IBM 2002 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2002 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

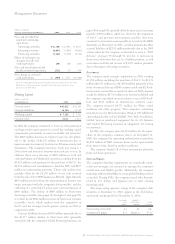

debt

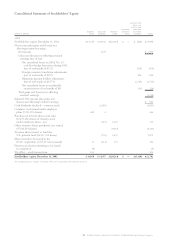

at december 31: 2002 2001

Debt to equity ratio 6.9x 6.8x

Global Financing funds its operations primarily through bor-

rowings using a debt-to-equity ratio of approximately 7 to 1.

The following table illustrates the correlation between

Global Financing assets and Global Financing debt. Both

assets and debt are presented in the Global Financing balance

sheet on page 61.

global financing assets and debt

(dollars in millions)

■global financing assets ■global financing debt

The company’s Global Financing business provides funding

predominantly for the company’s external customers but also

provides intercompany financing for the company (internal),

as described in the “Description of Business” on page 60. As

previously stated, IBM manages and measures Global Financing

as if it were a standalone entity and accordingly, interest

expense relating to debt supporting Global Financing’s exter-

nal customer and internal business is included in the “Global

Financing Results of Operations” on page 60 and in note x,

“Segment Information,” on pages 100 to 104.

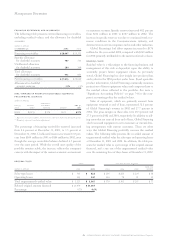

In the company’s Consolidated Statement of Earnings on

page 64, however, the interest expense supporting Global

Financing’s internal financing to the company is reclassified

from Cost of financing to Interest expense.

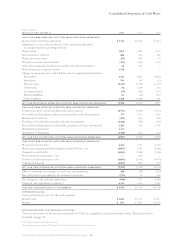

liquidity

Global Financing is a segment of IBM and as such is supported

by IBM’s liquidity position and access to capital markets.

Global Financing generated cash in 2002, which was primarily

driven by net income and a decline in assets. Cash was

deployed to reduce debt and pay dividends in order to main-

tain an appropriate debt to equity ratio.

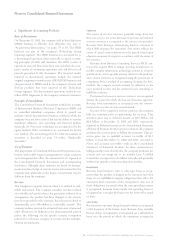

Critical Accounting Estimates

As discussed in note a, “Significant Accounting Policies,” on

pages 70 to 75, the application of GAAP involves the exercise of

varying degrees of judgment. The following areas require more

judgment relative to the others and relate to Global Financing:

financing receivables reserves

The company reviews its financing receivables portfolio at

least quarterly in order to assess collectibility. A description

of the methods used by management to estimate the amount

of uncollectible receivables is included on pages 73 and 74.

Factors that could result in actual receivable losses that are

materially different from the estimated reserve include sharp

changes in the economy, or a large change in the health of a

particular industry segment that represents a concentration

in the company’s receivables portfolio.

residual value

Residual value represents the estimated fair value of equip-

ment under lease as of the end of the lease. The company

estimates the future fair value of residual values by using his-

torical models, the current market for used equipment and

forward-looking product information such as marketing plans

and technological innovations. These estimates are periodically

reviewed and any other-than-temporary declines in estimated

future residual values are recognized upon identification.

Anticipated increases in future residual value are not recognized

until the equipment is remarketed. Factors that could cause

actual results that materially differ from the estimates include

severe changes in the used equipment market brought on by

unforeseen changes in technology innovations and any result-

ing changes in the useful lives of used equipment. Previous

writedowns of residual values have not been material.

Market Risk

See pages 58 and 59 for discussion of the company’s overall

market risk.

Looking Forward

Given Global Financing’s mission of supporting IBM’s hard-

ware, software and services, originations for both customer

and commercial finance businesses will be dependent upon

the overall demand for IT equipment.

Interest rates and the overall economy (including currency

fluctuations) will have an effect on both revenue and gross

profit. The company’s interest rate risk management policy,

however, combined with the Global Financing funding strategy

(see page 60), should mitigate gross profit erosion due to

changes in interest rates. The company’s policy of matching

asset and liability positions in foreign currencies will limit the

impacts of currency fluctuations.

The economy could impact the credit quality of the

Global Financing receivables portfolio and therefore the level

of provision for bad debts. Global Financing will continue to

apply rigorous credit policies in both the origination of new

business and the evaluation of the existing portfolio.

As seen above, Global Financing has historically been able

to manage residual value risk through both insight into the

product cycles as well as through its remarketing business.

Global Financing has policies in place to manage each of

the key risks involved in financing. These policies, combined

with product and customer knowledge, should allow for the

prudent management of the business going forward, even

with the uncertainty of the current economy.

Management Discussion

63international business machines corporation and Subsidiary Companies

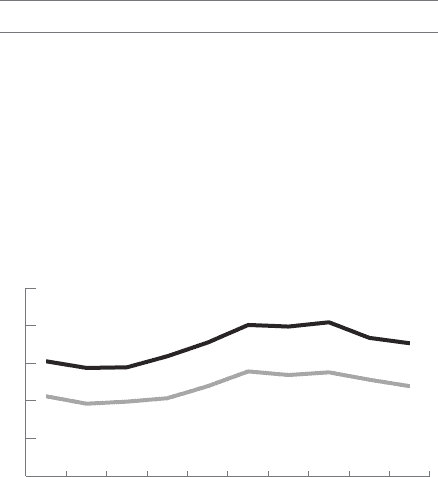

1993 1994 1995 1996 1997 1998 1999 2000 2001 2002

10

20

30

40

$50