IBM 2002 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2002 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to Consolidated Financial Statements

77international business machines corporation and Subsidiary Companies

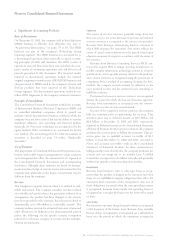

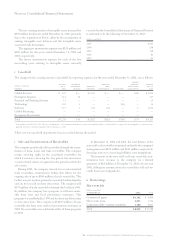

In July 2002, the FASB issued SFAS No. 146, “Accounting

for Costs Associated with Exit or Disposal Activities.” SFAS

No. 146 supersedes EITF No. 94-3, “Liability Recognition for

Certain Employee Termination Benefits and Other Costs to

Exit an Activity (Including Certain Costs Incurred in a

Restructuring),” and requires that a liability for a cost associ-

ated with an exit or disposal activity be recognized when the

liability is incurred. Such liabilities should be recorded at fair

value and updated for any changes in the fair value each

period. A notable change from EITF No. 94-3 involves one-

time employee termination costs whereby the employee to be

terminated is required to render service between the notifica-

tion date and the date the employee will be terminated in

order to receive any termination benefits. For these situations

whereby the required postnotification service period extends

beyond the minimum retention period required by local law,

the fair value of the liability will be recognized ratably over the

service period. This change is effective for new exit or disposal

activities initiated after December 31, 2002. Had SFAS No. 146

been effective for the company’s second quarter and fourth

quarter 2002 actions, a portion of the pre-tax employee ter-

mination costs listed in the table on pages 91 and 92 would

have been amortized over the applicable service periods, until

the respective employees were terminated. The impact of

SFAS No. 146 on the company’s future Consolidated Financial

Statements will depend upon the timing of and facts under-

lying any future one-time workforce reduction actions.

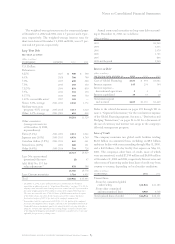

In November 2002, the EITF reached a consensus on

Issue No. 00-21, “Accounting for Revenue Arrangements

with Multiple Deliverables.” This Issue provides guidance on

when and how to separate elements of an arrangement that

may involve the delivery or performance of multiple products,

services and rights to use assets into separate units of account-

ing. The guidance in the consensus is effective for revenue

arrangements entered into in fiscal periods beginning after

June 15, 2003. The company will adopt Issue No. 00-21 in

the quarter beginning July 1, 2003. The transition provision

allows either prospective application or a cumulative effect

adjustment upon adoption. The company is currently evalu-

ating the impact of adopting this guidance.

In November 2002, the FASB issued Interpretation No. 45

(FIN 45), “Guarantor’s Accounting and Disclosure Require-

ments for Guarantees, Including Indirect Guarantees of

Indebtedness of Others,” which addresses the disclosures to

be made by a guarantor in its interim and annual financial

statements about its obligations under guarantees. FIN 45

also requires the recognition of a liability by a guarantor at

the inception of certain guarantees that are entered into or

modified after December 31, 2002.

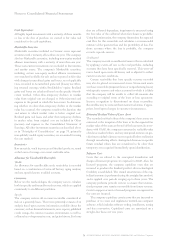

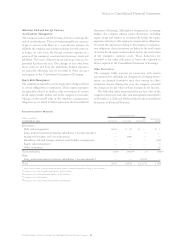

The company has adopted the disclosure requirements of

FIN 45 (see note a, “Significant Accounting Policies,” on pages

70 through 75, and note o, “Contingencies and Commit-

ments,” on pages 88 and 89) and will apply the recognition

and measurement provisions for all material guarantees

entered into or modified in periods beginning January 1,

2003. The impact of FIN 45 on the company’s future

Consolidated Financial Statements will depend upon

whether the company enters into or modifies any material

guarantee arrangements.

In January 2003, the FASB issued Interpretation No. 46

(FIN 46), “Consolidation of Variable Interest Entities,”

which addresses consolidation by business enterprises of vari-

able interest entities that either: (1) do not have sufficient

equity investment at risk to permit the entity to finance its

activities without additional subordinated financial support,

or (2) the equity investors lack an essential characteristic of a

controlling financial interest.

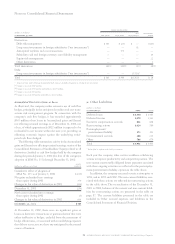

FIN 46 requires disclosure of Variable Interest Entities

(VIEs) in financial statements issued after January 31, 2003, if

it is reasonably possible that as of the transition date: (1) the

company will be the primary beneficiary of an existing VIE

that will require consolidation or, (2) the company will hold a

significant variable interest in, or have significant involvement

with, an existing VIE. Pursuant to the transitional require-

ments of FIN 46, the company will adopt the consolidation

guidance applicable to existing VIEs as of the reporting period

beginning July 1, 2003. Any VIEs created after January 31,

2003, are immediately subject to the consolidation guidance

in FIN 46.

The company’s program to sell state and local government

receivables, as described in note j, “Sale and Securitization of

Receivables,” on page 82, involves qualifying special purpose

entities, and therefore is not subject to FIN 46.

The company does not have any entities that require

disclosure or new consolidation as a result of adopting the

provisions of FIN 46.