IBM 2002 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2002 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

72 international business machines corporation and Subsidiary Companies

Stock-Based Compensation

The company applies Accounting Principles Board (APB)

Opinion No. 25, “Accounting for Stock Issued to Employees,”

and related Interpretations in accounting for its stock-based

compensation plans. Accordingly, the company records

expense for employee stock compensation plans equal to the

excess of the market price of the underlying IBM shares at the

date of grant over the exercise price of the stock-related

award, if any (known as the intrinsic value). Generally, all

employee stock options are issued with the exercise price

equal to the market price of the underlying shares at the grant

date and therefore, no compensation expense is recorded. In

addition, no compensation expense is recorded for purchases

under the Employees Stock Purchase Plan (ESPP) in accor-

dance with APB Opinion No. 25. This plan is described on

pages 94 and 95. The intrinsic value of restricted stock units

and certain other stock-based compensation issued to

employees as of the date of grant is amortized to compensa-

tion expense over the vesting period. To the extent there are

performance criteria that could result in an employee receiv-

ing more or less (including zero) shares than the number of

units granted, the unamortized liability is marked to market

during the performance period based upon the intrinsic value

at the end of each quarter.

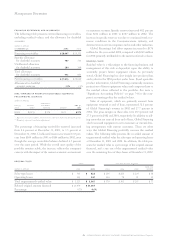

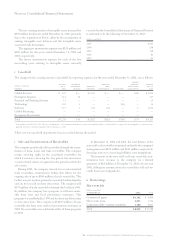

The following table summarizes the pro forma operating

results of the company had compensation cost for stock

options granted and for employee stock purchases under the

ESPP (see note v, “Stock-Based Compensation Plans” on

pages 94 and 95) been determined in accordance with the fair

value based method prescribed by Statement of Financial

Accounting Standards (SFAS)No. 123, “Accounting for

Stock-Based Compensation.”

(dollars in millions except per share amounts)

for the year ended december 31: 2002 2001 2000

Net income applicable

to common stockholders,

as reported $«3,579 $«7,713 $«8,073

Add: Stock-based employee

compensation expense

included in reported

net income, net

of related tax effects «112 «104 «82

Deduct: Total stock-based

employee compensation

expense determined under fair

value method for all awards,

net of related tax effects «1,315 «1,343 «972

Pro forma net income $«2,376 $«6,474 $«7,183

Earnings per share:

Basic

—

as reported $«««2.10 $÷«4.45 $«««4.58

Basic

—

pro forma $«««1.40 $÷«3.74 $÷«4.07

Assuming dilution

—

as reported $«««2.06 $÷«4.35 $«««4.44

Assuming dilution

—

pro forma $«««1.39 $÷«3.69 $÷«3.99

The pro forma amounts that are disclosed in accordance

with SFAS No. 123 reflect the portion of the estimated fair

value of awards that was earned for the years ended Dec-

ember 31, 2002, 2001 and 2000.

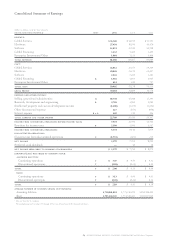

The fair value of stock option grants is estimated using

the Black-Scholes option-pricing model with the following

assumptions:

for the year ended december 31: 2002 2001 2000

Te rm (years)*54/54/5

Volatility** 40.4% 37.7% «32.0%

Risk-free interest rate (zero

coupon U.S. treasury note) 2.8% 4.4% 5.1%

Dividend yield 0.7% 0.5% 0.5%

Weighted-average fair

value per option $«28 $«42 $«36

*There were no tax incentive options granted in 2002. Option term is 5 years for

non-tax incentive options for the year ended December 31, 2002. Option term is

4 years for tax incentive options and 5 years for non-tax incentive options for the

years ended December 31, 2001 and 2000.

** To determine volatility, the company measured the daily price changes of the stock

over the respective term for tax incentive options and non-tax incentive options.

Income Taxes

Income tax expense is based on reported income before

income taxes. Deferred income taxes reflect the effect of

temporary differences between asset and liability amounts

that are recognized for financial reporting purposes and the

amounts that are recognized for income tax purposes. These

deferred taxes are measured by applying currently enacted tax

laws. Valuation allowances are recognized to reduce the

deferred tax assets to the amount that is more likely than not

to be realized. In assessing the likelihood of realization, man-

agement considers estimates of future taxable income.

Translation of Non-U.S. Currency Amounts

Assets and liabilities of non-U.S. subsidiaries that operate in a

local currency environment are translated to U.S. dollars at

year-end exchange rates. Income and expense items are trans-

lated at weighted-average rates of exchange prevailing during

the year. Translation adjustments are recorded in Accumulated

gains and (losses) not affecting retained earnings within

Stockholders’ equity.

Inventories, Plant, rental machines and other property-

net, and other non-monetary assets and liabilities of non-U.S.

subsidiaries and branches that operate in U.S. dollars, or

whose economic environment is highly inflationary, are

translated at approximate exchange rates prevailing when the

company acquired the assets or liabilities. All other assets and

liabilities are translated at year-end exchange rates. Cost of

sales and depreciation are translated at historical exchange

rates. All other income and expense items are translated at

the weighted-average rates of exchange prevailing during the

year. Gains and losses that result from translation are

included in net income.