IBM 2002 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2002 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

79international business machines corporation and Subsidiary Companies

balance to the Global Services segment. The goodwill is not

deductible for tax purposes. The overall weighted-average

life of the intangible assets purchased is approximately three

years. The results of operations of the acquired businesses

were included in the company’s Consolidated Financial

Statements from the respective dates of acquisition.

2001

In 2001, the company completed two acquisitions at a cost of

approximately $1,082 million.

The larger acquisition was Informix Corporation’s

(Informix) database software business. The company paid

approximately $1 billion in cash for the net assets of the busi-

ness. Under the terms of the acquisition, the company paid

$889 million of the purchase price in 2001. The balance was

paid in January 2003. The Informix acquisition provided the

company with a database software system for data warehous-

ing, business intelligence and transaction-handling systems

that are used by more than 100,000 customers. In addition,

the acquisition significantly increased the size of the com-

pany’s UNIX database business. The company purchased

Informix in the third quarter of 2001.

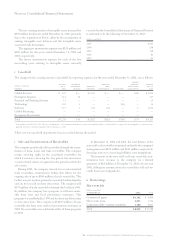

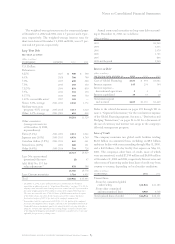

The following table presents the allocation of purchase

price related to the 2001 acquisitions as of the respective

dates of acquisition.

amortization

(dollars in millions) life (in years)informix other

Current assets $««««156 $«««57

Fixed/non-current assets 41 21

Intangible assets:

Goodwill «591 «««25

Customer lists 5220 «—

Completed technology 3140 «—

Trademarks 210«—

Total assets acquired «1,158 «103

Deferred revenue (101) «(2)

Payables/accrued expenses (55) (21)

Total liabilities assumed «««(156) ««(23)

Total purchase price $«1,002 $«««80

Informix

The primary items that generated goodwill are the value of

the acquired assembled workforce and the synergies between

Informix and the company created by the combination.

Goodwill of $591 million has been assigned to the Software

segment. Almost all of the goodwill is deductible for tax

purposes. This transaction occurred after June 30, 2001, and

therefore, the acquired goodwill is not subject to amortization.

The overall weighted-average life of intangible assets pur-

chased from Informix is 4.2 years. The results of operations

of Informix were included in the company’s Consolidated

Financial Statements as of July 2, 2001.

Other Acquisitions

The primary items that generated goodwill are the synergies

between the acquired business and the company and the pre-

mium paid by the company for the right to control the business

acquired. Goodwill of $25 million has been assigned to the

Global Services segment. The goodwill is not deductible for

tax purposes. The results of operations of the acquired busi-

ness were included in the company’s Consolidated Financial

Statements from the date of acquisition.

2000

In 2000, the company completed nine acquisitions at a cost of

approximately $511 million.

The largest acquisition was LGS Group Inc. (LGS). The

company acquired all the outstanding stock of LGS in April

2000 for $190 million. LGS offers services ranging from appli-

cation development to information technology (IT) consulting.

The results of operations of LGS were included in the com-

pany’s Consolidated Financial Statements as of April 2000.

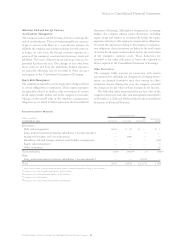

The table below presents the allocation of the purchase

price related to the 2000 acquisitions as of the respective dates

of acquisition.

(dollars in millions) lgs other

Tangible net assets $«««31 $«««68

Goodwill «159 «««220

Other identifiable intangible assets —36

In-process research and development —9

Deferred tax liabilities related to

identifiable intangible assets «— «««(12)

Total purchase price $«190 $«321