IBM 2002 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2002 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

92 international business machines corporation and Subsidiary Companies

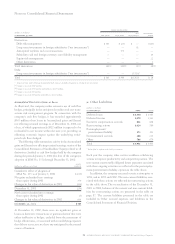

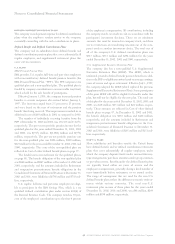

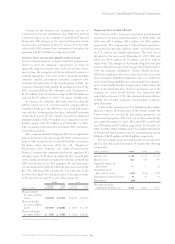

the fourth quarter of 2002. The company entered into a

limited supply agreement with EIT for future products,

and it will also lease back, at fair market value rental

rates, approximately one-third of the Endicott campus’

square footage for operations outside the interconnect

OEM business.

(g) As part of the strategic realignment of the company’s

Microelectronics business, the company reached an

agreement to sell certain assets and liabilities comprising

its Mylex business to LSI Logic Corporation and the

company sold part of its wireless phone chipset opera-

tions to TriQuint Semiconductor, Inc. in June 2002. The

Mylex transaction was completed in August 2002. The

loss of $74 million for the Mylex transaction and the real-

ized gain of $11 million for the chipset sale were recorded

in Other (income) and expense in the Consolidated

Statement of Earnings.

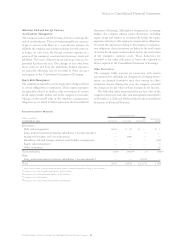

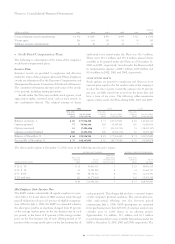

(h) The majority of the workforce reductions relate to the

company’s Global Services business. The workforce reduc-

tions represent 14,213 people of which approximately

94 percent left the company as of December 31, 2002. See

(d) on page 91 for information on the non-current portion

of the liability. These charges were included in SG&A

expense in the Consolidated Statement of Earnings.

(i) The space accruals are for ongoing obligations to pay rent

for vacant space that could not be sublet or space that was

sublet at rates lower than the committed lease arrange-

ments. This space relates primarily to workforce dynamics

in the Global Services business and the downturn in cor-

porate technology spending on services. The length of

these obligations varies by lease with the longest extending

through 2009. These charges were recorded in Other

(income) and expense in the Consolidated Statement

of Earnings.

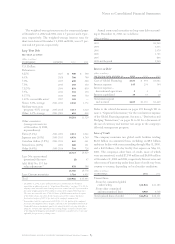

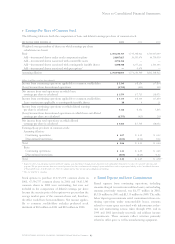

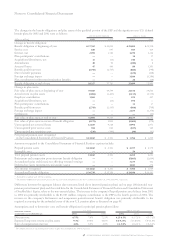

(a) The majority of the workforce reductions relate to the

company’s Global Services business. The workforce reduc-

tions represent 3,541 people who are expected to leave the

company by the end of the first quarter of 2003 ($305 mil-

lion in the table above). These charges were included in

SG&A expense in the Consolidated Statement of Earnings.

The workforce reductions also affected 1,203 acquired

PwCC employees who are expected to leave the company

by the end of the first quarter of 2003 ($48 million in the

table above). These costs were included as part of the lia-

bilities assumed for purchase accounting.

The non-current workforce accrual relates to termi-

nated employees in certain countries outside the United

States, for whom the company is required to make annual

payments to supplement their incomes. Depending on

individual country legal requirements, these required

payments will continue until the former employee begins

receiving pension benefits or dies.

(b) The majority of the space accruals are for ongoing obliga-

tions to pay rent for vacant space of PwCC that could not

be sublet or space that was sublet at rates lower than the

committed lease arrangements. The length of these obli-

gations varies by lease with the longest extending through

2019. The charges related to IBM space ($17 million)

were included in Other (income) and expense in the

Consolidated Statement of Earnings. The costs related to

acquired PwCC space were included as part of the liabili-

ties assumed for purchase accounting ($235 million in the

table above comprise $62 million current and $173 mil-

lion non-current).

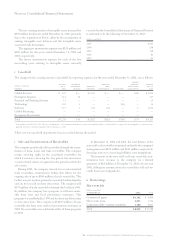

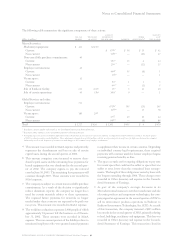

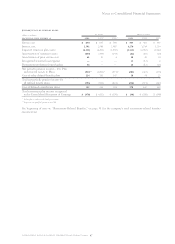

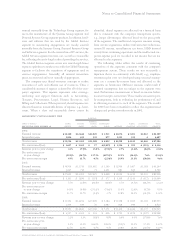

Fourth Quarter Actions

During the fourth quarter of 2002, the company executed several actions related to the company’s acquisition of PwCC.

Specifically, the company rebalanced both its workforce and its leased space resources. The following table summarizes the

significant components of these actions:

recorded in

purchase

recorded in the consolidated accounting

statement of earnings (see note c)total

total sale or liability liability liability liability

pre-tax write-off recorded recorded recorded other as of

(dollars in millions) charges of assets in 4th qtr. in 4th qtr. in 4th qtr. payments adjustments*dec. 31, 2002

Workforce: $«305(a) $«—

Current $«248 $«««48(a) $«296 $«16 $«(2) $«278

Non-current 57(a) —57——57

Vacant space: «17(b) «4

Current 662

(b) 68 1 — 67

Non-current 7173(b) 180 — — 180

Total $«322 $«««4 $«318 $«283 $«601 $«17 $«(2) $«582

*Principally represents currency translation adjustments.