IBM 2002 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2002 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management Discussion

56 international business machines corporation and Subsidiary Companies

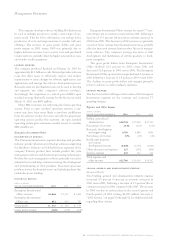

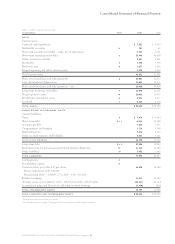

(dollars in millions)

for the year ended december 31: 2002 2001 2000

Net cash provided by/

(used in) continuing

operations:

Operating activities $«13,788 $«13,966 $««8,837

Investing activities (6,897) (5,862) «(4,001)

Financing activities (7,265) (5,309) (6,359)

Effect of exchange rate

changes on cash and

cash equivalents 148 (83) (147)

Net cash (used in)/provided

by discontinued operations*(722) 55 190

Net change in cash and

cash equivalents $÷«««(948) $«««2,767 $«(1,480)

*Does not include approximately $1,170 million of net proceeds from the sale of the

HDD business. Such proceeds are included in Net cash used in from Investing

activities in the table above.

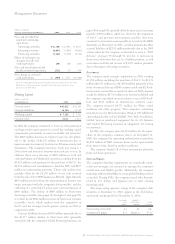

Working Capital

(dollars in millions)

at december 31: 2002 2001

Current assets $«41,652 $«42,461

Current liabilities 34,550 35,119

Working capital $÷«7,102 $«««7,342

Current ratio 1.21:1 1.21:1

In 2002 the company continued to focus on cash generation

and improved its performance in several key working capital

components, particularly accounts receivable and inventory.

The $809 million decrease in Current assets was due prima-

rily to the decline of $1,156 million in Inventories due to

improvements in inventory levels across all business units and

divestitures. The company’s inventory levels now stand at a

20-year low and inventory turnover increased year to year. In

addition, there was a decrease of $418 million in Cash and

cash equivalents and Marketable securities, resulting from the

$2,852 million cash payment for the purchase of PwCC, the

$2,092 million cash contribution to fund the PPP, and $857

million in restructuring payments. These cash outlays were

partially offset by the $1,170 million of net cash received

from the sale of the HDD business to Hitachi, approximately

$650 million received from the monetization of interest rate

swaps associated with the company’s debt portfolio, and the

collection of a receivable for prior years’ taxes and interest of

$460 million. The decline of $660 million in Short-term

financing receivables (see pages 60 through 63 and page 81)

was offset by the $814 million increase in Notes and accounts

receivable

—

trade, which resulted from the acquisition of

PwCC and the stronger fourth quarter revenue in 2002 as

compared to 2001.

Current liabilities decreased $569 million primarily due to

the $5,157 million decline in Short-term debt (primarily

associated with the company’s Global Financing business, see

pages 60 through 63), partially offset by increases in Accounts

payable of $583 million, which was driven by the acquisition

of PwCC and previous intercompany payables that were

converted to external accounts payable as a result of the HDD

divestiture on December 31, 2002, as well as increases in Other

accrued liabilities of $2,192 million primarily due to the 2002

actions taken by the company as described in note s, “2002

Actions,” on pages 90 through 92 and due to increases in

short-term derivatives that are in a liability position, as well

as increases in Deferred income of $1,053 million primarily

due to the impact of foreign currencies.

Investments

The company made strategic acquisitions in 2002, totaling

$3,958 million, including the purchase of PwCC for $3,474

million ($2,852 million in cash, $294 million primarily in the

form of restricted shares of IBM common stock and $328 mil-

lion in notes convertible to restricted shares of IBM common

stock). In addition, $4,750 million was invested in RD&E and

the company capitalized external software costs of $254 mil-

lion and $343 million of internal-use software costs.

The company invested $4,753 million for Plant, rental

machines and other property. This comprises continuing

investments in the Microelectronics Division 300 millimeter

chip-making facility in East Fishkill, New York. In addition,

Global Services purchased equipment for its SO business

and Global Financing invested in equipment for leasing

to customers.

In 2002, the company spent $4,212 million for the repur-

chase of the company’s common shares. At December 31,

2002, the company has remaining authorization to purchase

$3,864 million of IBM common shares in the open market

from time to time, based on market conditions.

The company funded all of these investments primarily

from cash from operations.

Debt and Equity

The company’s funding requirements are continually moni-

tored and strategies are executed to manage the company’s

overall asset and liability profile. Additionally, the company

maintains sufficient flexibility to access global funding sources

as needed. During 2002, the company issued debt denomi-

nated in U.S. dollars and Japanese yen to meet existing

financing needs.

The major rating agencies’ ratings of the company’s debt

securities at December 31, 2002, appear in the table below

and remain unchanged from December 31, 2001:

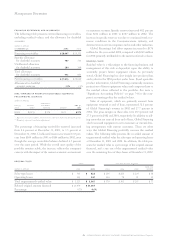

standard moody’s

and investors fitch

poor’sservice ratings

Senior long-term debt A+ A1 AA-

Commercial paper A-1 Prime-1 F-1+