IBM 2002 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2002 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

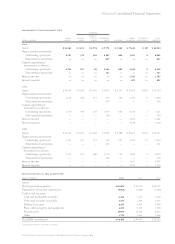

Notes to Consolidated Financial Statements

100 international business machines corporation and Subsidiary Companies

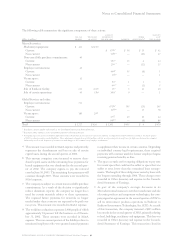

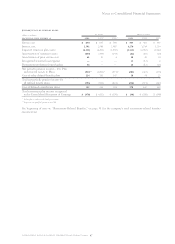

The changes in the benefit obligation and plan assets of

the U.S. plan for 2002 and 2001 are as follows:

(dollars in millions) 2002 2001

Change in benefit obligation:

Benefit obligation at beginning of year $««6,148 $««6,443

Service cost 49 65

Interest cost 421 437

Actuarial gains (170) (183)

Participant contributions —71

Benefits paid from trust —(68)

Direct benefit payments (566) (617)

Benefit obligation at end of year 5,882 6,148

Change in plan assets:

Fair value of plan assets at

beginning of year 84

Actual return on plan assets 21

Participant contributions 119 71

Benefits paid (119) (68)

Fair value of plan assets at end of year 10 8

Benefit obligation in excess

of plan assets (5,872) (6,140)

Unrecognized net actuarial losses 595 781

Unrecognized prior service costs (493) (653)

Accrued postretirement benefit

liability recognized in the

Consolidated Statement

of Financial Position $«(5,770) $«(6,012)

The plan assets primarily comprise short-term fixed-income

investments.

The benefit obligation was determined by applying the

terms of medical, dental and life insurance plans, including the

effects of established maximums on covered costs, together with

relevant actuarial assumptions. These actuarial assumptions

include a projected health care cost trend rate of 10 percent.

The projected health care cost trend rate assumption is pro-

jected to be 10 percent in 2003, and is assumed to decrease

gradually to 4.5 percent by 2008 and remain constant thereafter.

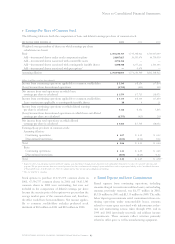

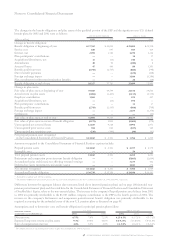

weighted-average

assumptions for nonpension

postretirement benefit plans

as of december 31: 2002 2001 2000

Discount rate 7.00% 7.00% 7.25%

Expected return on

plan assets 5.0% 5.0% 5.0%

The company evaluates its actuarial assumptions on an annual

basis and considers changes in these long-term factors based

upon market conditions and the requirements of SFAS No. 106,

“Employers’ Accounting for Postretirement Benefits Other

Than Pensions.” The discount rate changes did not have a

material effect on net postretirement benefit cost for the

years ended December 31, 2002, 2001 and 2000.

The health care cost trend rate has an insignificant effect

on plan costs and obligations. A one-percentage-point change

in the assumed health care cost trend rate would have the

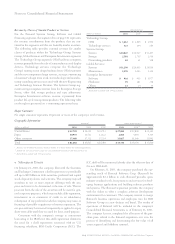

following effects as of December 31, 2002:

one-percentage- one-percentage-

(dollars in millions) point increase point decrease

Effect on total service and

interest cost $«««5 $«««(4)

Effect on postretirement

benefit obligation $«32 $«(38)

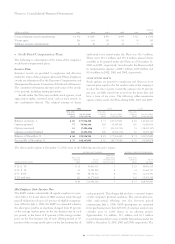

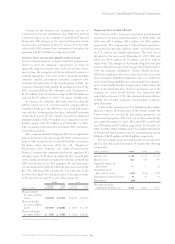

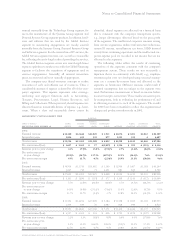

xSegment Information

IBM uses advanced IT to provide customer solutions. The

company operates primarily in a single industry using several

segments that create value by offering a variety of solutions

that include, either singularly or in some combination, tech-

nologies, systems, products, services, software and financing.

Organizationally, the company’s major operations comprise

a Global Services segment; three hardware product segments

—

Systems Group, Personal Systems Group and Technology

Group; a Software segment; a Global Financing segment; and

an Enterprise Investments segment. The segments are deter-

mined based on several factors, including customer base,

homogeneity of products, technology and delivery channels.

Information about each segment’s business and the products

and services that generate each segment’s revenue is located

in the “Description of Business” sections of the Management

Discussion on pages 44 through 50 and page 60.

In the first quarter of 2001, the company reorganized the

Personal Systems segment and renamed it the Personal and

Printing Systems segment. In accordance with the organiza-

tional change, the company transferred the Printing Systems

Division from the Technology segment to the Personal and

Printing Systems segment. At the same time, the xSeries

servers were transferred to the Enterprise Systems segment

from the Personal Systems segment.

In 2003, the company renamed all of its hardware seg-

ments without changing the organization of these segments.

The Enterprise Systems segment was renamed the Systems

Group segment, the Personal and Printing Systems segment

was renamed the Personal Systems Group segment and the

Technology segment was renamed the Technology Group

segment.

Due to the sale of the HDD business as described in note c,

“Acquisitions/Divestitures,” on pages 78 to 80 and consis-

tent with the “Basis of Presentation” discussed in note a,

“Significant Accounting Policies,” on page 70, the income

statement and cash flow statement information for the

Technology Group segment has been reclassified to exclude

or to separate the results of the discontinued HDD business.

Segment revenue and pre-tax income include transactions

between the segments that are intended to reflect an arm’s-

length transfer price. Specifically, semiconductors are