IBM 2002 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2002 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

88 international business machines corporation and Subsidiary Companies

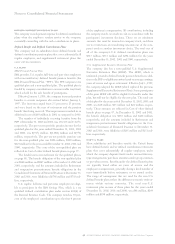

In addition, the company is a defendant in a class action

challenge to its defined benefit plan. The suit alleges that the

current pension plan formulas violate a number of Employee

Retirement Income Security Act (ERISA) provisions including

the ERISA age discrimination provision.

While it is not possible to predict the ultimate outcome of

the matters discussed above, given the unique factors and

circumstances involved in each matter, historically, the com-

pany has been successful in defending itself against claims and

suits that have been brought against it, and payments made by

the company in such claims and suits have not been material

to the company. The company will continue to defend itself

vigorously in all such matters and believes that if it were to

incur a loss in any such matter, such loss should not have a

material effect on the company’s business, financial condition

or results of operations.

Commitments

The company has applied the disclosure provisions of FASB

Interpretation No. 45 (FIN 45), “Guarantor’s Accounting and

Disclosure Requirements for Guarantees, Including Indirect

Guarantees of Indebtedness of Others,” to its agreements that

contain guarantee or indemnification clauses. These disclosure

provisions expand those required by FASB Statement No. 5,

“Accounting for Contingencies,” by requiring a guarantor to

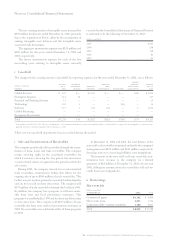

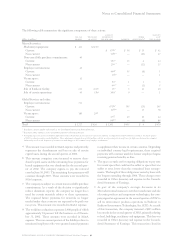

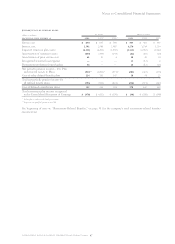

net change in unrealized (losses)/gains on

marketable securities (net of tax)

(dollars in millions)

at december 31: 2002 2001

Net unrealized losses arising

during the period $«(13) $«(154)

Less: Net gains/(losses) included

in net income for the period 3*(246) *

Net change in unrealized (losses)/

gains on marketable securities $«(16) $««««92

*Includes write-downs of $36 million and $287 million in 2002 and 2001, respectively.

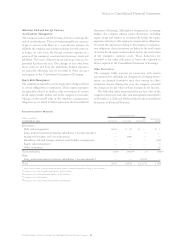

oContingencies and Commitments

Contingencies

The company is subject to a variety of claims and suits that

arise from time to time in the ordinary course of its business,

including actions with respect to contracts, IP, product liabil-

ity, employment and environmental matters. The company is a

defendant and/or third-party defendant in a number of cases in

which claims have been led by current and former employees,

independent contractors, estate representatives, offspring and

relatives of employees seeking damages for wrongful death and

personal injuries allegedly caused by exposure to chemicals in

various of the company’s facilities from 1964 to the present.

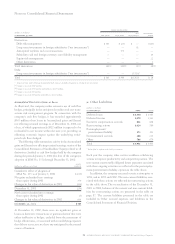

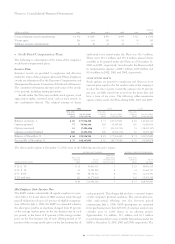

Employee Benefits Trust

In 1997, the company created an employee benefits trust to

which the company contributed 10 million shares of treasury

stock. The company was authorized to instruct the trustee to

sell such shares from time to time and to use the proceeds

from such sales, and any dividends paid or earnings received

on such stock, toward the partial payment of the company’s

obligations under certain of its compensation and benefit

plans. The shares held in trust were not considered outstand-

ing for earnings per share purposes until they were

committed to be released. The company did not commit any

shares for release from the trust during its existence nor were

any shares sold from the trust. The trust would have expired

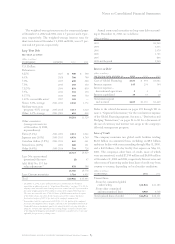

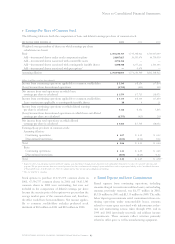

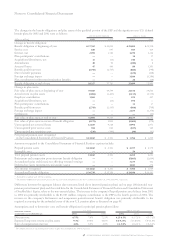

accumulated gains and (losses)not affecting retained earnings*

net net accumulated

unrealized foreign minimum unrealized gains/(losses)

gains/(losses)currency pension gains/(losses)not affecting

on cash flow translation liability on marketable retained

(dollars in millions) hedge derivatives adjustments adjustment** securities earnings

December 31, 2000 $««««— $««(73) $««««(218) $«(78) $««««(369)

Cumulative effect on January 1, 2001 219 — — — 219

Change for period 77 (539) (308) 92 (678)

December 31, 2001 296 (612) (526) 14 (828)

Change for period (659) 850 (2,765) (16) (2,590)

december 31, 2002 $«(363) $«238 $«(3,291) $«««(2) $«(3,418)

*Net of tax.

** Reclassified to conform with 2002 presentation.

in 2007. Due to the fact that the company had not used the

trust, nor was it expected to need the trust prior to its expira-

tion, the company dissolved the trust, effective May 31, 2001,

and all of the shares (20 million on a split-adjusted basis) were

returned to the company as treasury shares. Dissolution of

the trust did not affect the company’s obligations related to

any of its compensation and employee benefit plans or its

ability to settle the obligations. In addition, the dissolution is

not expected to have any impact on net income. At this time,

the company plans to fully meet its obligations for the com-

pensation and benefit plans in the same manner as it does

today, using cash from operations.