operations of the segments consistent with the company’s

management system. These results are not necessarily a

depiction that is in conformity with GAAP; e.g., employee

retirement plan costs are developed using actuarial assump-

tions on a country-by-country basis and allocated to the

segments on headcount. Different amounts could result if

actuarial assumptions that are unique to the segment were

used. Performance measurement is based on income before

income taxes (pre-tax income). These results are used, in part,

by management, both in evaluating the performance of, and

in allocating resources to, each of the segments. The results

for 2000 have been reclassified to reflect the organizational

changes and product transfers made in 2001.